Bitcoin Mining Difficulty Plunge to Threaten Security, Maybe Not Price

Bitcoin’s mining difficulty is correlated with its hashrate, which is the measure of computational power per second used when mining, or the speed of mining.

Blockworks exclusive art by Axel Rangel

- Mining difficulty is the measure of how challenging it is for miners to create new blocks

- Difficulty had been steadily rising until late May when the hashrate started to falter

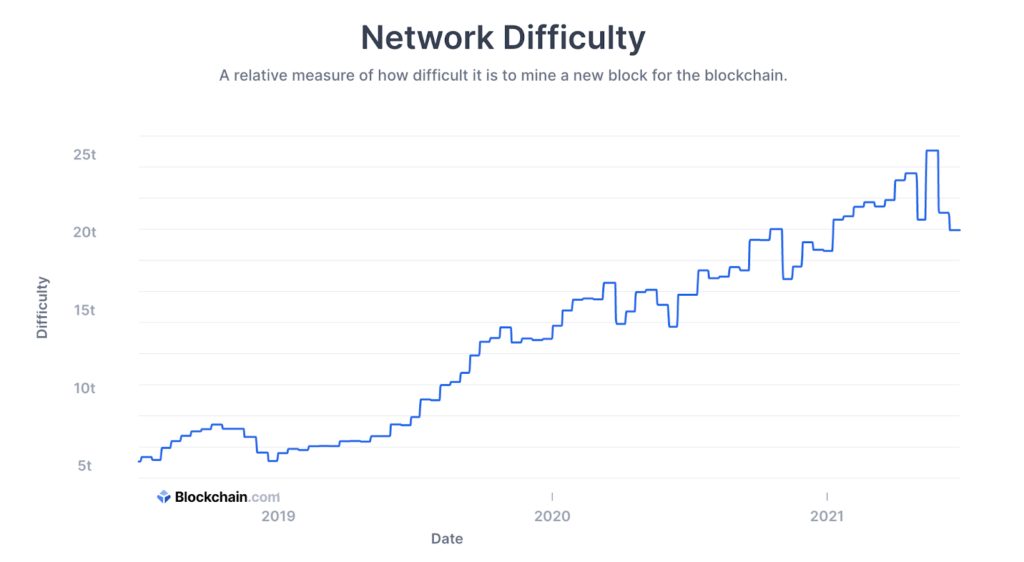

Bitcoin’s mining difficulty, the measure of how arduous it is for miners to solve the equations necessary to create new blocks, may fall a record amount of more than 20% in four days.

A 21% decrease in difficulty, which is what on-chain data sites are predicting, would be the largest difficulty plunge in bitcoin’s history. Bitcoin’s difficulty has decreased for the past two adjustment periods, falling 16% on May 30 and 5% on June 14. Another fall would mark the first time since December 2018 that the measure fell three consecutive times.

Difficulty is adjusted every 2016 blocks, which generally is about every two weeks. The adjustment occurs so that the average time between blocks remains at 10 minutes. The current average difficulty level is 19.93, up from 15.78 one year ago.

Bitcoin’s mining difficulty is correlated with its hashrate, which is the measure of computational power per second used when mining, or the speed of mining. A higher hashrate means higher difficulty, and vice versa.

“Difficulty has been increasing steadily for a long time so if you weren’t worried about the hashrate a few months ago, there’s no reason to be worried now,” said Garrette Furo, advisor to the Cosmos Network. “There was a pretty intense dip in hashpower a year or two ago and the price didn’t even react, so maybe it has more to do with the news. Causality for price movements is very odd in the bitcoin market.”

Even with a fall in difficulty, bitcoin mining is substantially more challenging than in the past, Furo pointed out.

There are several factors that impact hashrate, the recent dip is largely attributed to China’s mining bans, but it is not expected to last forever.

“China’s crackdown results in lower hashrates and difficulty while miners are offline,” said. “This is temporary.”

While a lower hashrate is temporary, it is unclear when it may start increasing again. Bitcoin mining requires space and infrastructure that takes time to create. Some miners may be starting to leave China for other, more mining-friendly locations, but it is difficult to predict how quickly this may happen.

A high difficulty measure means it takes more computing power to mine the same number of blocks, enhancing network security.

“A decrease in difficulty is associated with a decrease in security,” said Furo. “The network is more vulnerable but that does not mean it’s particularly easy to attack or dangerous to use.”

Bitcoin’s price, Furo pointed out, is increasingly reflective of government actions.

“While China is working on kicking out miners, Latin America and El Salvador are totally welcoming the remittance angle, not the store of value angle, to fix remittance infrastructure,” said Furo.