Bitcoin Surges Above $50K, Cardano Rises, US Dollar Slips: Markets Wrap

Bitcoin continues to rise on a depreciating dollar ahead of the Fed’s Jackson Hole Economic Symposium.

SHUTTERSTOCK

- Visa bought its first CryptoPunk for $150,000 in ether, benchmarking the payment processor as the first to start an NFT collection

- Paypal Holdings expanded its crypto-related services into the United Kingdom, the company announced on Monday

Bitcoin hit a three-month high on Monday morning, trading above $50,000 for the first time since May.

To recap, the largest crypto by market capitalization hit an all time high of $64,654.15 on April 14. The asset shed around 43% from the coin’s ATH to roughly $28,000 in July.

Volatile trading sessions ensued following various Chinese regulatory clampdowns which range from a ban on bitcoin mining, to any transaction/holding of the digital asset class at-large. (Not to mention a string of bullish news of institutional adoption and more.)

Despite a months-long downtrend the crypto has since gotten its footing. BTC has a return on investment (ROI) of around 43.56% in the past 30 days, according to Messari. Ethereum has a ROI of 51.49% in the same timeframe.

Ethereum continues to rise on the coattails of the non-fungible token gravy train. On Monday, Visa announced its purchase of CryptoPunk #7610 for $150,000 in ethereum, benchmarking the payment processor as the first to start a NFT collection. Digital asset bank Anchorage facilitated the transaction, Blockworks reported. Visa’s Head of Crypto Cuy Sheffield said CryptoPunk is a “cultural icon for the crypto community.”

Altcoins like Cardano continue to rise 11% after hitting an ATH of $2.52 on Friday. On Monday, the ADA was trading at $2.88 as or press time.

Investors are eyeing The Federal Reserve’s Jackson Hole Economic Symposium (now a virtual event) starting on Thursday for signals of future tapering or interest rate hikes. Bitcoin continues to rise on a depreciating dollar.

DeFi

- Uniswap is trading at $28.90 with a total value locked of $4,833,170,999 up 4.6% in 24 hours at 4:00 pm ET.

- Chainlink is trading at $28.55, advancing 4.9% with trading volume at $1,466,917,748 in 24 hours at 4:00 pm ET.

- DeFi:ETH is 33.2% at 4:00 pm ET.

Crypto

- Bitcoin is trading around $49,308.52, up 1.23% in 24 hours at 4:00 pm ET.

- Ether is trading around $3,320.03, advancing 4.49% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.067, up 3.02% at 4:00 pm ET.

- VIX is down -8.41% to 17.00 at 4:00 pm ET.

Insight

Ulrik K.Lykke Executive Director at crypto/digital assets hedge fund ARK36, said,

“The first reason to expect higher BTC prices is that the current price trend is driven mostly by spot purchases. When Bitcoin was last at $50K levels last time, much of the market activity was leverage trades which made for a much less resilient market structure,” Lykke said in a note. “Earlier this year, investor sentiment was insatiable amid expectations of parabolic rallies, but markets rarely move in one direction, even in a bull market. The blockchain fundamentals and a large number of deleverage positions make us very bullish on the development of the uptrend once the $50K barrier has been breached.”

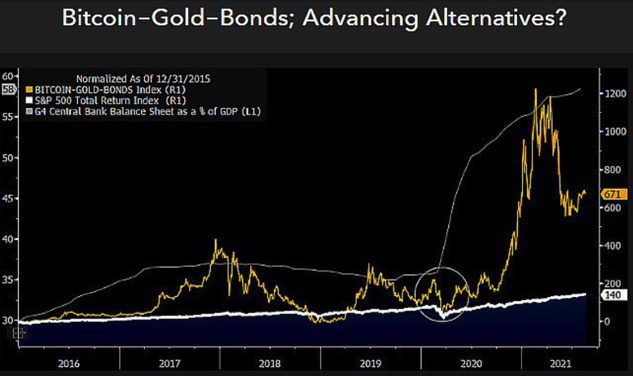

Source: Senior commodity strategist for Bloomberg Intelligence Mike McGlone

Source: Senior commodity strategist for Bloomberg Intelligence Mike McGlone

Currencies

- The US dollar fell -0.55%, according to the Bloomberg Dollar Spot Index.

Equities

- The Dow was up 0.61% to 35,355.

- S&P 500 advanced 0.85% to 4,479.

- Nasdaq was up 1.55% to 14,942.

Commodities

- Brent crude fell to $68.58 per barrel, up 5.25%.

- Gold was up 1.25% to $1,805.20.

Fixed Income

- US 10-year treasury yields 1.255% as of 4:00 pm ET.

We are looking out for

- The now-virtual Jackson Hole Economic Policy Symposium from will begin on Thursday

- US personal income and spending data will be released on Friday

In other news…

Paypal Holdings expanded its crypto-related services into the United Kingdom, the company announced on Monday. This permits users to buy, sell and keep their crypto assets in their Paypal accounts.

That’s it for today’s markets wrap. I’ll see you back here tomorrow.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.