Blockchain game studio Battlebound shuts down

Anterris is cancelled, and the fate of Evaverse doesn’t look great

Kjetil Kolbjornsrud / Shutterstock modified by Blockworks

This is a segment from The Drop newsletter. To read full editions, subscribe.

Another blockchain gaming studio is shutting down — Battlebound is closing its doors.

The studio was overseeing two games, including the metaverse game Evaverse and an in-development RPG dubbed Anterris.

Battlebound previously raised $4.8 million in seed funding back in 2022 from investors including a16z and Dapper Labs. It gained another $3 million by selling NFTs.

The company had the budget for what’s often called an “AA game” or the equivalent of two indie games, but it did not have the means for more ambitious projects (“AAA” games can have budgets of over $100 million each).

Evaverse screenshot

Evaverse screenshot

The closure comes “despite the recent traction we’ve been building for four years with a lean, scrappy team, extending our runway as far as possible while trying to secure our next funding round,” Battlebound wrote in a post.

“We excelled at doing more with less and staying afloat while developing above our weight. Ultimately, we’re in the same position as many studios before us, closing our doors due to remarkably challenging market dynamics,” the post continued.

Screenshot from Anterris game in development

Screenshot from Anterris game in development

On LinkedIn, Battlebound CEO and founder Adam Hensel said: “Thousands of players participated in our final playtest, and watching them enjoy years of hard work makes everything worth it.”

Hensel had previously worked at League of Legends publisher Riot Games for four years, most recently as a senior technical artist.

It really sucks to see yet another ambitious game studio unable to raise funds to continue a project. Other blockchain-powered or crypto-optional games like Dauntless and Eternal Dragons have also been cancelled in the past year. Blockchain game tracker BigBlockchainGameList found that 60 crypto games were discontinued in Q1 of 2024, but admits that tracking this can be “imprecise and [a] lagging indicator” for “general ecosystem trends.”

Midnight Society, the studio behind the ambitious (yet ultimately unreleased) NFT-optional shooter Deadrop, announced its shutdown in January after severing ties with its co-founder following public controversy and struggling to raise further funds.

Metaverse games aren’t really my thing, but Anterris looked like it was shaping up to be a cozy fantasy RPG.

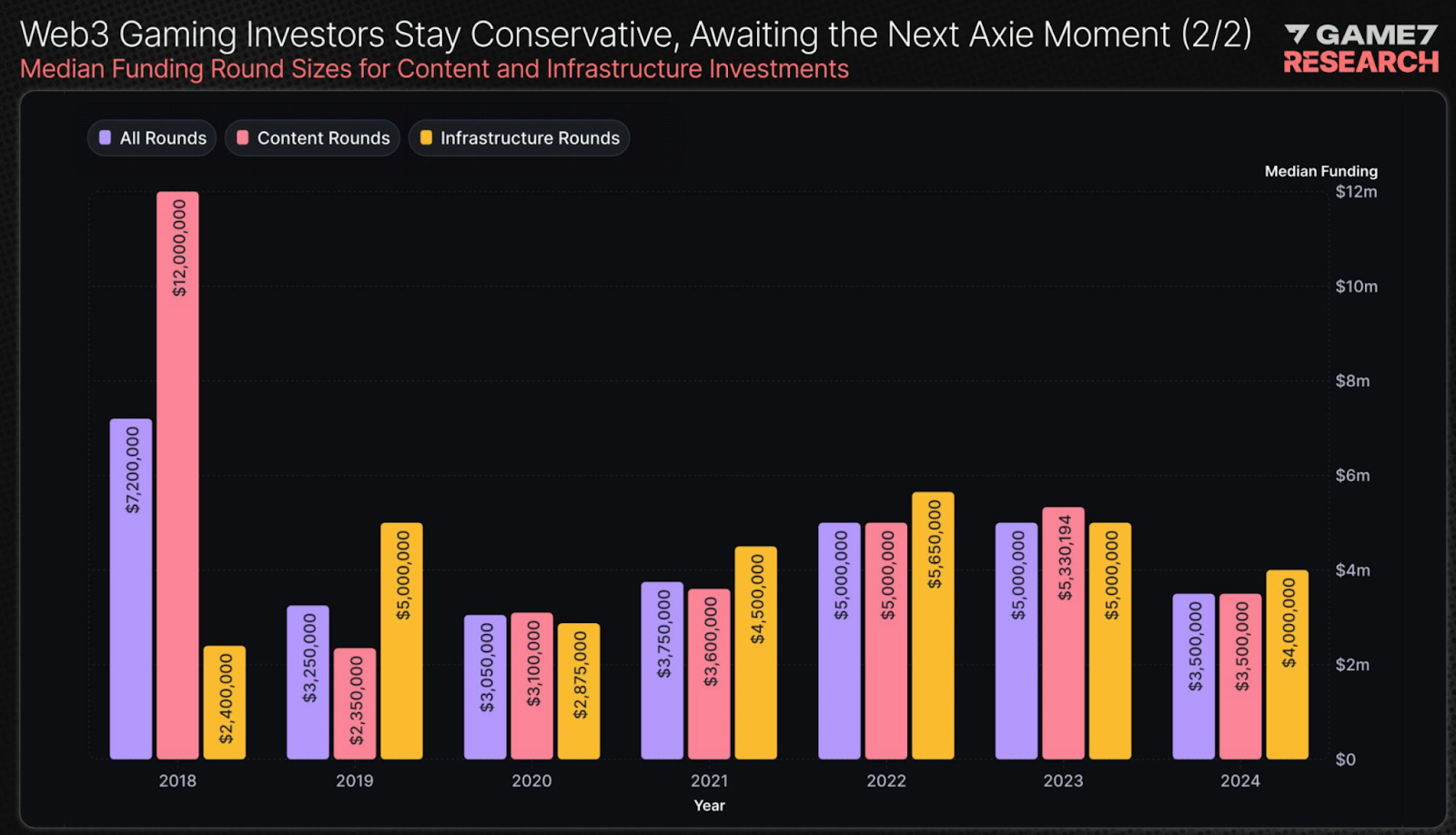

Funding round sizes for Web3 gaming over time, from Game7

Funding round sizes for Web3 gaming over time, from Game7

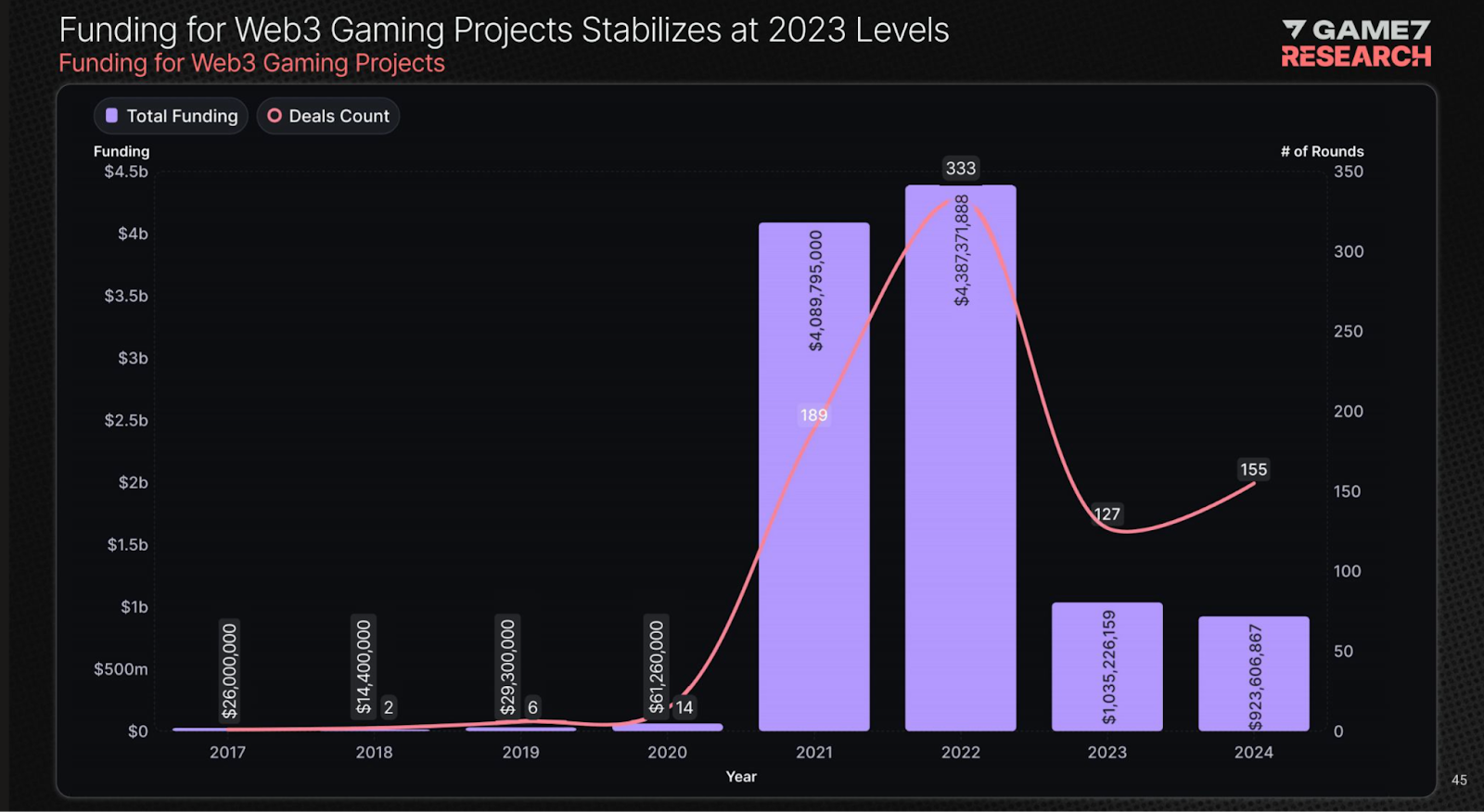

New blockchain game announcements decreased 36% last year compared to 2023, according to Game7, a research-from-crypto gaming group and research firm. That means things are slowing down, but that’s not necessarily a bad thing for crypto gaming.

I’d take a handful of quality games from dedicated teams over a wide array of shovelware any day of the week.

Chart of Web3 gaming funding from Game7

Chart of Web3 gaming funding from Game7

Game7 also found that only 45% of crypto games are in a playable state, meaning the majority of known blockchain games are still in development.

Aaaaaaand now we wait.

Updated March 13, 2025 at 4:04 pm ET: Removed mention of EVA token. Battlebound clarified there is no EVA token and any existing ones are fake.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.