BTC, SOL Investment Products See Highest Inflows in October, Year-to-Date Flows Hit ATH

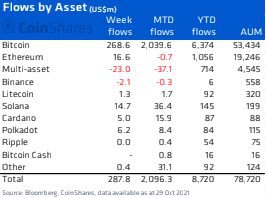

Digital asset investment products saw inflows totaling $288 million last week, bringing the total inflows year-to-date to a record $8.7 billion, according to CoinShares.

Source: Shutterstock

- Digital asset investment products have seen 30% more inflows than in 2020

- Multi-asset investment products saw outflows totaling a record US$23 million, in what is now a three-week run of outflows, said the CoinShares report

CoinShares released their weekly fund flows data for the week ending Friday, October 29. The report shows that 2021 has been a record year for digital asset investment products, which have seen a record $8.7 billion of inflows.

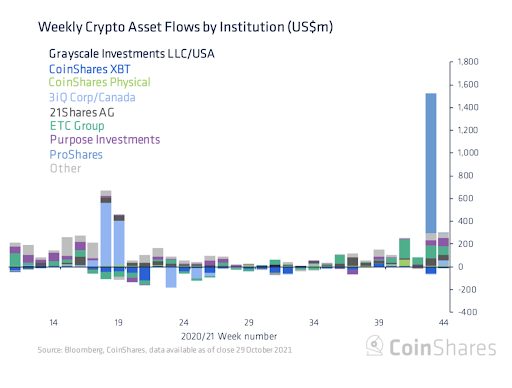

The main catalyst for the record amount of inflows has been the approval of a BTC ETF in the United States. This is made very clear in the chart below under week number 43 when the ProShares ETF, BITO, began trading.

However, the US-based ETFs only saw $53 million of inflows this past week, representing just under 19% of product inflows. Canadian and European-based exchange trade products made up a bulk of the flows, according to CoinShares.

Bitcoin products saw the largest volume of inflows, with 93% of the $288 million being allocated towards the largest digital asset by market capitalization.

Ethereum broke its three-week dry spell by recording $16.7 million of inflows. Ethereum based investment products have now seen $1.056 billion of inflows year-to-date.

Despite having a market capitalization of $507 million versus BTC’s $1.1 trillion, year-to-date flows are just one-sixth that of BTC investment vehicles. This signals that institutional adoption of BTC is far greater than ether and that the second-largest digital asset could have more upside if that dynamic were to change.

Digital asset investors are seen rotating out of products that provide exposure to numerous assets in a basket, implying that money managers are taking concentrated bets over a wide array of exposure. Multi-asset investment vehicles have seen month-to-date outflows of $37.1 million, according to the report.

Solana (SOL) has caught the eye of institutional investors. It has seen the largest amount of inflows amongst altcoins, with $36.4 million over the past month. It has outpaced Ethereum based products as investors seeking larger returns look for higher alpha plays.