Canada seizes $56M in crypto from TradeOgre exchange

RCMP dismantles TradeOgre after Europol tip, citing FINTRAC violations and suspected laundering

Iryna Tolmachova/Shutterstock and Adobe modified by Blockworks

The Royal Canadian Mounted Police (RCMP) seized more than CAD $56 million in cryptocurrency from TradeOgre, marking Canada’s largest crypto seizure and the first dismantling of an exchange by domestic law enforcement.

The action, announced Thursday, followed a June 2024 referral from Europol that triggered a Money Laundering Investigative Team probe.

Investigators determined the platform contravened Canadian regulations by failing to register with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) as a money services business and by not identifying its clients.

Authorities said this anonymity attracted criminal organizations seeking to launder illicit funds. “Investigators have reason to believe that the majority of funds transacted on TradeOgre came from criminal sources,” the RCMP stated in its release.

While the RCMP did not specify which cryptocurrencies were seized, Decrypt reported assets included bitcoin, ether, XRP, litecoin, tron and Qubic. Transaction data will be analyzed further, and charges may follow. The RCMP also issued a public appeal for information, underscoring that the investigation remains ongoing.

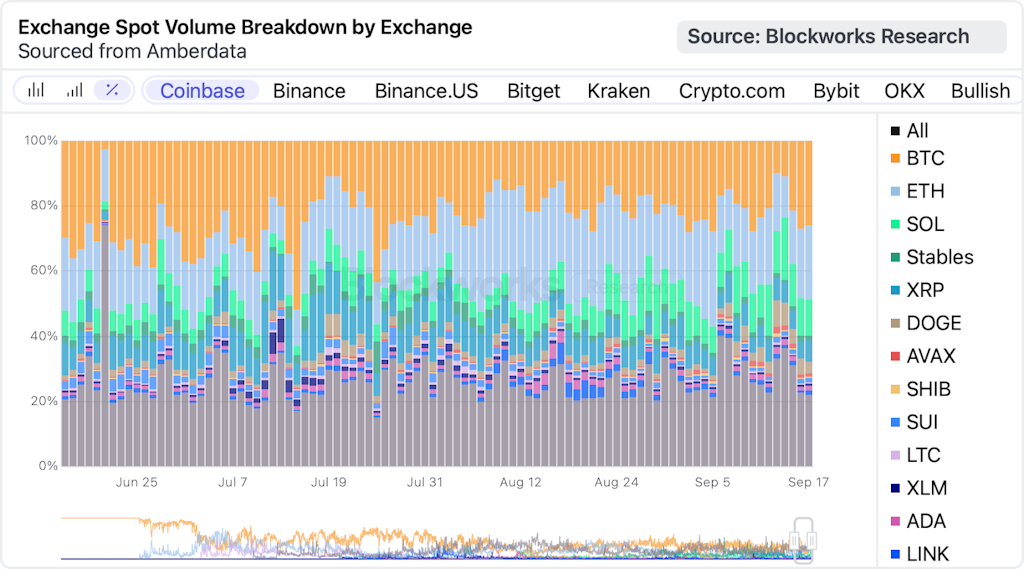

Blockworks Research data show that centralized exchanges collectively handled more than $400 billion in monthly spot volume at several points in 2025, with Binance, Coinbase, and Kraken accounting for the majority. By contrast, unregistered platforms such as TradeOgre operate outside mainstream reporting and liquidity measures, making them harder to monitor for compliance and money laundering risks.

This is a developing story.

This article was generated with the assistance of AI and reviewed by editor Jeffrey Albus before publication.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.