Coinbase Expands Borrowing Using Bitcoin as Collateral

Extension of service comes after company said competition inspires growth.

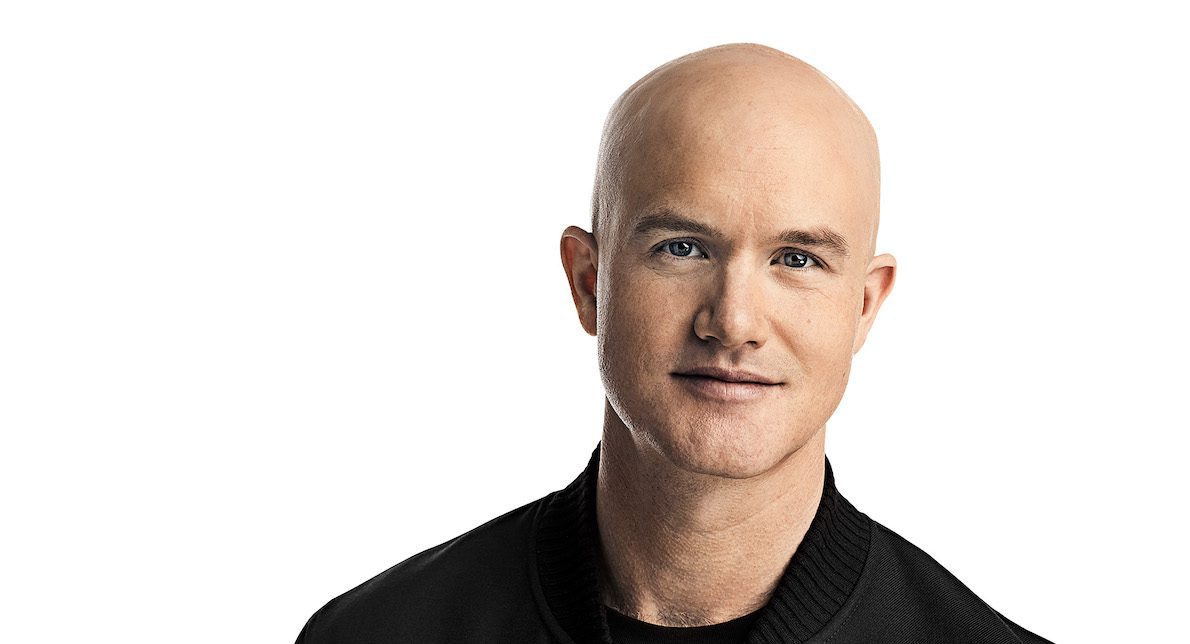

Brian Armstrong, CEO and co-founder, Coinbase, Inc.; Source: Coinbase, Inc. (Ethan Pines)

- Crypto exchange recently adds line of credit up to $100,000 to its growing user base

- Service expansion is latest step of growth for Coinbase as competition in space has grown.

Coinbase on Wednesday expanded its service that allows US users to borrow cash using bitcoin as collateral without having to sell the cryptocurrency.

The company recently added a line of credit of up to 40% of a customer’s bitcoin account value capped at $100,000 to residents in Arizona, California, Idaho, Ohio and Tennessee, a Coinbase spokesperson told Blockworks. The exchange also offers fixed term loans of up to 30% of a user’s bitcoin — also up to $100,000 — within 15 different states.

There is no fee or credit check, and the borrower pays a 7.9% annual percentage rate. The borrowed cash can be deposited to PayPal or transferred to a user’s bank account through an automated clearing house. The customer would then pay the interest due each month — a $10 minimum — and can pay off the balance when they are ready.

The service is an expansion of what Coinbase announced last year.

Coinbase launched a waitlist for the borrowing service in August before it became active in October. The latest offering and new states do not have a waitlist and are immediately active, a spokesperson noted.

“We hear from customers that they need cash for expenses like home renovations or car repairs, but they do not want to prematurely sell their crypto, or take out high-interest loans that could come with 20%+ APR,” Thorsten Jaeckel, a product manager at Coinbase, wrote in an August 2020 blog post.

The latest extension comes as crypto exchanges are looking to focus on the infrastructure and services that will be essential in supporting the next bull run, Brian Hoffman, Kraken’s crypto platform lead, said last month.

“Our competitors are supporting certain crypto assets that are experiencing large trading volume and growth in market capitalization that we do not currently support, as well as offering new products and services that we do not offer,” Coinbase said in a May 13 shareholder letter. “We welcome these challenges as they indicate that the market we serve is growing rapidly, but we also have to continue to move quickly to address them, and that inspires us towards action and growth.”

Coinbase continued to launch products that attracted new customers and deepened relationships with existing ones, the company noted in the letter.

During its first earnings report after becoming a public company, Coinbase said that it reached 56 million users, up from 34 million in the first quarter of 2020. The exchange acquired Bison Trails earlier this year, which it said will allow companies to send and store crypto, accept crypto payments and build their businesses with crypto-native infrastructure.

The company also last month announced a revamp of its prime brokerage service, Coinbase Prime, in order to better serve institutional clients. More recently, ForUsAll, a retirement investment platform for small businesses, partnered with Coinbase to allow employers to offer alternative investment options within 401(k) plans starting in July. ForUSAll will be using Coinbase Institutional for custody and exchange for the digital assets, as employees will be able to put 5% of their balances into an account that has exposure to certain cryptocurrencies.