Coinbase Stock Down About 5% After Missing Projections Again

Coinbase execs urge investors to look at the bigger picture in shareholder letter reporting revenue drop

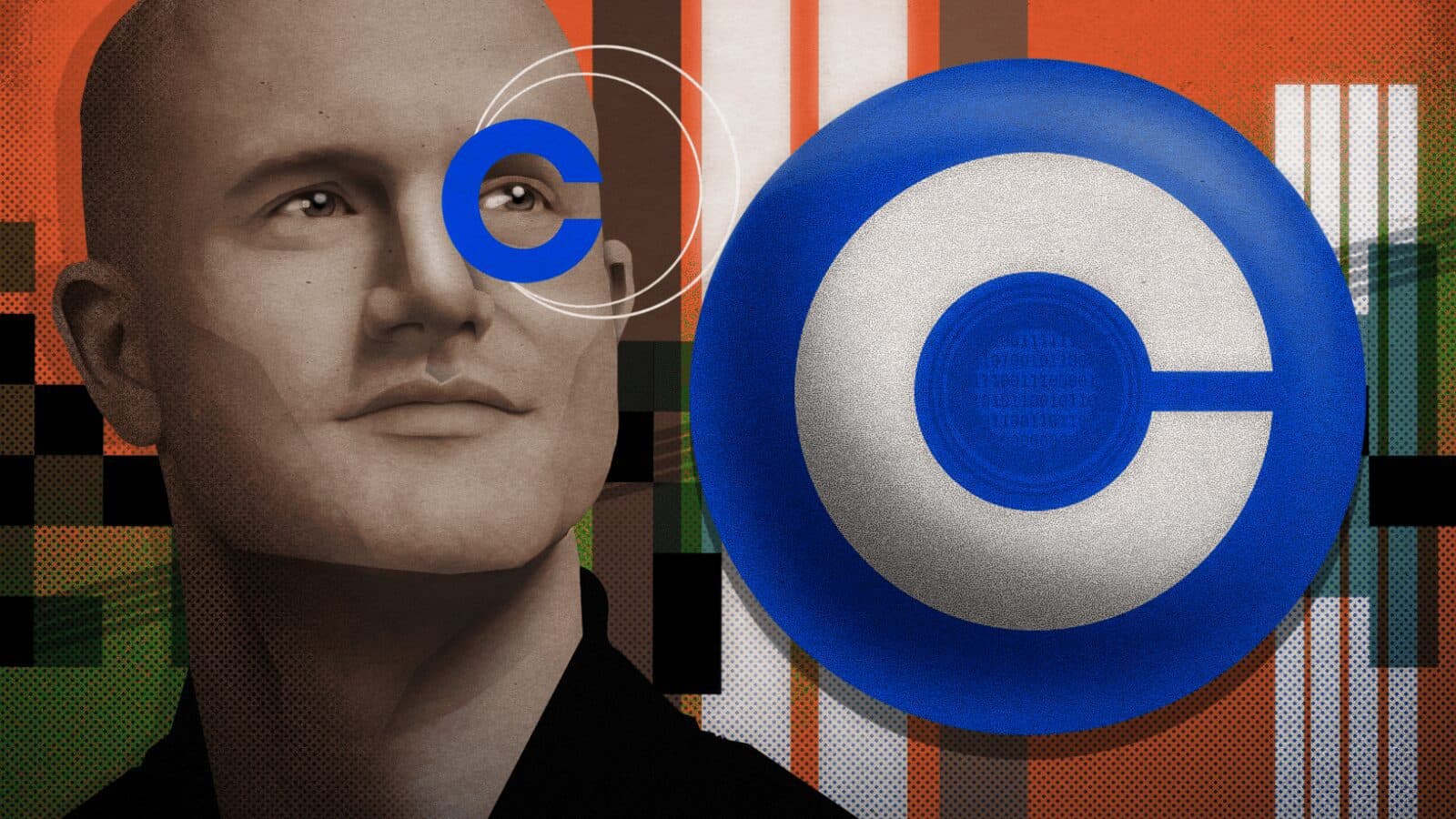

Coinbase CEO Brian Armstrong | blockworks exclusive art by axel rangel

- Coinbase reported $803 million in revenue, down from $1.17 billion in Q1

- Total quarterly trading volume was $217 billion, about a 30% decrease

Crypto exchange Coinbase reported $803 million in revenue during the second quarter, coming in markedly shy of analysts’ estimates of $854.8 million.

Shares were down about 5% in after-hours trading.

Of Coinbase’s second quarter revenue, $655 million came from trading fees, a 35% decline from the first quarter. Of that, $39 million came from institutional investor transactions, a 17% decline over the same period.

Coinbase’s monthly active users dipped to 9 million in the second quarter, down from 9.2 million.

Total quarterly trading volume was $217 billion, about a 30% decrease— which the exchange attributed to market conditions in its shareholder letter, released ahead of Tuesday’s earnings call.

Revenue from subscription and services came in at $147 million, down 3% and up 44% year over year.

“We highlight the 44% year-over-year growth because it helps illustrate that these revenues are less volatile compared to transaction revenue,” the exchange wrote.

The exchange said it has “paused some smaller and longer-term products and expects to sequence our international growth efforts,” in order to focus on growing the Coinbase retail app, Coinbase Prime, staking features, developer products and its Web3 business.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.