CoinSpot to Launch NFT Marketplace Within Exchange’s Own Platform

CoinSpot said Friday it will become the first crypto exchange nationally to offer its users the ability to buy NFTs within its platform

Credit: Shutterstock

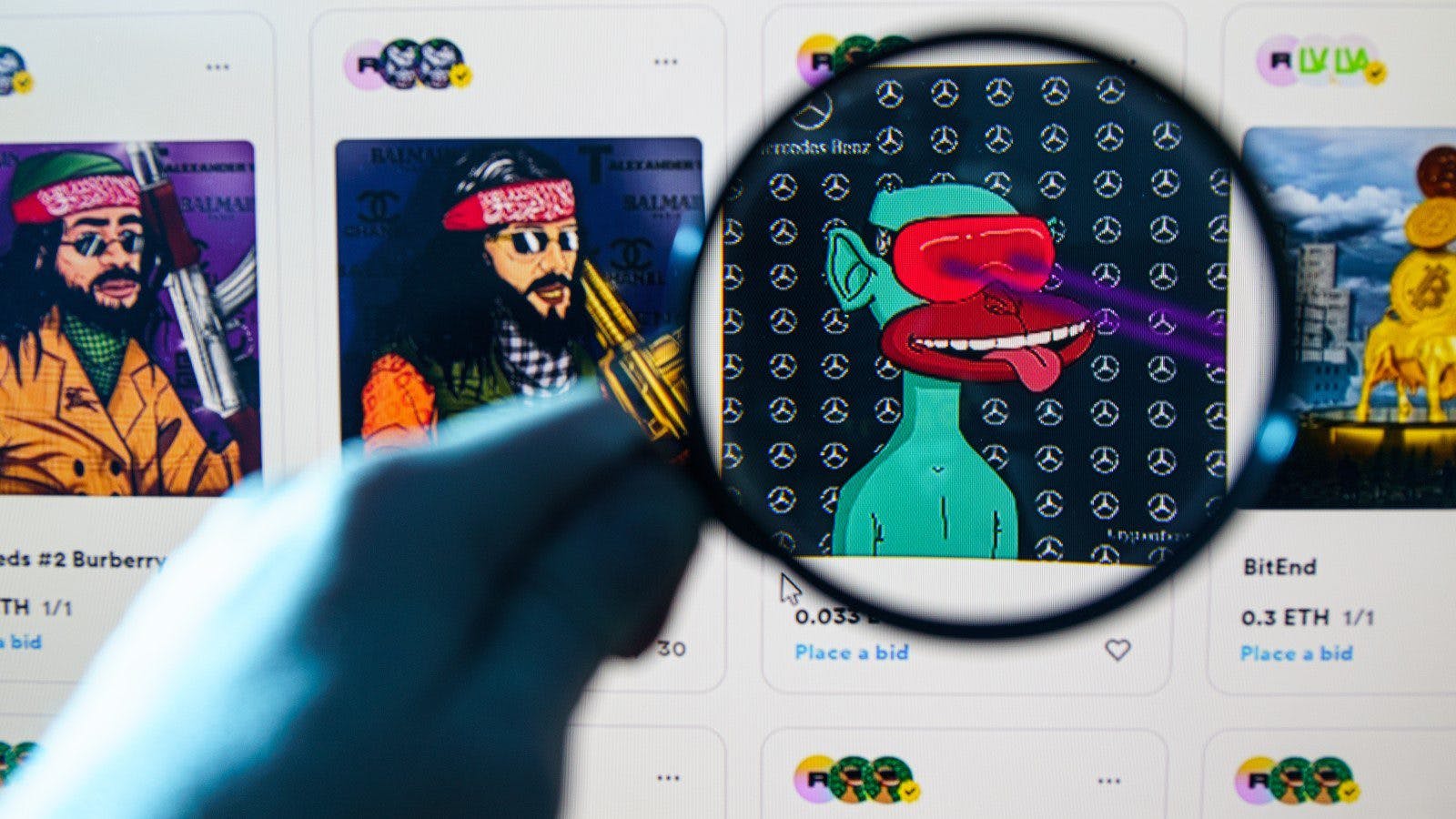

- CoinSpot said it wants to simplify the process for buying or selling NFTs and is planning to launch an NFT marketplace atop its platform

- The marketplace will feature Bored Ape Yacht Club NFTs as well as BossLogic artworks

One of Australia’s largest exchanges by total users said Friday it is launching an NFT marketplace within its existing platform this week in a bid to simplify the buying and selling process.

The (non-fungible token) marketplace will initially list a curated group of well known NFT projects including Bored Ape Yacht Club and Australian Creator BossLogic’s Gauntlet series.

The exchange, which is approved by the country’s transaction watchdog AUSTRAC, is the first of its kind in the country to begin offering users the ability to make purchases within its platform, CoinSpot said.

CoinSpot is expecting to add more NFTs “over the coming months” as it attempts to ease what it sees as a burden when purchasing digital assets through external marketplaces.

“No other platform currently allows users to purchase NFTs with any crypto of choice,” a company spokesperson told Blockworks. The platform said users will be able to make purchases using most well-known crypto.

Current processes for buying NFTs from marketplaces such as OpenSea involve establishing a crypto wallet, connecting said wallet to a marketplace and ensuring the right crypto is loaded to place a bid.

Most well-known projects are denominated or sold for ether. Still, CoinSpot argues the problem lay in a newcomer’s lack of education around the technology and is seeking to reduce “technical barriers.”

“If we look back at the emergence of the early internet, it’s clear that building the most accessible, easy-to-use and secure technology is the key to mass,” said CoinSpot Chief Product Officer Gary Howells. “Everyday Australians shouldn’t have to jump through hoops or miss out on accessing projects just because the current process of buying NFTs is complicated and confusing.”

He said that people should have the same access to the market despite whether they were a layperson or a high-profile individual.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.