Crypto Markets Rally; US Stocks Hold Gains: Markets Wrap

“The macro spillover came early with crypto markets tumbling this week along with global risk assets in response to the Evergrande headlines,” QCP Capital Broadcast said. “For a market that was starving for directional catalysts and [was] extra edgy from FOMC uncertainty, this ‘risk-off’ was the perfect excuse for a hard dip.”

SHUTTERSTOCK

- Solana ($SOL) and Avalanche ($AVAX) jumped roughly 19% and 23% on-day, according to Messari

- Dapper Labs announced a $250 million funding round, bringing the company to a valuation of $7.6 billion

Cryptocurrency markets rallied following early-week losses as Federal Reserve officials maintained that inflation is “transitory” and that the US will continue its $120 billion per month bond purchases (for now). In a statement from the Federal Open Market Committee (FOMC) on Wednesday, officials said tapering “could be warranted soon” due to the country’s economic growth.

Bitcoin, often referred to as a hedge against inflation, advanced roughly 6% on-day. Ethereum followed suit, up over 9%, as of press time.

This was a nice change of tune for the market which plunged during a broad sell-off on Monday. Some point to growing concerns over Evergrande’s financial woes to the $250 billion market loss, Blockworks previously reported. Major cryptos have since slowly recovered, but not all the way. BTC is still down almost 10% on the week.

Elsewhere, big gains were made in altcoins like Solana ($SOL) and Avalanche ($AVAX) which jumped roughly 19% and 23% on-day, according to Messari.

DeFi

- Terra ($LUNA) is trading at $31.05, up 16.4% and trading volume at $1,480,483,285 in 24 hours.

- Uniswap ($UNI) is trading at $21.3, rising 5.7% with a total value locked at $4,363,399,894 in 24 hours at 4:00 pm ET.

- DeFi:ETH is 32.1% at 4:00 pm ET.

Crypto

- Bitcoin is trading around $43,432.91, up 6.12% in 24 hours at 4:00 pm ET.

- Ether is trading around $3,025.99, advancing 9.35% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.069, rising 2.57% at 4:00 pm ET.

Insight

“The macro spillover came early with crypto markets tumbling this week along with global risk assets in response to the Evergrande headlines. Markets turned bearish from Monday morning, with China and Hong Kong on holiday for the Mid-Autumn Festival,” QCP Capital Broadcast said in a note. “For a market that was starving for directional catalysts and [was] extra edgy from FOMC uncertainty, this ‘risk-off’ was the perfect excuse for a hard dip.”

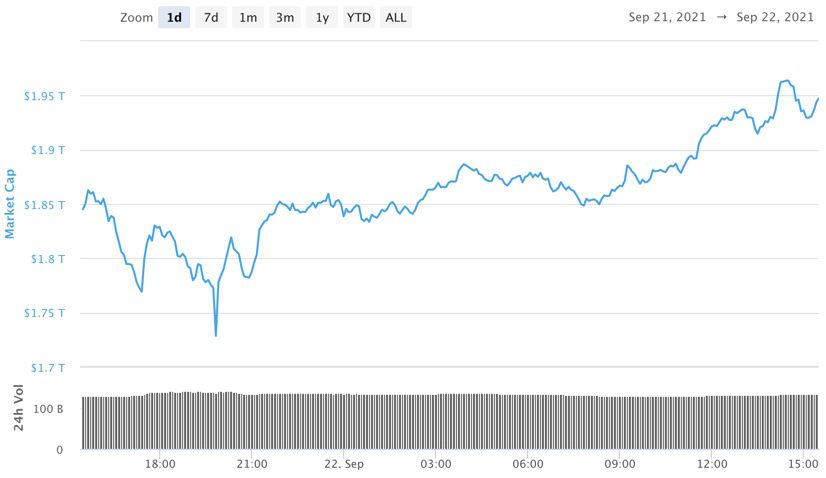

Total crypto market capitalization over the past day Source:CoinMarketCap

Total crypto market capitalization over the past day Source:CoinMarketCapAll major Wall Street gauges closed ahead for a second day in a row amid volatile trading sessions in September. Earlier in the month, the S&P 500 fell 1.7% — its worst trading week since May.

Equities

- The Dow rose 1.14% to 34,304.

- S&P 500 was up 1.22% to 4,407.

- Nasdaq made gains of 1.16% to 14,923.

Commodities

- Brent crude was up to $76.11 per barrel, rising 2.34%.

- Gold fell -0.55% to $1,768.4.

Currencies

- The US dollar strengthened 0.12%, according to the Bloomberg Dollar Spot Index.

Fixed Income

- US 10-year treasury yields 1.316% as of 4:00 pm ET.

In other news…

Dapper Labs, the creator of NFT projects like NBA Top Shot, announced a $250 million funding round on Wednesday, bringing the company to a valuation of $7.6 billion, Blockworks reported.

We are looking out for

- Federal Reserve Chairman Jerome Powell will discuss pandemic recovery on Friday

That’s it for today’s markets wrap. I’ll see you back here tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.