Crypto Prices Collapse Across the Board, Dragged by Bitcoin and Ether

Weak bitcoin and ether prices have triggered a market-wide downturn as the US dollar continues to strengthen

Source: DALL·E

- Almost every top-50 digital asset has lost value over the past week

- Markets now have a chance to consolidate ahead of Ethereum’s “Merge” to proof-of-stake

Crypto prices are deep in the red. Over the past week, digital assets have shed more than 10% from their collective capitalizations — representing more than $111 million in lost nominal value.

Bellwether digital asset bitcoin (BTC) tanked 8% this morning, as did number-two ether. BTC fell below $21,500 — more than 10% below its price recorded last Friday.

BTC had only just broken a two-month high over the weekend when it rose above $24,500.

Ether (ETH) also lost 10% over the past week, dropping from almost $1,900 to $1,700. All the while, the US dollar index DXY has been surging and the dollar is poised for parity with the euro for the second time in six weeks.

Open interest for bitcoin futures fell about 8% over the past day, from around $14.1 billion to just over $13 billion, after remaining steady in the past week, according to CoinGlass. Open interest for ether futures is down about 9% over the past seven days, from $9.15 billion to $8.3 billion.

Open interest typically falls alongside sharp drawdowns as overleveraged speculators’ positions are liquidated en masse.

ETH’s spot price is still positive for August so far, having retained 1% gains as of 12:00 pm ET, while BTC dropped 8%. Both assets have lost more than half their value in the year to date.

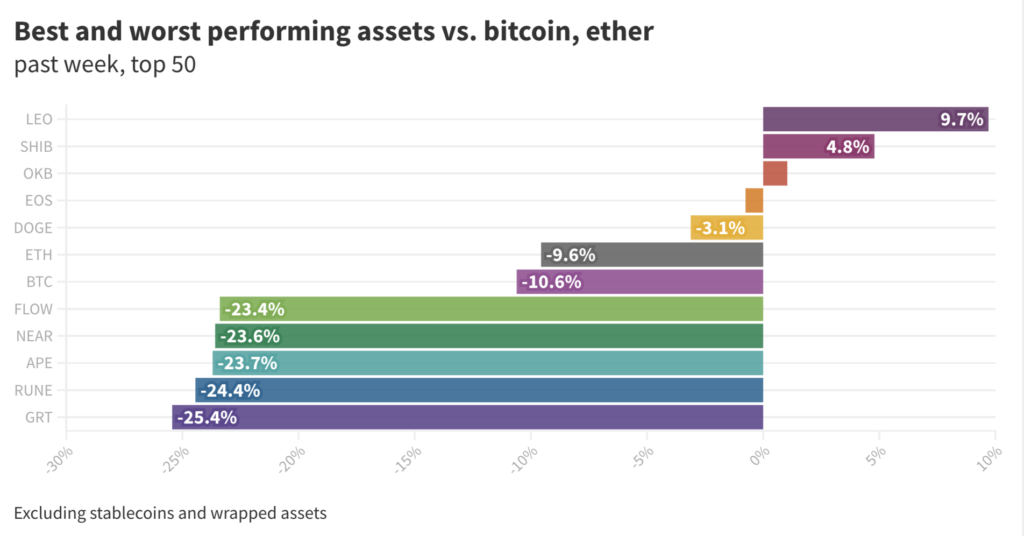

Just three digital assets of the top 50 by market value (sans stablecoins and wrapped assets) saw prices increase over the past seven days: Meme-driven shiba inu (SHIB) added almost 5% while native crypto exchange tokens unus sud leo (LEO) and okb jumped 10% and 1%, respectively.

For scale, the top 50 digital assets lost 15% on average over the past week.

Exchange tokens seem strong but bitcoin and ether still drive crypto prices

As Blockworks has previously reported, Bitfinex’s LEO has regularly outperformed the market this year. In fact, LEO is up 37% throughout 2022 — a year which has seen crypto markets tank 53% overall.

The token has been buoyed by an attractive buy-back-and-burn mechanism that could be accelerated if US authorities return billions of dollars in bitcoin stolen from the platform in 2016.

OKCoin’s okb boasts a similar burn scheme, which reduces its supply alongside trade volume.

But Vivek Raman, head of proof-of-stake at crypto services unit BitOoda, told Blockworks one shouldn’t read too much into exchange tokens right now.

“The most recent market rally was led by ETH, and the exchange tokens lagged during that rally,” Raman said. “Therefore, on a move lower, it makes sense that ETH and BTC lead the way down and the exchange tokens are lagging once again.”

“My guess would be that if we see a prolonged drawdown, exchange tokens will underperform again.”

Chart by David Canellis

Chart by David CanellisWhile Raman noted the recent meme coin rallies marked some bullish sentiment, he described moves made by SHIB, OKB and LEO as “just noise.” The true crypto fundamental plays are still driven by bitcoin and ether.

And so, 15 of the top 50 digital assets shed more than 20% — led by the graph (-25.5%), thorchain (-24.5%), apecoin (-24%), near (-23.5%) and flow (-23.5%).

Traders flocked to stablecoins to shelter from volatility. Over the past week, the top four stablecoins (tether, USD coin, binance usd and dai) have seen their shared market dominance jump 11 percentage points, from around 11.5% to 12.75%.

Bitcoin and ether dominance, on the other hand, have remained relatively flat.

NFT market faces reckoning and liquidations

As for NFTs, floor prices for both CryptoPunks and Bored Ape Yacht Club tokens are down 11% over the week, now 65.95 ETH ($111,600) and 69.69 ETH ($117,900) respectively.

The NFT (non-fungible token) outlook is even worse when you zoom out: Delphi Digital reported yesterday that NFT collections listed on lending protocol BendDAO collapsed 18%-39% over the past 30 days — putting borrowers at risk of having their NFTs liquidated unless they repay their debts immediately.

Raman said: “APE and FLOW are notable underperformers as the NFT market has entered a fairly vicious repricing downward. There has been concern about liquidations around Bored Apes, and apecoin is a proxy for NFT activity.”

He also noted that FLOW’s weakness makes sense with broader NFT softness, as its primary focus is supporting the NFT ecosystem. Raman considers the recent pullback a chance for healthy consolidation ahead of the Merge, which “provides idiosyncratic alpha upside for ETH and should be a short term catalyst for the space.”

Jeff Dorman, chief investment officer at digital asset management firm Arca, reasoned that the biggest takeaway over the past week is that practically all tokens declined in a risk-off week for all risk assets.

This was the first time we’ve seen a broad market response since digital assets bottomed in mid-June, Dorman said.

“Prior to this week, for the past six weeks, we saw much greater dispersion, with big winners and big losers each week, with market leaders in their respective sub-sectors leading the way higher,” he said.

Crypto prices are indeed grim, but equity markets aren’t too hot either. Benchmark indexes, the broad S&P 500 and tech-heavy NASDAQ 100, are both shaky after a few strong weeks — down 1% and 2% respectively.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.