Cryptos, Stocks Rally on Hope Fed Will Pivot

Central bankers could be forced into a pivot if economic conditions don’t improve

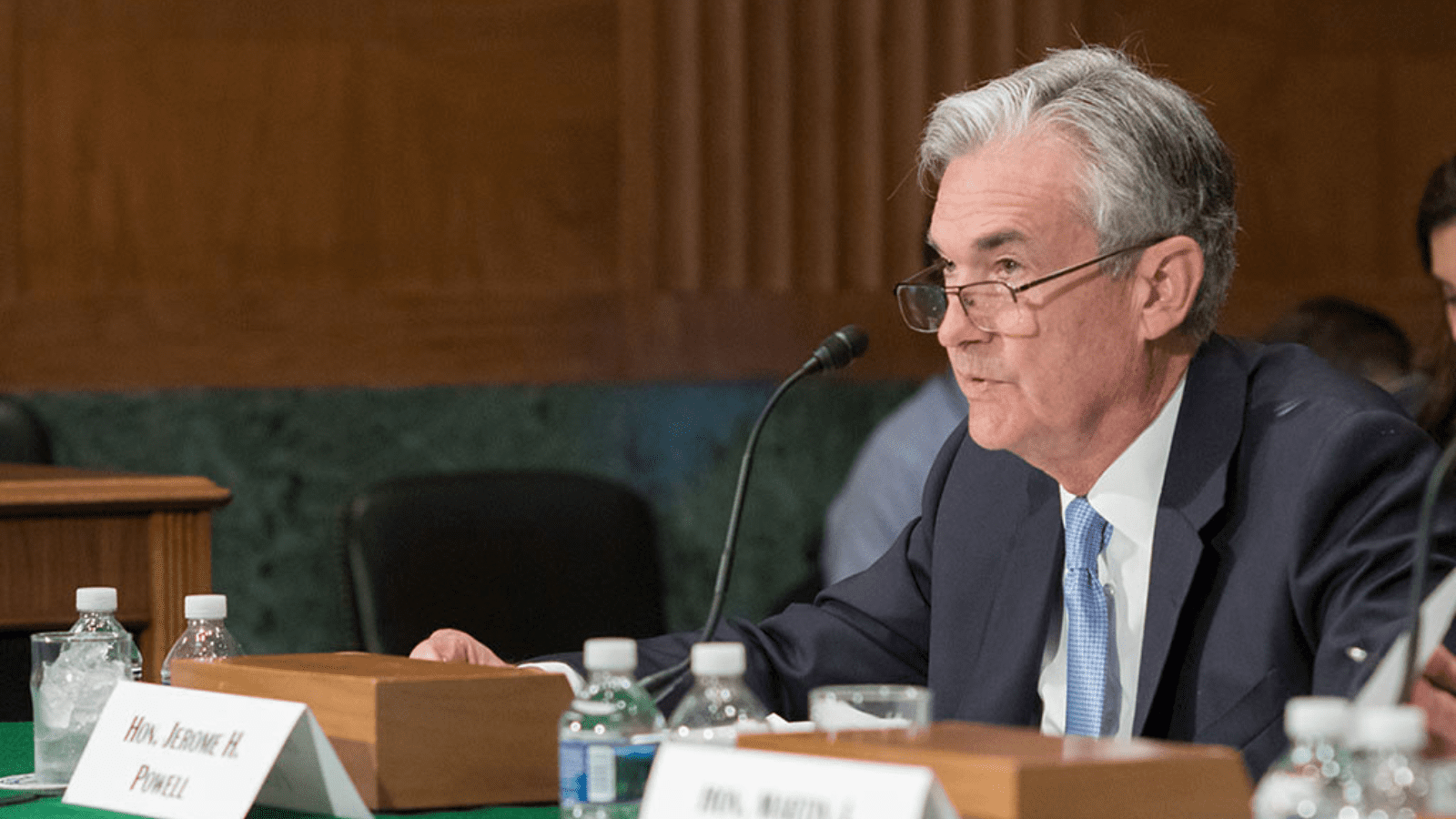

Federal Reserve Chair Jerome Powell | Source: Federal Reserve (CC license)

- The Fed is willing to rethink its current policy direction if economic conditions continue to deteriorate, minutes show

- Markets seem confident that a pivot is on the horizon

The Federal Reserve has started to hint that certain economic conditions may warrant a turnaround on its aggressive quantitative tightening, sending markets back in the green, according to Fed minutes released Wednesday.

After officials opted to raise rates 0.75% for a third straight time at its last meeting in September, the Fed may rethink its strategy if economic metrics continue to clock in below expectations.

“Participants judged that the Committee needed to move to, and then maintain, a more restrictive policy stance in order to meet the Committee’s legislative mandate to promote maximum employment and price stability,” the minutes said.

The September producer price index, released ahead of the minutes, came in higher than expected, sending stocks into a volatile position. The figure came in 0.4% higher last month.

Tuesday’s New York Fed September Survey of Consumer Expectations found spenders are expecting to pay more in the coming months, especially for rent. The survey shows expectations for 9% to 10% rental inflation remain. Just before the pandemic, in February 2020, expected one-year rent inflation was a relatively normative 5.2 percent.

“Perceptions of housing inflation have yet to weaken, and these are a core component of the CPI calculation,” Nicolas Colas, co-founder of DataTrek Research, told Blockworks. “On the wage inflation front, households still expect to see record levels of income growth over the next year. This tells us that markets are right to be concerned about Fed rate increases continuing into 2023.”

Growth forecasts for the second half of the year and 2023, meanwhile, have been lowered — despite a rebound in gross domestic product growth during the second quarter.

“Several participants noted that, particularly in the current highly uncertain global economic and financial environment, it would be important to calibrate the pace of further policy tightening with the aim of mitigating the risk of significant adverse effects on the economic outlook,” the minutes said.

Equities moved up slightly on the news. The S&P 500 gained 0.4% toward the end of Wednesday’s trading session, while the Nasdaq rose 0.5%. Bitcoin and ether rallied 0.5% and 1.5%, respectively.

Even as traders appear optimistic about a pivot, futures markets are still pricing in an 84% chance of a 75 basis point hike and a 16% chance of a 0.5% rise next month, according to CME data.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.