Grinch rally: Crypto indices track lower through the week

The AI sector was the top loser on the week, trading down -26%

Danylo_K/Shutterstock and Adobe modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Crypto and risk assets continue to show weakness heading into year-end, not adding to the holiday spirit. Risk assets are in search of a floor, driven by fundamental flows supported by ETFs or protocol buybacks.

Indices

This week closes out with continued weakness across the board, and in crypto risk in particular. Both the S&P 500 and the Nasdaq 100 moved over a -1% lower this week, with gold being the one instrument showing strength. Concurrently, every crypto index we track has traded lower throughout the week. Notably, exchange tokens, buyback leaders, and the 2025 crypto equity cohort outperformed BTC intra-week, while everything else underperformed.

The AI sector was the top loser on the week, trading down -26%. The downside was led by TAO, which notched new multi-month lows after being a top performer in October.

Broadly, crypto continues its downtrend, with majors like BTC, ETH and SOL showing weakness while longer tail alts make larger moves to the downside. Risk is in search of a fundamental floor, which still may remain lower until price/buybacks becomes too compelling, and buyback flows from these protocol cashflows can set a low. Similarly, majors may need an uptick in ETF inflows to set their low, while the support provided by these vehicles has been anemic in the weeks past.

Weekend Reading

Taking a Step Back to Step Forward

Michael W. Green published a blog post titled “Taking a Step Back to Step Forward” that reframes US economic precarity through a structural and mathematical lens. Drawing on Ole Peters’ “Equation of Life,” Green argues that wealth naturally concentrates without redistribution (τ < 0), leading to systemic inequality. He critiques distorted CPI measures, technocratic complacency, and housing scarcity as mechanisms of economic extraction. With credit spreads artificially tight despite rising defaults, he warns of financial fragility. Green calls for civic engagement and institutional accountability, setting the stage for further essays and political interviews focused on systemic reform. Read more

Annual State of Sky Ecosystem

Sky Frontier Foundation published a research report titled “Annual State of Sky Ecosystem” outlining the protocol’s major achievements and financial growth in 2025. The Sky Ecosystem saw an 86% increase in USDS supply (to $9.86B), outpacing the broader stablecoin market. Sky Protocol generated $435M in revenue and $168M in profits, with substantial SKY token buybacks and staking rewards. With new regulatory clarity via the GENIUS Act and multiple Sky Agent launches, the report projects strong institutional adoption and protocol expansion in 2026, positioning Sky as a leader in decentralized, yield-bearing stablecoins. Read more

Beware the Lofty Promises of TradFi Firms Embracing Tokenization

Omid Malekan published a blog post titled “Beware the Lofty Promises of TradFi Firms Embracing Tokenization” that critiques traditional financial institutions (DTCC, Visa, SWIFT, Stripe, PayPal) for selectively embracing blockchain benefits while ignoring its existential threats to their legacy business models. Malekan argues these firms tout tokenization, but avoid decentralization, risking co-opting crypto’s core values. He warns that permissioned chains and regulatory lobbying may dilute crypto’s foundational principles. While he advocates engagement with TradFi, he urges the crypto community to defend public, permissionless networks and resist compromising decentralization for mainstream adoption.

Not ‘No One Wants Non‑USD Stables’ — It’s ‘No Banks Want Non‑USD Inventory’

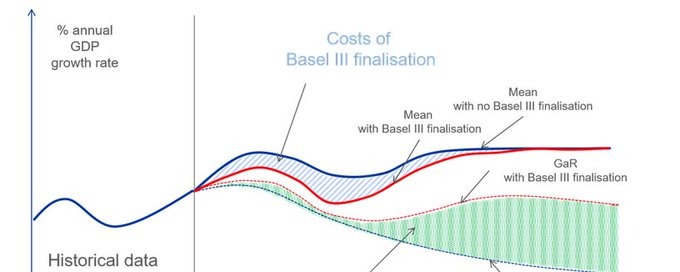

@DeFi_Cheetah on X published an article post titled “It’s Not ‘No One Wants Non‑USD Stables’ — It’s ‘No Banks Want Non‑USD Inventory’” arguing that the real barrier to non-USD stablecoin adoption is not demand, but structural limitations in the global banking system. The piece dissects how Basel III regulations, liquidity constraints, and G-SIB penalties discourage banks from holding non-USD inventories or servicing emerging market corridors. The result is a liquidity vacuum in non-USD FX markets. The author calls for DeFi-native solutions to bootstrap non-USD stable liquidity, warning that relying on traditional FX infrastructure will fail by design. Read more

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.