LayerZero Adds $6.3M in Series A Funding Led by Binance Labs and Multicoin Capital

The project previously raised $2 million in a seed round bringing its total fundraising to $8.3 million to date.

Source: Shutterstock

- Participation in the round includes Sino Global Capital, Defiance, Delphi Digital, Robot Ventures, Spartan, Hypersphere Ventures, Protocol Ventures and Gen Block Capital

- The funds will be used for the further creation of its endpoints across the ecosystem, Bryan Pellegrino, co-founder of LayerZero Labs told Blockworks

Binance Labs and Multicoin Capital co-led a $6.3 million Series A funding round for LayerZero, a new omnichain interoperability protocol, the company announced Thursday.

Participation in the round includes Sino Global Capital, Defiance, Delphi Digital, Robot Ventures, Spartan, Hypersphere Ventures, Protocol Ventures and Gen Block Capital. The project has raised $2 million in a seed funding round bringing its total fundraising to $8.3 million to date, LayerZero said.

The funds will be used for the further creation of its endpoints across the ecosystem, Bryan Pellegrino, co-founder of LayerZero Labs told Blockworks.

LayerZero has not been launched yet because it’s currently under three audits that are expected to be completed at the end of October, but Pellegrino said he expects the network to launch shortly after.

“For cross-chain bridging and messaging, almost every existing approach falls into one of two broad categories. The first is having a consensus forming middle chain validate and forward messages between chains. The second is running a light node on-chain,” Ryan Zarick, co-founder and CTO of LayerZero Labs wrote in a blog post.

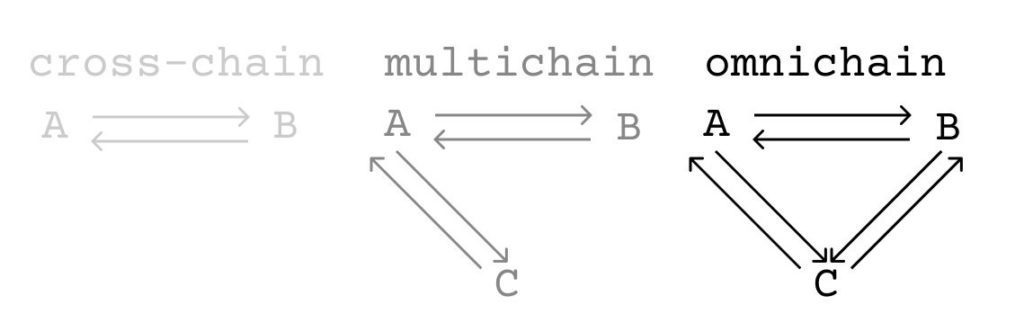

The omnichain protocol unites decentralized applications, or dapps, across blockchains. Most people think of cross-chains protocols, which is like having a bridge from Ethereum to Avalanche and while Ethereum has bridges to many other chains (BSC, Polygon, Avalanche, Solana, Fantom, etc.), Avalanche does not connect to those, Pellegrino noted.

“So we might call Ethereum multi-chain but each of it’s connected chains are still siloed and have limited communication pathways. Omnichain is when all chains are connected to each other chain directly and natively,” Pellegrino said.

Its protocol runs an “Ultra Light Node” that provides the security of a light node with the cost-effectiveness of middle chains, Zarick said.

It connects disparate blockchains by passing messages between chains instead of centralizing security around a single hub, which allows for cheaper transactions but a single point of failure, it said. On-chain light nodes are secure but expensive while middle chains are inexpensive but less secure, Zarick said.

“I think most people can see that the proliferation of chains is not something that is going to stop anytime soon,” Pellegrino said. “We’re never going to have a chain that does it all perfectly, and different use cases have different needs. LayerZero enables dapps to take advantage of the benefit of each chain and utilize the best parts of them,” Pellegrino added.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.