MicroStrategy Announces New $414.4M Bitcoin Buy

As of today, CEO Michael Saylor says the firm holds 121,044 bitcoins acquired for approximately $3.57 billion at an average price of roughly $29,534 per bitcoin.

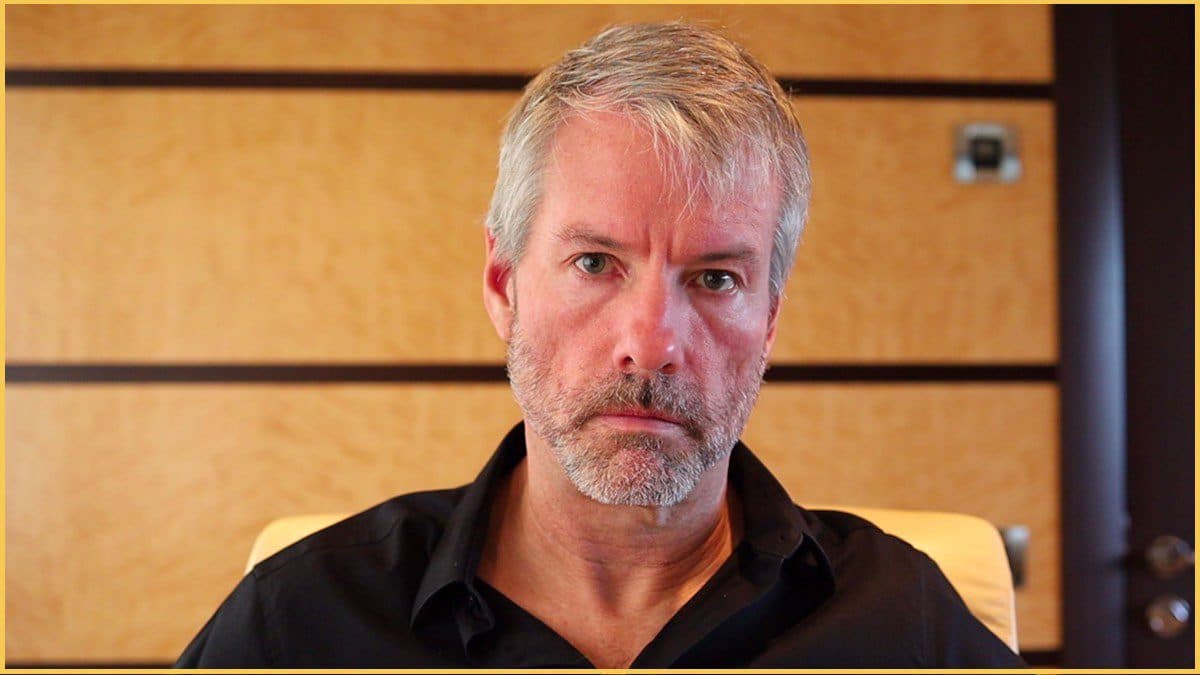

Michael Saylor, CEO, MicroStrategy

- MicroStrategy has purchased an additional 7,002 bitcoins at an average price of $59,187 per BTC

- Michael Saylor announced the firm’s latest round of bitcoin buying via Twitter after filing a Form 8-K with the SEC

MicroStrategy CEO Michael Saylor championed his company’s latest big bitcoin buy on Twitter Monday morning — a whopping 7,002 BTC totaling $414.4 million in cash with an average entry price of $59,187 per bitcoin.

The announcement follows the filing of a Form 8-K with the Securities and Exchange Commission. The filing reports that the purchases were made between October 1, 2021 and November 29, 2021, and continues the plan Saylor has been communicating for months.

In June, MicroStrategy announced that it would be selling debt to purchase more bitcoin. The company added $243 million worth of bitcoin in September, bringing its total bitcoin buys for the third quarter to 8,957 bitcoins.

The latest SEC filing, notes that a June 14, 2021 Open Market Sale Agreement, with Jefferies LLC as agent, enabled MicroStrategy to issue and sell shares of its class A common stock, and that it had indeed sold an aggregate of 571,001 shares in the past two months, at an average gross price per share of approximately $732.16, generating net proceeds of approximately $414.4 million — the same amount used to purchase the new bitcoins.

As of today, November 29, 2021, the public company, already the largest such corporate holder of bitcoin, touts an astronomical 121,044 bitcoins on its balance sheet. Saylor reports that these were acquired for approximately $3.57 billion at an average price of around $29,534 per bitcoin, which would put the present value of the BTC at more than $6.9 billion today.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.