MicroStrategy’s Saylor: Bitcoin is Apex Achievement of Humankind

Putting money into stocks and bonds was no longer serving Saylor. The numbers speak for themselves, he said from the stage at Bitcoin 2021.

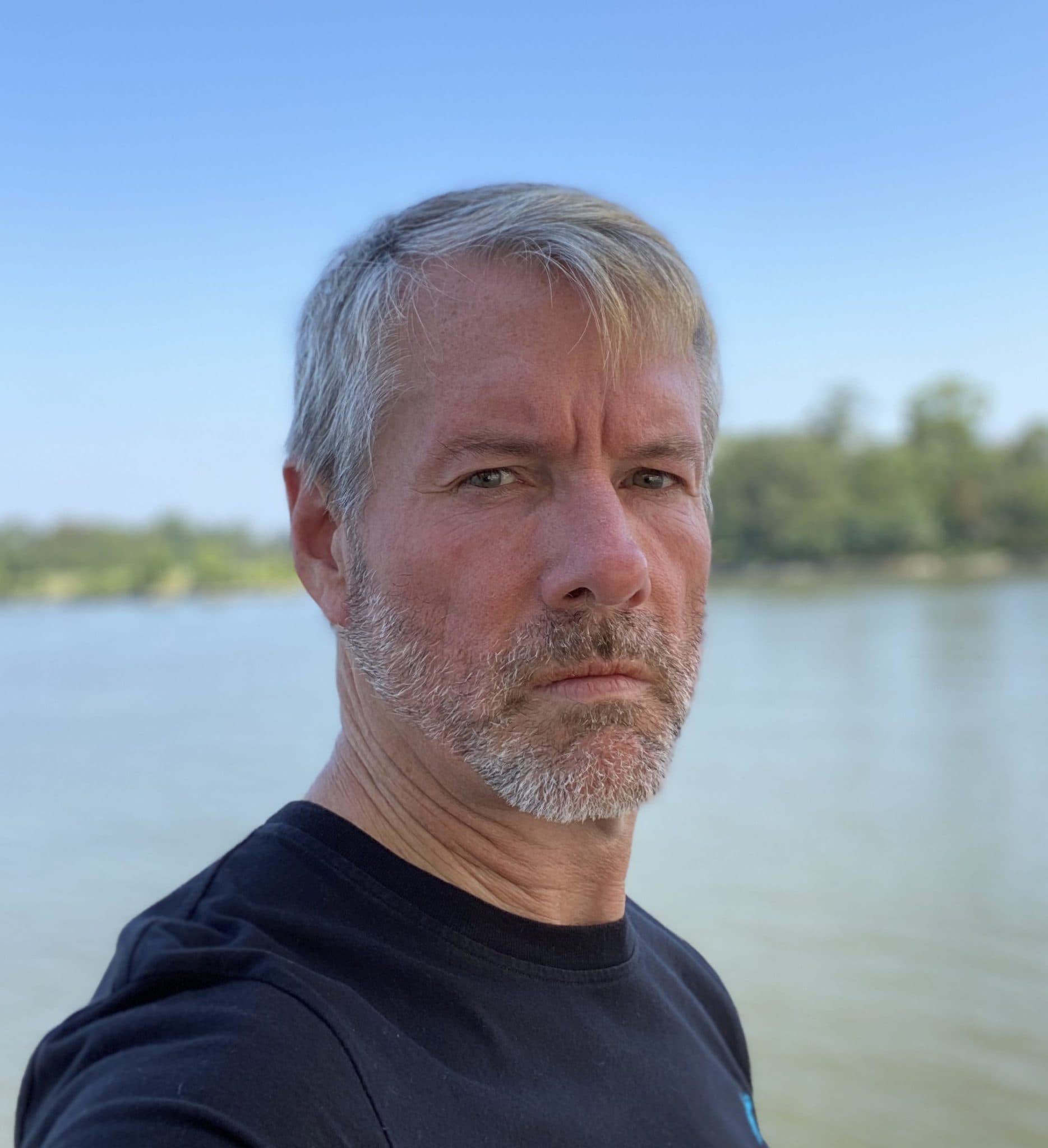

Michael Saylor, Chairman & CEO, MicroStrategy

- On the one-year anniversary of his first bitcoin purchase, Saylor revealed that bitcoin is now the only investment he believes in

- The pandemic forced Saylor to rethink his view on inflation, which had previously never been a concern for him

Bitcoin 2021, Miami — MicroStrategy CEO Michael Saylor was advised to buy bitcoin back in 2014, but he waited until mid-2020 before taking the plunge into the asset class. On the one-year anniversary of his first bitcoin purchase, Saylor revealed that bitcoin is now the only investment he believes in.

“I guess I lost faith in all of my traditional investments,” Saylor said during a panel discussion at the Bitcoin 2021 conference in Miami, referring to what made him eventually decide to venture into crypto.

Putting money into stocks and bonds was no longer serving him, Saylor said. The numbers speak for themselves, he said.

Michael Saylor on the stage at Bitcoin 2021 in Miami.

Michael Saylor on the stage at Bitcoin 2021 in Miami.

“Bitcoin delivers about 200x higher ROI than assets like Apple and Google,” he said. “The returns are even larger compared to JPM, Bank of America — all these other organizations.”

The pandemic forced the MicroStrategy CEO to rethink his view on inflation, which had previously never been a concern for him. The excessive money printing that started in 2020 and extended into this year made him nervous, he said. Bitcoin provided a store of value, and that attracted him to the digital asset.

While inflation has been a concern, the recent selloff in the bitcoin market and the industry’s ongoing battle with Tesla CEO Elon Musk do not frighten him at all. In response to questions over bitcoin’s energy use, he pointed to the figure that bitcoin recycles 0.25% of the world’s wasted energy for mining.

“I think Bitcoin is the most efficient use of energy the human race has come up with,” Saylor said. “It takes wasted energy and creates prosperity and freedom.”

Read more of our coverage from Bitcoin 2021 here.