Oil Soars Amid Surging Global Demand; Equities Advance While Crypto Dips: Markets Wrap

The OPEC ministerial panel recommended an increase in output of the red-hot commodity to compensate for the surging demand of oil in more industrialized countries.

Source: Shutterstock

- Consumer prices paid for materials hiked up to the highest they have since 1979, according to ISM data.

- CoinFund led a $2 million investment round for an esports startup.

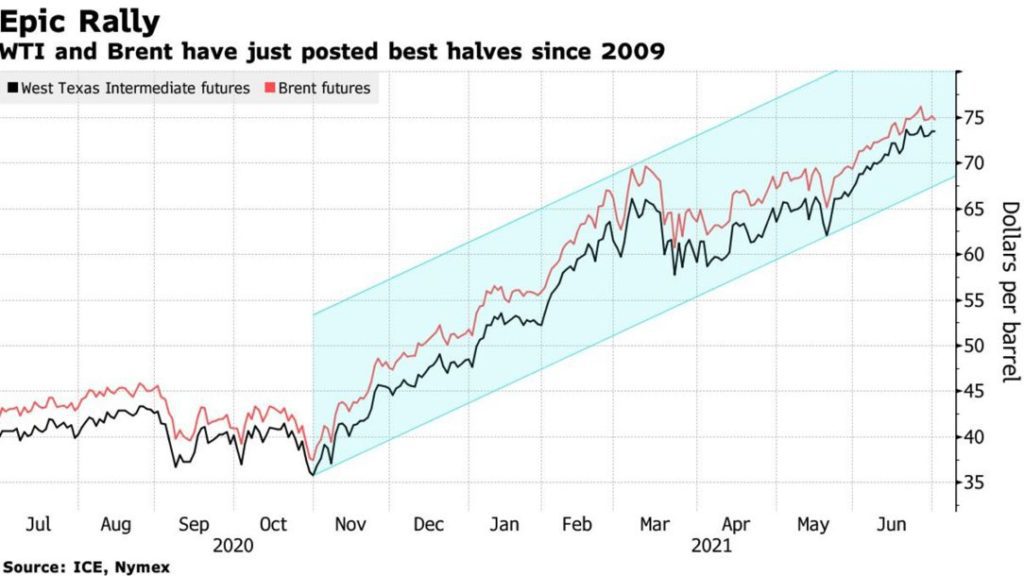

Oil wrapped up its best half since 2009 in the wake of the OPEC ministerial panel meeting. US crude surged above $75 a barrel, a benchmark high since 2018. Meanwhile, Brent crude touched $76 a barrel, inching up 2% intraday.

The alliance’s joint committee recommended a gradual increase in supply of the red-hot commodity to compensate for the surging demand in more industrialized countries, expecting demand to rise 2.7 million barrels a day in 2021. A delegate said that the majority of growth will come from the United States, adding 1.5 million barrels a day. However, the group is still negotiating details and the meeting has been delayed until Friday.

As oil prices hit benchmark highs, gold followed suit. Silver and copper shed -0.23% and -1.20% respectively.

Commodities

- Crude oil sits at $74.90 per barrel, inching up 1.96%.

- Gold is up 0.29% to $1,776.80

Insight

Director of energy futures at Mizuho Securities, Robert Yawger, told Blockworks why the commodity “ripped higher today.”

“They added barrels…They claim that the market needed it. I’m not really convinced that that is the case. That’s usually a bearish development. But the diceyness of the situation is not playing out in that direction because they’re only adding basically 400,000 barrels versus (the) expectation,” Yawger said. “Generally, the whole crude oil community coming in today was looking for an increase of about 550,000 barrels. The amount they’re adding is smaller than what people were expecting…You got a ripper to the upside here as a result.”

In a sea of strong economic data, Wall Street indices advanced. The S&P 500 opened at a record high. Tech-heavy Nasdaq Composite and The Dow Jones Industrial Average made small gains. Airline stocks also inched higher with continued reopening efforts.

Weekly jobless claims surprised investors by falling to a pandemic low on Thursday. Those applying for benefits fell 51,000 to 364,000, showing signs of optimism for the labor market, the data released Thursday revealed.

US manufacturing continues to grow too, according to data from the Institute for Supply Management (ISM) released Thursday. Consumer prices paid for materials hiked up to the highest they have since 1979. However, supply chain issues and labor scarcity are still of concern.

Equities

- The Dow was up 0.38% to 34,633.

- S&P 500 inched up 0.52% to 4,319.

- Nasdaq was up 0.13% to 14,522.

Insight

“We’ve seen the first phase, and the S&P’s string of recent new highs says we’re still in it,” Co-founder of DataTrek Research, Nicholas Colas said in a note. “But, at some point we hit phase two and markets then wrestle with what the ‘right’ valuation is for that new environment. While these awkward mid-cycle periods are rarely bull market killers, they can make for very low returns… and valuations are high enough currently that peaking earnings could be a larger risk than before.”

Crypto

- Bitcoin is trading around $33,236.07, down -3.89% in 24 hours at 4:00 pm ET.

- Ether is trading around $2,111.37, shedding -5.67% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.063, down -2.28% at 4:00 pm ET, according to TradingView.

- VIX fell -2.46% to 15.44 at 4:00 pm ET.

Fixed Income

- The US 10-year yields 1.465% as of 4:00 pm ET.

Currencies

- The US dollar strengthened 0.14%, according to the Bloomberg Dollar Spot Index.

In other news…

CoinFund led a $2.3 million investment round for an esports startup, Community Gaming, as the blockchain and gaming sectors intersect. The New York-based company automates esports tournaments, using blockchain-enabled payment solutions to pay out winners automatically via crypto wallets, Blockworks reported Thursday.

Insight

“This investment round further accelerates the convergence of gaming and blockchain, specifically through supporting Community Gaming’s expansion of its product feature set and geographic coverage,” said Evan Feng, venture and liquid investor at CoinFund.

We’re watching out for …

- June US jobs report will be released on Friday.

- European Central Bank president Christine Lagarde will speak Friday.

That’s it for today’s markets wrap. I’ll see you back here tomorrow.