Oil

Traders can now access UK crude oil, palladium and platinum perpetual contracts on Bitfinex Derivatives

Investors are watching the developing conflict in Ukraine and await Biden’s executive crypto order and new interest rates

BTC, ETH and LUNA lead the rebound in digital assets after a large post Thanksgiving day sell-off induced by fears of a new Covid-19 variant.

US stocks fall as investors eye price pressures, the delta virus strain and looming risks of elevated inflation levels.

Bitcoin has shed 11% in the past seven days, its largest single-week drop since May

On the 16th anniversary of Hurricane Katrina, the category four storm arrived with winds above 150 mph, striking key energy hub Port Fourchon, whose docking site supports roughly 90% of the Gulf’s oil rigs.

Despite a decent start in earnings season, the Dow Jones Industrial Average broke a multi-week string of gains, shedding 0.5%.

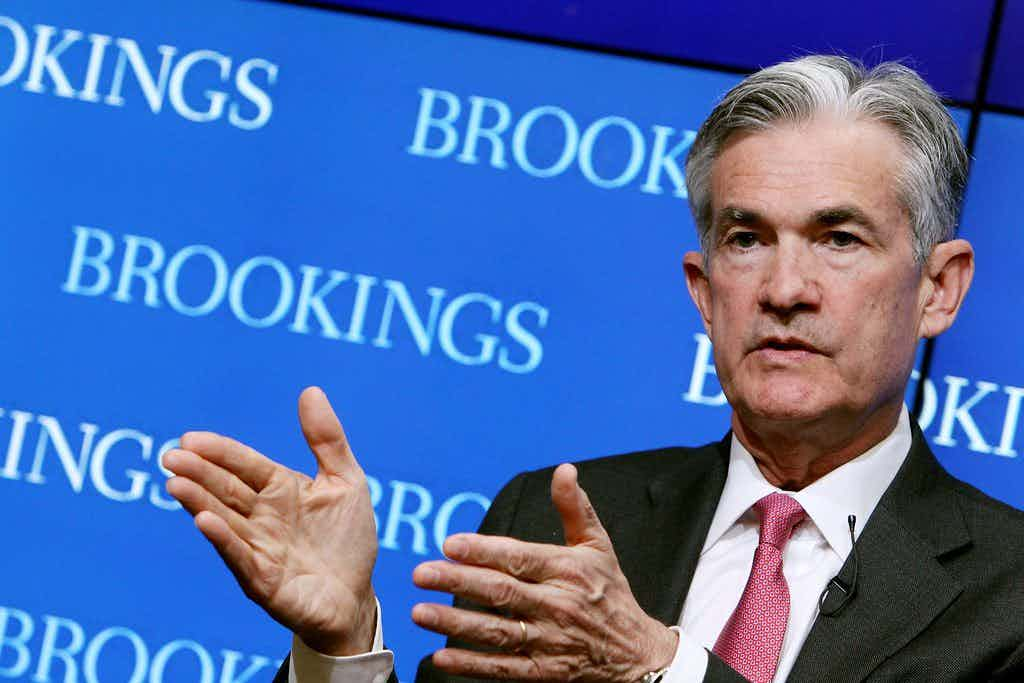

Weary investors speculate sustainability of economic growth while Fed chair insists that high inflation is temporary.

Oil benchmarked a six-year high then tumbled after OPEC+ chaos, resulting in spat between Saudi Arabia and UAE.

“I think the reason the market liked the June jobs reports today is because it doesn’t change the expectation for the Fed,” said Tom Essaye, President of Sevens Report Research. “That to me is the biggest takeaway. It was a pretty goldilocks report.”

The OPEC ministerial panel recommended an increase in output of the red-hot commodity to compensate for the surging demand of oil in more industrialized countries.