Stocks Rise After GDP Data; Cryptos Stay Steady: Markets Wrap

Despite disappointing data and looming Covid restrictions, all Wall Street gauges closed ahead.

Source: Shutterstock

- Peter Theil’s Valar Ventures led a $25 million Series A funding round for lending platform, Vauld.

- PayPal is set to expand its crypto capabilities and DeFi apps, the company’s CEO said during its earnings call.

Major indices advanced on Thursday. Investors continued to assess economic growth amid rising Covid cases, gross domestic product data and jobless claims.

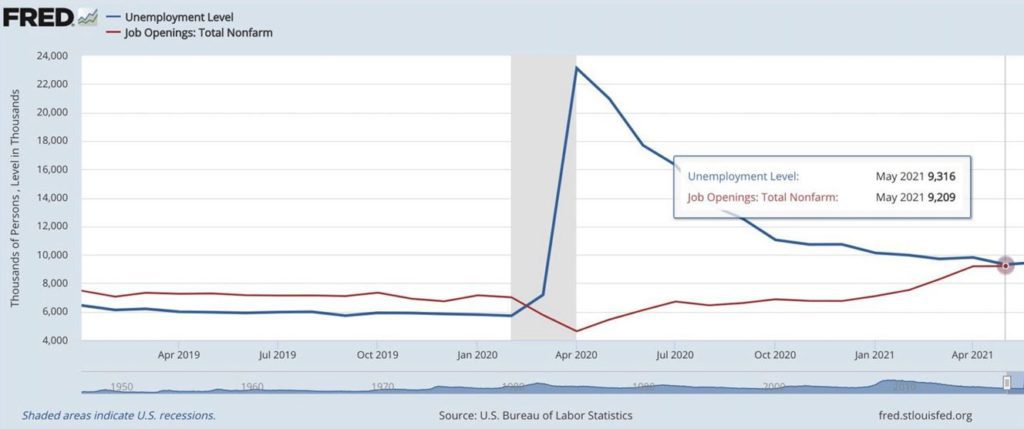

GDP figures rose to 6.5% from last year, but fell below economists’ predictions of 8.4%. Initial jobless claims were lower last week, but the job market still have a major shortage problem.

On the Nasdaq, Robinhood made its trading debut today on the public markets with an underwhelming performance for prospective retail investors to come. Shares were listed around $38, the low-end of underwriters’ estimates. The IPO valued the trading platform at approximately $31.8 billion. However, after the opening bell, the company’s shares shed more than 10% intraday, Blockworks reported. Amazon and Facebook both fell after earnings.

Despite disappointing data and looming Covid restrictions, all Wall Street gauges closed ahead.

Equities

- The Dow was up 0.44% to 35,084.

- S&P 500 advanced 0.42% to 4,419.

- Nasdaq had an uptick of 0.11% to 14,778.

Insight

“What is going on with the US labor market that we have as many job openings as unemployed workers? While Chair Powell has never explicitly said it, the Fed clearly thought that pre- and post-pandemic labor markets would be roughly mirror images of each other. Workers who lost their jobs would be recalled once the economy recovered, plus or minus a small percent,” according to a note from DataTrek. “Instead, we have a very hot labor market AND still-high unemployment.”

Source: DataTrek

Source: DataTrekBitcoin continues to trade near $40,000, a multi-day bullish streak for the decentralized currency. On Wednesday, the crypto briefly touched a six-week high, trading at almost $41,000.

In regulatory news, a last-minute amendment was made to collect taxes on cryptocurrencies through a US infrastructure deal. Following the news, bitcoin remained at $39,000.

Bitcoin is up 10.58% returns on investment to the dollar in the past month, according to Messari. Bitcoin has maintained support around $36,000 to $40,000 for the past several days.

In decentralized finance (DeFi), PayPal is set to expand its crypto capabilities, which the company’s CEO said could include smart contracts and central bank digital currencies, Blockworks reported. Ascensive Assets, a digital asset investment firm run by ex-pro poker players, scored $130 million in funding, CoinDesk first reported. The crypto VC firm will use funds to focus on DeFi markets.

DeFi

- Uniswap is trading at $19.32 with a total value locked of $4,219,765,552 up 0.4% in 24 hours at 4:00 pm ET.

- Chainlink is trading at $18.87, declining -2.3% with trading volume at $578,993,985 in 24 hours at 4:00 pm ET.

- DeFi:ETH is 31.4% at 4:00 pm ET.

Crypto

- Bitcoin is trading around $39,660.93, down -0.89% in 24 hours at 4:00 pm ET.

- Ether is trading around $2,312.83, advancing 0.62% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.0582, up 1.33% at 4:00 pm ET.

- VIX is down -5.08% to 17.38 at 4:00 pm ET.

Insight

“Regarding ETHBTC, we are more bullish ETH over BTC and look for this cross to trade higher over the medium-term. We are looking at the 0.055 level as support for the Wave 4 triangle to end – and Wave 5 higher to begin…For ETH itself, 2.4k is the range resistance that would need to break to see a move higher,” QCP Capital Broadcast said in a Wednesday note over Telegram.

Fixed Income

- US 10-year treasury yields 1.271% as of 4:00 pm ET.

Commodities

- Brent crude is up to $75.85 per barrel, advancing 1.53%.

- Gold rose 1.56% to $1,827.80.

Currencies

- The US dollar fell -0.45%, according to the Bloomberg Dollar Spot Index.

In other news…

Peter Theil’s Valar Ventures led a $25 million Series A funding round for lending platform, Vauld, Blockworks reported on Thursday. The company said it has raised a cumulative $27 million in capital to date. Vauld’s AUM and user base has also grown more than 200 times in the past year, according to the company’s CEO and co-founder.

Insight

“Cryptocurrencies offer individuals a unique opportunity to not only invest in the future but also a new way to build wealth,” co-founder Darshan Bathija said in an interview with Blockworks.

We’re watching out for…

- ExxonMobil Corp. will release their earnings on Friday.

That’s it for today’s markets wrap. I’ll see you back here tomorrow.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.