Strategic Advisory Firms Merge to Become Crypto Space’s Go-To M&A Specialists

Executives at Architect Partners and Emergents expect another deal-filled year after busy 2021

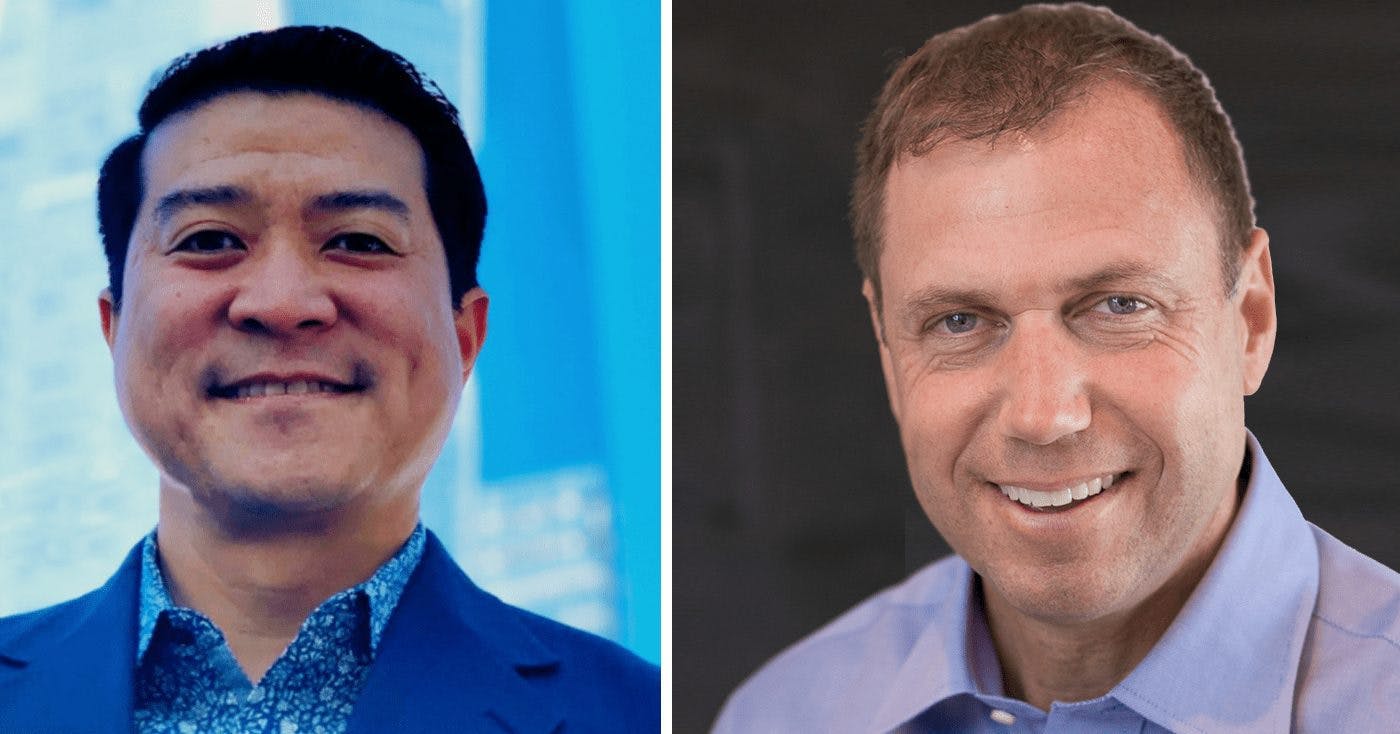

Elliot Chun and Eric Risley of Architect Partners

- “As a small firm, building a presence in an emerging area can be a tremendous competitive differentiator,” Architect Partners Managing Partner Eric Risley said

- The merge comes after crypto M&A tripled and capital raise transactions nearly doubled from 2020 to 2021

Architect Partners is merging with crypto-native investment bank team Emergents in an effort to become the go-to M&A and financing advisory firm in the crypto space following a deal-filled year.

Architect Partners has delivered M&A and strategic financing advisory services to entrepreneurs, public company senior executives and boards of directors since it was founded in 2010. The company tracks crypto mergers and acquisitions, private financings and public company valuation trends and publishes alerts on all announced transactions.

Emergents, founded in 2017, is an emerging technology investment bank team focused on crypto, blockchain and climate tech. It offers strategic advisory and capital raising services to innovators and entrepreneurs.

With the addition of the Emergents team, Architect Partner’s crypto unit is the largest group in the firm as measured by revenue and professionals, firm executives said.

Of the dozen or so employees at the company, about two-thirds are dedicated exclusively to the crypto space, Architect Partners Managing Partner Eric Risley told Blockworks.

“As a small firm, building a presence in an emerging area can be a tremendous competitive differentiator,” Risley explained. “When we started Architect Partners…it was really clear in my mind to focus and find our spot and be really deep and good at it.”

Emergents Managing Partner Elliot Chun said that Emergents has believed since 2019 that crypto, as an industry and an asset class, is positioned for transformational growth.

After the merge with Architect Partners, he added, the combined firm will better be able to connect with both crypto native firms, as well as traditional asset managers, corporations and other institutional investors transitioning to the space.

“That is where our teams can really fit today and going forward,” Chun noted in an interview with Blockworks.

“With all the tailwinds behind crypto, with all the tailwinds behind the various enterprise use cases that we’re seeing, it’s a great time to be making this move.”

Crypto M&A activity accelerating

The merge, announced on Thursday, comes after crypto mergers and acquisitions accelerated in 2021 — tripling from 2020 levels, according to the firms, while capital raise transactions nearly doubled over that span.

One of the biggest deals of last year — excluding those involving special purpose acquisition companies (SPACs) — was Galaxy Digital’s $1.2 billion purchase of BitGo.

2021 also witnessed a new type of blockchain-based merger between DAOs, one approved by governance token holders of Rari Capital (RGT) and Fei protocol (TRIBE).

Ryan McCulloch, an investment banking associate at Architect Partners, previously told Blockworks in an interview that he expects large financial companies to continue looking to buy crypto data providers, stablecoin issuers and digital asset firms focused on payments.

Chun highlighted the merge of the Polygon and Hermez networks last year, noting that he expects to see more of those types of deals in 2022.

Risley said Architect Partners plans to announce four closed crypto M&A deals in the next six weeks, though he did not specify which companies were involved.

“Two of which are with the top one percent marquee names in the sector and all of which have massive strategic value,” he noted. “Most of the deals that we have within Architect Partners…are in the crypto sector, and we anticipate that will increasingly be the case and will become 100% at some point.”

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.