US Stocks Extend Losses; LUNA Surges: Markets Wrap

Equities may continue volatile trading sessions as investors remain uncertain about US economic growth due to rising Covid-19 cases, an unclear tapering timeline and more.

source: SHutterstock

- Switzerland’s regulator will allow SIX Digital Exchange to operate a stock exchange and a central securities depository for digital assets

- Terra’s native token (LUNA) jumped almost 40% on-day as major cryptos tumbled

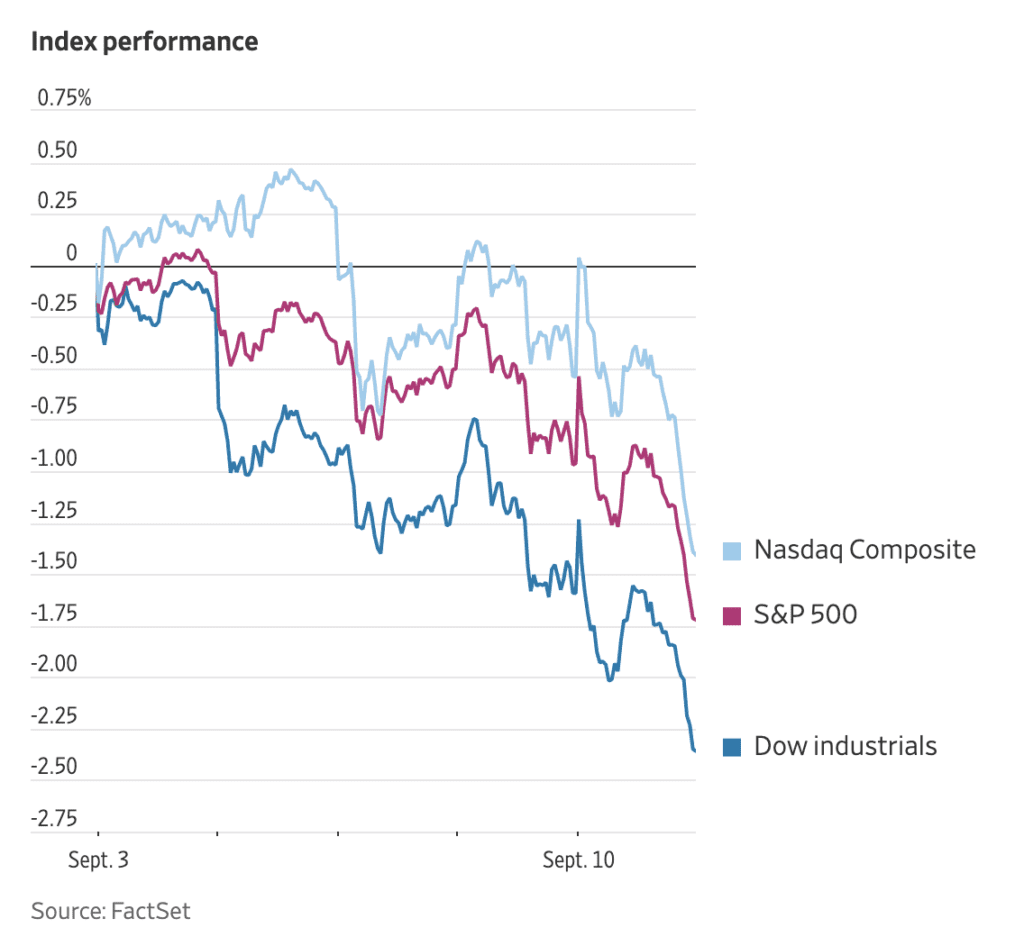

US stocks fall for the week.

Major equities like the S&P 500 and the Dow Jones Industrial Average extended losses for a fifth day in a row, the longest losing streak both indices have had since June. The Dow plunged over 200 points on Friday. Apple Inc. was one of the biggest laggards in the index, shedding over 3% on-day. This was the the tech giant’s biggest loss in over three months.

Equities may continue volatile trading sessions as investors remain uncertain about US economic growth due to rising Covid-19 cases, an unclear tapering timeline and more.

Equities

- The Dow declined -0.57% to 34,680.

- S&P 500 is down -0.56% to 4,468.

- Nasdaq shed -0.68% to 15,144.

Source: The Wall Street Journal

Source: The Wall Street JournalTerra’s native token, LUNA, jumped almost 40% on-day as major cryptos tumbled. LUNA is trading at $41.32, according to CoinGecko. Despite modest gains the day before, bitcoin and ethereum both declined around 3%, as of press time.

Crypto

- Bitcoin is trading around $45,645.82, declining -2.05% in 24 hours at 4:00 pm ET.

- Ether is trading around $3,323.58, down -3.96% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.072, declining -1.98% at 4:00 pm ET.

DeFi

- Terra (LUNA) is trading at $41.32, advancing 37.3% and trading volume at $3,717,787,984 in 24 hours.

- Chainlink (LINK) is trading at $26.77, declining -6.7% with trading volume at $1,712,485,842 in 24 hours at 4:00 pm ET.

- DeFi:ETH is 32% at 4:00 pm ET.

Insight

“Historically, September isn’t kind to the market for both equities and crypto. Since 2011, there were only three times when BTC had a positive return in September,” BKCoin Capital’s Kevin Kang said. “Since Tuesday, the market has been choppy but there were a number of outperforming outliers, specifically Solana (SOL), continuing to rally and recording all time highs day after day – reaching $216 yesterday. Solana’s 11,500% return YTD is nothing but impressive.”

Terra (LUNA) trading over the past day Source:TradingView

Terra (LUNA) trading over the past day Source:TradingViewCommodities

- Brent crude was up to $72.96 per barrel, advancing 2.1%.

- Gold declined -0.58 to $1,789.5.

Currencies

- The US dollar strengthened 0.13%, according to the Bloomberg Dollar Spot Index.

Fixed Income

- US 10-year treasury yields 1.343% as of 4:00 pm ET.

In other news…

Switzerland’s regulator will allow the SIX Digital Exchange to operate a stock exchange and a central securities depository for digital assets, Blockworks reported on Friday.

That’s it for today’s markets wrap. I’ll see you back here on Monday.

Are you a UK or EU reader that cant get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.