Pantera Capital: Invest in Crypto With a Multi-Year Outlook

Bitcoin has fallen about 53% from its all-time highs of about $63,000 in April. While the cryptocurrency remains low, many market participants aren’t worried.

Dan Morehead, founder, CEO and Co-CIO of Pantera Capital

- People investing in cryptocurrencies and tokens should have a multi-year perspective, according to Pantera Capital CEO Dan Morehead.

- Long term, the company projects the terminal value of bitcoin as high as $700,000 in five to 10 years if 3.5 billion people on earth with a smartphone partake in using the digital coin.

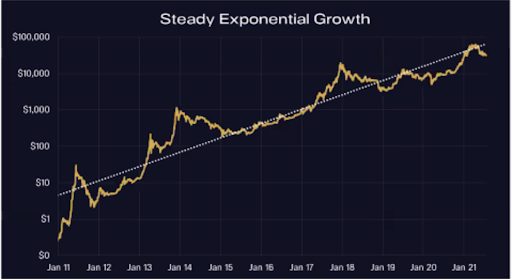

Bitcoin has its manic bubbles and drawdowns, but when looking from a bird’s eye view, it has a steady exponential growth rate, Pantera Capital CEO Dan Morehead during a conference call on Tuesday.

That same morning, bitcoin prices retreated below $30,000 for the first time in almost a month.

In fact, the digital coin has fallen about 53% from its all-time highs of about $63,000 in April.

In March, Morehead said bitcoin was on track to hit $115,000 by August 2021 while skeptics like Ray Dalio predicted a crash.

Today, the cryptocurrency is well below that $115,000 prediction, but still many market participants aren’t worried, including Morehead.

“Things change quickly in this space. I think that the reasons the markets have fallen are transitory,” he said.

Pantera Capital is an asset management firm with an estimated $3.1 billion in assets under management and currently offers a range of investment funds focused on cryptocurrencies and tokens. Its funds provide investors with exposure to the space, ranging from illiquid venture capital assets like early-stage tokens and multi-stage venture capital equity, to more liquid venture capital assets like bitcoin and other cryptocurrencies.

In the latest letter to investors, he said a convergence of elements has caused the blockchain markets to drop sharply but “the volatility has presented a very compelling opportunity,” Blockworks previously reported.

On average, bitcoin has tripped every year since its inception and is at a 233% compound annual growth rate, according to Pantera Capital.

Chart showing bitcoin pricing growth over time; Source: Pantera Capital

Chart showing bitcoin pricing growth over time; Source: Pantera Capital

Right now, bitcoin is trading 46% below its 11-year exponential trend, which is significant because only 15% of time in the history of bitcoin has it been this cheap, Morehead said.

“We like to remind people investing in tokens that they should have a multi-year perspective, and we like four-year returns because it takes out crazy wiggles from bubbles and bursts,” he said.

According to Morehead, supply and demand drives the price of bitcoin, and over time more people enter the market which brings in higher demand and less supply.

Pantera Capital chart showing potential terminal value of bitcoin; Source: Pantera Capital

Pantera Capital chart showing potential terminal value of bitcoin; Source: Pantera Capital

In December 2020, there were about 100 million people using bitcoin, the company said.

Although we’re in a “bear market right now, where everyone’s fearing for the worst,” there is a potential of 1 billion people using bitcoin by 2022, which could spike the price of bitcoin up to levels as high as $200,000, Morehead said.

With a cryptocurrency market size of $1.5 trillion, the industry is still in the early stages of adoption, Pantera noted while projecting the terminal value of bitcoin as high as $700,000 in five to 10 years if 3.5 billion people on earth with a smartphone partake in using the digital coin.

Get more breaking news and industry insights directly into your inbox. Subscribe to the Blockworks Daily newsletter for free.