Bitcoin Convert Dalio Bearish on American Future of Free Finance

Dalio imagines a scenario where investors grow tired of the low interest rates on US bonds and decide to no longer buy them. In response, the US doubles down on taxation and targets those swapping dollars for alternative assets.

key takeaways

- Dalio had previously been a major skeptic of bitcoin before having a ‘damascus moment’ earlier this year

- Another billionaire investor, Howard Marks changed his bitcoin tune and said that he initially dismissed cryptocurrency without information

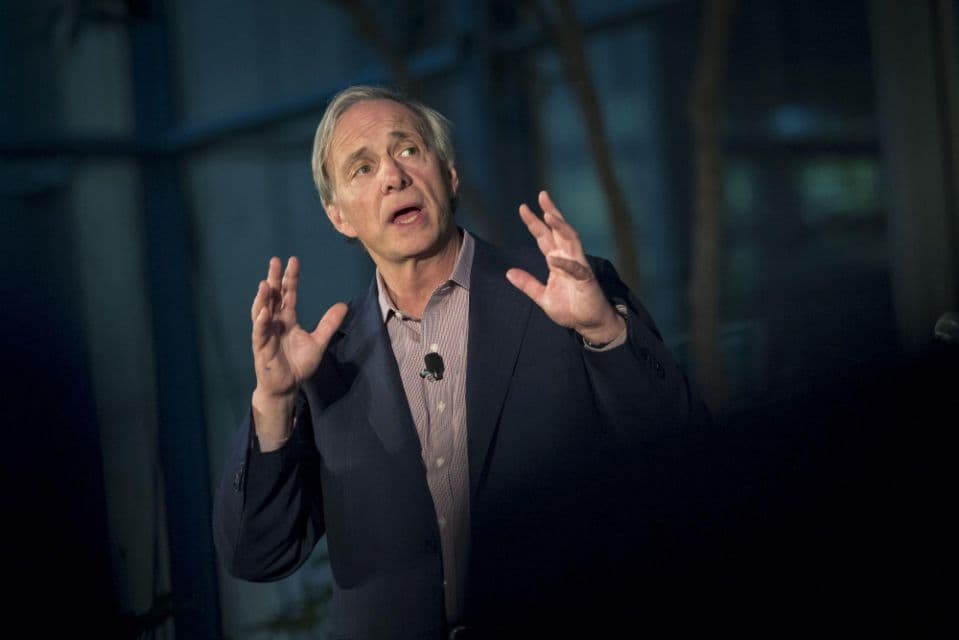

Debt from the fiscal response to Covid-19 will create a “new paradigm” involving possible prohibitions on alternative assets like bitcoin and more taxes according to hedge fund manager Ray Dalio.

Dalio, in a recent note on Linkedin, argued that the United States is on a path to being “inhospitable to capitalism”. Dalio imagines a scenario where investors grow tired of the remarkably low interest rates on US bonds and decide to no longer buy them, ending an era of “exorbitant privilege” where the US could issue unlimited debt because of infinite demand for said debt based on the holdings of institutional investors. In response, the US doubles down on taxation and targets those trying to swap their dollars for alternative assets.

“If history and logic are to be a guide, policy makers who are short of money will raise taxes and won’t like these capital movements out of debt assets and into other storehold of wealth assets and other tax domains so they could very well impose prohibitions against capital movements to other assets (e.g., gold, Bitcoin, etc.) and other locations,” he wrote.

Shocking tax changes…

Dalio cited Elizabeth Warren’s proposed wealth tax — though notes that it’s unlikely to pass in current form — as an example of this “new paradigm.”

“These tax changes could be more shocking than expected,” he wrote.

And the antidote? Short the dollar, he advised, adding that readers should position themselves with a “well-diversified portfolio of non-debt and non-dollar assets along with a short cash position.”

Steven McClurg, Chief Investment Officer of Valkyrie Investments, told Blockworks that this “new paradigm” means that investors are going to need to abandon their current portfolio structures and embrace a new reality.

“A prudent investor will abandon the 60/40 model for a 60/20/20 model: stocks, real estate, and crypto. And if you are very risky, add private equity,” he said. There is no longer room for fixed income for savers, which pains me to say as a former and long-time bond manager.”

McClurg doesn’t think that bitcoin will be singled out as its “too late now” thanks to Elon Musk and MicroStrategy’s Micheal Saylor, but warned of the damaging impact of capital controls on economies.

“Anytime a country restricts capital and asset flows in and out of its borders, they risk trade imbalances and wide spreads in currency trading,” he said. “We have seen this with Brazil, South Africa, and India in the last decade, where similar policy has dampened foreign investment and led to brain drains. India’s recent stance on crypto currencies will further suppress growth.”

Changing the bitcoin tune

Dalio hadn’t always been such a fan of bitcoin, and historically had said that it had no place in Bridgewater’s portfolio. But in late January, he changed his tune writing in a newsletter that bitcoin is “one hell of an invention” and cryptocurrency could be a “gold-like asset” especially in a period of intense volatility.

Separately today, another billionaire investor, Howard Marks changed his bitcoin tune and said that he initially dismissed cryptocurrency without enough information. Now, in an interview with the Korea Economic Daily, Marks said that people that bought bitcoin at $5,000 “look right.”

Bridgewater’s flagship fund lost 7.6% of its value last year, whereas bitcoin appreciated by roughly 400% from $7,500 to close 2020 at approximately $30,000. The fund announced in February that investment decisions would be made by three people now, and not just Dalio.

At the time of posting this story, BTC is trading at $55,891.