Stronghold Digital Mining

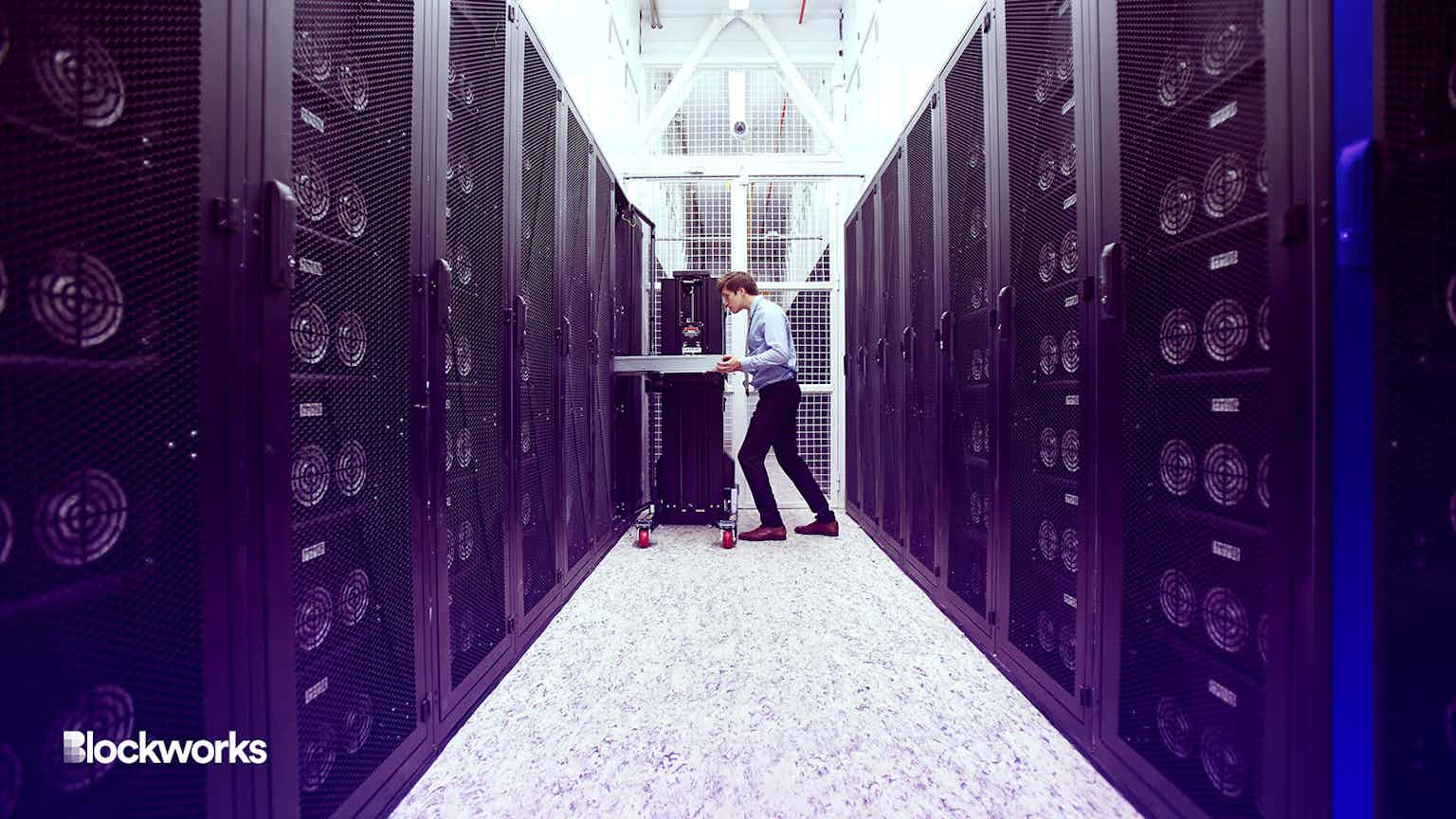

The Canadian company hopes to reach 950 megawatts of power capacity by the end of 2025 via its deal with New York-based Stronghold Digital Mining

Stronghold Digital Mining’s market value compared to its peers is “hard for us to understand,” CEO says

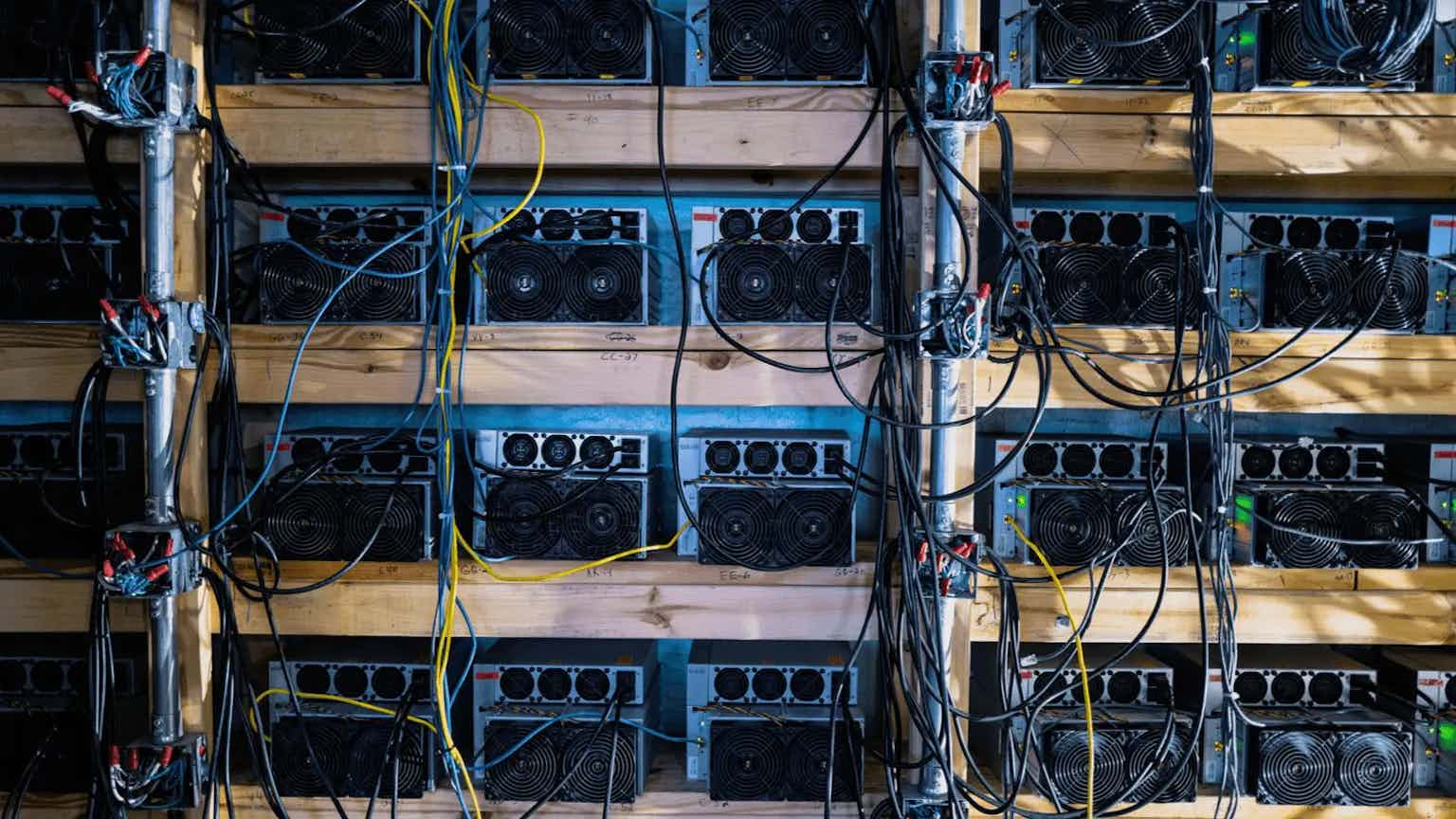

Stronghold Digital Mining is a Pennsylvania-based miner that repurposes waste coal for bitcoin mining

The miner is accused of misleading investors about its mining capacity and cost of operations, in direct violation with sections of the US Securities Act

Miners need to survive until the 2024 bitcoin halving, which historically creates a positive imbalance between bitcoin’s supply and demand, CoinShares says

The deal is structured to reduce the bitcoin miner’s debt load by about $18 million as Stronghold preps for what’s expected to be a prolonged crypto winter

More miner suffering is likely to be had before more bankruptcies, consolidation, analysts say

The bitcoin-friendly mining company’s stock price rose as much as 67.8% following its IPO launch at Nasdaq on Wednesday.

Stronghold plans to raise $100 million through offering 5,882,352 shares of its Class A common stock at a range between $16 and $18 price per share, the SEC filing showed.

Pennsylvania-based company that reclaims coal waste as a way to power bitcoin mining sees bitcoin as the vehicle to do urgently needed environmental cleanup.

While the company is focused on bitcoin, it may utilize its miners for other crypto assets depending on market conditions.

Stronghold expects to have over 28,000 cryptocurrency miners by the end of the year and is currently in negotiations to acquire additional facilities with over 200 megawatts of power capacity, according to reports.