Trust Machines Hires Former Coinbase, BNY Mellon Execs

A former Coinbase COO and senior attorney at the FTC have made the jump to the bitcoin-focused developer

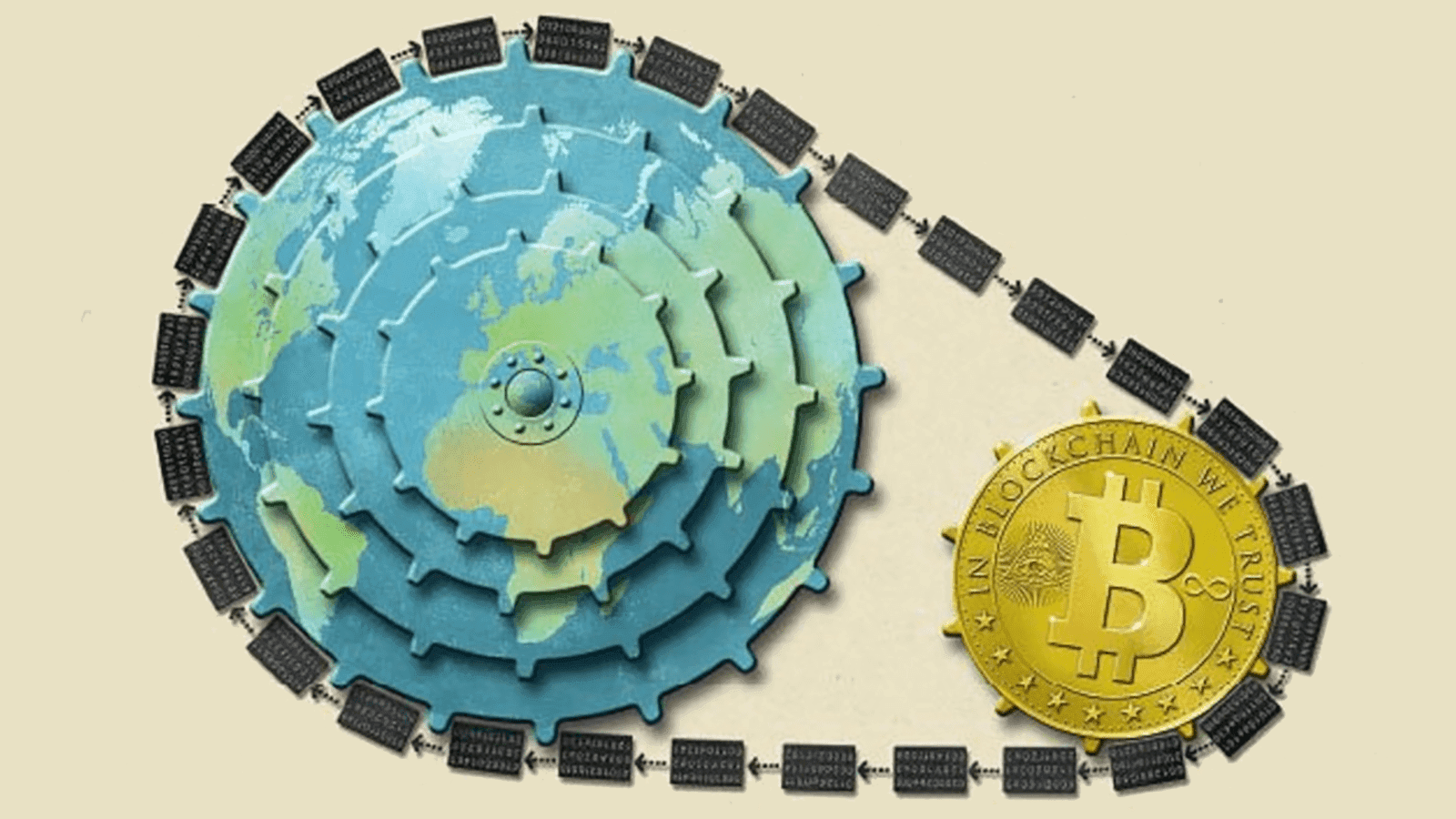

The Trust Machine, The Economist, October 31, 2015

- Asiff Hirji will join as an advisor, and Manas Mohapatra comes onboard as general counsel

- The announcement comes as several crypto heavyweights announce layoffs due to difficult market conditions

Blockchain startup Trust Machines has hired former Coinbase executive Asiff Hirji and former BNY Mellon deputy general counsel Manas Mohapatra.

Hirji, who served as president and chief operating officer at Coinbase between 2017 and 2019, joins the company as an advisor. He has held multiple director positions across various industries, briefly worked in an advisory role for venture capital firm a16z and currently holds a similar position at Warren Buffett-backed Nubank.

Mohapatra joins Trust Machines as general counsel. Among other roles, he’s previously worked as associate general counsel for Twitter for more than four years and as a senior attorney for the US Federal Trade Commission.

Another staff addition is Igor Sylvester, who will be joining the company’s engineering team. Prior to this role, he worked as a software engineer at Reddit and led a machine-learning team at Facebook.

“I’m excited to share that Trust Machines continues to attract world-class talent during this bear market to help build the world’s largest ecosystem of Bitcoin applications,” Muneeb Ali, CEO of Trust Machines, said in a statement.

Launched in early 2022, the company was co-founded by Ali — who also founded Stacks — and Princeton University computer science professor JP Singh. It raised $150 million in February, counting Breyer Capital, Digital Currency Group and GoldenTree among participant investors.

The name “trust machines” is a play on Turing machines — the first computer invented by Alan Turing at Princeton.

The company said it plans to make further key hires in the second half of this year. New hires in the cryptoasset industry have dwindled as more companies announce cost-cutting measures and slow down hiring efforts in a challenging macroeconomic environment. Heavyweight names such as Coinbase and Gemini have announced plans to cut staff.

But not everyone in the industry appears to be significantly affected. Earlier this month, Immutable’s co-founder Robbie Ferguson told Blockworks it was on a hiring spree and “now is not the time to take our foot off the pedal.” Exchanges OKX and Bitget too have announced plans to significantly boost their headcounts.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.