3AC Co-Founders Headed to Dubai, Want Orderly Liquidation: Report

“The whole situation is regrettable,” Kyle Davies told Bloomberg. “Many people lost a lot of money.”

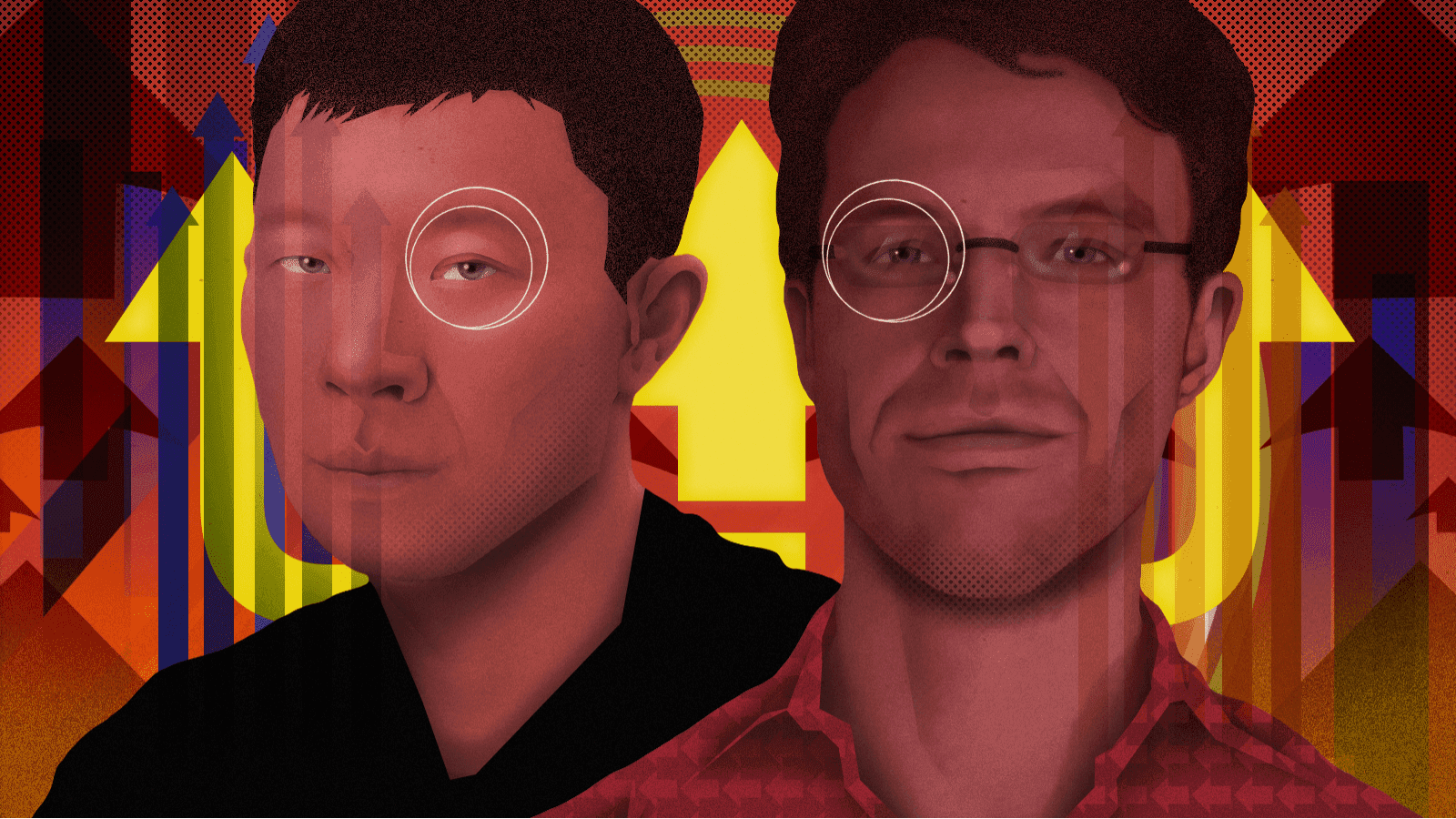

Three Arrows Capital founders Su Zhu and Kyle Davies | Blockworks exclusive art by axel rangel

key takeaways

- Zhu said it isn’t surprising that Celsius and other lenders had the same troubles

- Bitcoin’s plunge to $20,000 was the “nail in the coffin,” he said

Su Zhu and Kyle Davies are finally openly addressing the collapse of their hedge fund Three Arrows Capital (3ac) after liquidators accused them of failing to cooperate over creditor claims.

The 35-year-olds, who began the company at their kitchen table in 2012, spoke to Bloomberg in an extensive interview about the fund’s inability to meet margin calls on loans that they now regret.

Both highlighted that they suffered deep losses, and denied taking out money from the fund before it collapsed. Zhu claimed he put more money into the fund around the time of its breakdown.

Liquidators for 3AC’s creditors said in a July 8 filing that both co-founders were not cooperating meaningfully and wouldn’t speak when asked questions on a Zoom call. Court records show their lawyers from Advocatus and Solitaire spoke instead.

But Zhu told Bloomberg the specifics of the call with Davies and two lawyers from Solitaire didn’t mean they were not cooperating with “all relevant authorities.” One lawyer said both co-founders were on their way to the United Arab Emirates, but didn’t disclose where they were speaking from.

3AC’s bankruptcy triggered a meltdown among crypto lenders that partly contributed to the downturn in crypto markets and a liquidity crisis for several firms, including Voyager and Celsius. The fund had a long list of counterparties whose money was dependent on its ability to stay afloat.

But the strategy to borrow money from across the industry and make investments into emerging projects suffered after stablecoin TerraUSD’s collapse, bringing down investors that held concentrated bets on the firm.

“The whole situation is regrettable,” Davies told Bloomberg. “Many people lost a lot of money.”

3AC now owes $3.5 billion to about 27 crypto firms, with crypto brokerage Genesis being the top creditor with a claim of $2.3 billion. So far, liquidators have reportedly managed to seize assets worth $40 million.

Zhu said they had positioned themselves for a “kind of market that didn’t end up happening,” and the contagion that spread to other firms wasn’t shocking because all have similar yield-generating strategies.

Defending speculation about lavish lifestyles

A recent affidavit filed by 3AC’s liquidator Russell Crumpler said Zhu and Davies made a down-payment on a $50 million yacht, implying they used the fund’s assets for extravagant personal expenses.

Zhu said the yacht, which has a “full money trail,” was purchased more than a year ago and was meant to be used in Europe. He claimed he doesn’t have a lavish lifestyle, that he biked to and from work each day and that his family owned just two homes in Singapore.

He further defended their manner of living by saying they weren’t seen in clubs or driving Ferraris and Lamborghinis, and that speculation about their lives is merely a smear effort.

‘Nail in the coffin’

3AC’s troubles came shortly after the sudden collapse of TerraUSD and its sister token LUNA, which wiped out the savings of thousands of investors. The fund, which invested about $200 million in LUNA, suffered heavy losses as a result.

Zhu told Bloomberg that 3AC may have been too close to Terra’s founder Do Kwon as he moved to Singapore, and believed the project would do “very big things.” He described it as a “Long Term Capital moment” under which 3AC dabbled in various types of trades.

“And then they kind of all got super marked down, super fast,” he said.

LUNA’s collapse didn’t immediately have an impact on 3AC, but the real blow was bitcoin’s drop from $30,000 to $20,000.

“That ended up being kind of the nail in the coffin,” Zhu said.

Overconfidence in the long-running bull market contributed to the fund’s own mistakes as well as the industry’s lenders, according to him. 3AC’s partners were well aware of associated risks and its website never pitched itself as risk-free, he added.

Both Zhu and Davies now want to keep a low profile and are hoping for an orderly liquidation of their fund’s assets.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.