3AC Liquidators Want to Subpoena Su Zhu, Kyle Davies via Twitter

The firm overseeing 3AC’s liquidation asked a US court for permission to subpoena Su Zhu and Kyle Davies via Twitter and email while their locations remain unknown to the public

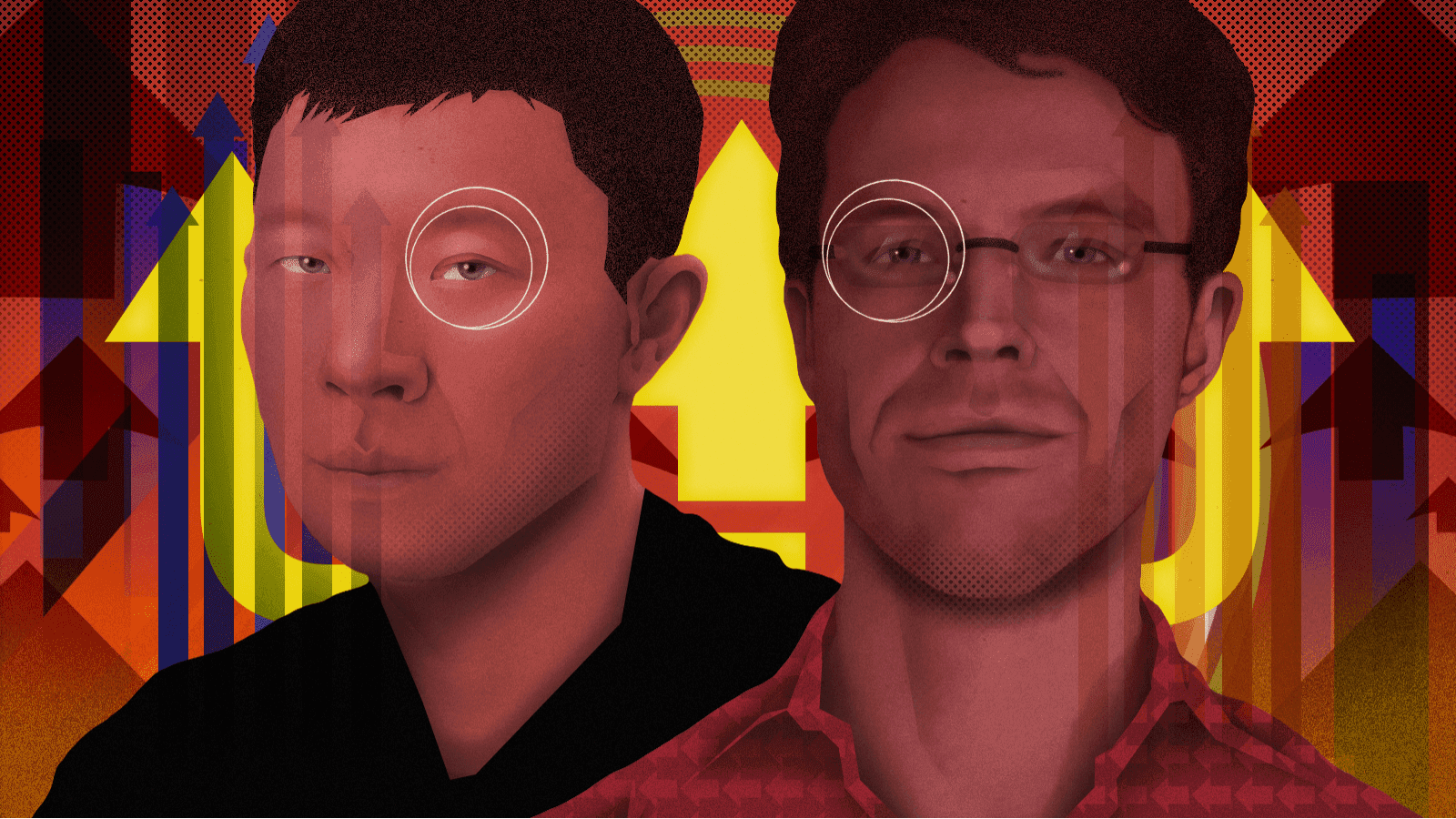

Three Arrows Capital founders Su Zhu and Kyle Davies | Blockworks exclusive art by axel rangel

- Co-founders’ Singapore counsel refused to accept papers on behalf of clients, motion states

- Fund’s investment managers have produced only “piecemeal, selective disclosures”

Teneo, the foreign representative of insolvent crypto hedge fund Three Arrows Capital (3AC), has asked for authorization to serve subpoenas for the production of documents and testimony of co-founders Su Zhu and Kyle Davies through unconventional methods, given that they are “yet to offer any forthright cooperation.”

In a motion filed on Oct. 14, they asked a US judge to authorize the issue of subpoenas via the founders’ Twitter pages, their email addresses and the email address of Advocatus Law — the Singapore-based counsel “purporting to represent the founders.”

3AC is seeking protection from creditors in the Southern District of New York under Chapter 15, a process that allows foreign debtors to shield assets in the US.

Earlier court documents allege both Zhu and Davies have been uncooperative with liquidators. And as per the latest development, they still seem to be unwilling to engage.

Su Zhu and Kyle Davies non-public locations muddle liquidation process

Since their whereabouts “remain unknown,” the filing stated, foreign representatives requested Advocatus to accept the papers. But the law firm declined to accept service on behalf of its clients.

Advocatus also previously denied Teneo’s requests for an urgent meeting with the founders. While they did offer an introductory Zoom call, neither Zhu nor Davies spoke despite being asked direct questions, Friday’s motion said.

They have refused to cooperate with the liquidators’ efforts to access 3AC’s books and records in their possession, providing only “meager information” that represents an incomplete list of assets and selective disclosures, the filing added.

If granted, the subpoenas would require 3AC’s founders to produce documents to “identify the existence of, location of, and method of accessing and controlling” company assets.

The foreign representatives have also requested Solitaire, the Singapore counsel “purporting to represent” 3AC’s former investment manager, for access to other critical information and believes the firm is withholding relevant valuable information.

“The Investment Managers’ piecemeal, selective disclosures are insufficient and their lack of forthright cooperation has hindered the Foreign Representatives’ ability to perform their duties,” the filing said.

Teneo representatives didn’t comment on the matter beyond the court filing. 3AC, Advocatus and Solitaire didn’t return Blockworks’ request for comment by press time.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.