Bitcoin Rallies After Tumbling Below $30,000; Stocks Climb After Fed Hearing: Markets Wrap

“China has formally banned cryptocurrency several times over the last few years so this news should be no surprise…Instead it’s ignored by industry vets whilst retail investors try and make sense of the news, often causing a sell off,” Ledgermatic CEO Luke Sully said in a note.

A segment of the painting "BTC1" by Nelly Baksht whose work was on display in the Art Gallery at Bitcoin 2021.

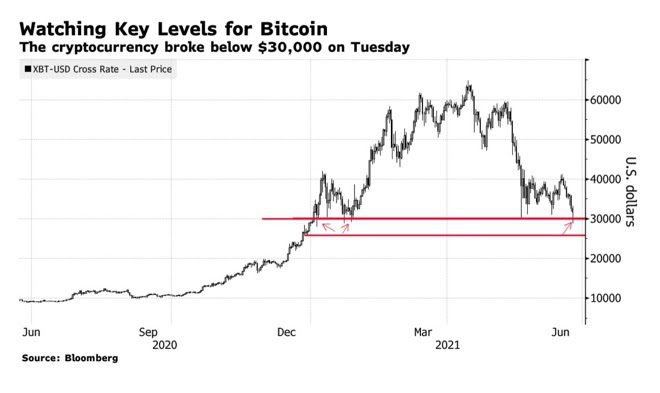

- Bitcoin fell to a months-low of $28,390.50 at 9:55 am ET.

- Powell soothed investors’ concerns, maintaining price pressures are likely to be transitory.

As China’s clampdown on cryptos continued, the largest digital currency hit a new five-month low on Tuesday morning. Intensified regulations on bitcoin mining and forcing the country’s largest financial institutions to block all of the digital asset’s transactions may have paved the way to the coin’s fall below $30,000.

China’s central bank, The People’s Bank of China (PBOC) said the digital currency “spawns the risks of criminal activities such as illegal asset transfers and money laundering, and endangers people’s wealth” in a note on Monday morning. And over the weekend 90% of China’s bitcoin mining was estimated to be shut down, according to a report on Sunday from the Global Times.

Within the throes of a volatile morning, bitcoin fought its way back up to $33,000 at 2:44 pm ET.

Crypto

Bitcoin fell to a months-low of $28,390.50 at 9:55 am ET. The cryptocurrency whipsawed to $32,863.94 as of 4:00 pm ET, up 0.71% over the past 24 hours.

- Ether is trading at around $1,924.01 falling -1.14% in 24 hours respectively.

- ETH:BTC is at 0.058, down -1.68% as of 4:00 pm ET.

- VIX is down -7.04% to 16.63 as of 4:00 pm ET.

Insight

“China has formally banned cryptocurrency several times over the last few years so this news should be no surprise but this risk is not baked into the price. Far from it. Instead it’s ignored by industry vets whilst retail investors try and make sense of the news, often causing a sell off,” Ledgermatic CEO Luke Sully said in a note.

Equities

Stocks climbed after Federal Reserve chair Jerome Powell gave his testimony at a House Select Subcommittee hearing for Covid relief programs on Tuesday afternoon. Powell soothed investors’ concerns, maintaining price pressures are likely to be transitory.

Powell further reassured that 5% inflation would be unacceptable and said that he had “a level of confidence” that prices will come down…at some point.

- The Dow was up 0.2% to 33,945.

- The S&P 500 rose 0.5% to 4,246.

- Nasdaq Composite hit a record closing high of 14,253 up 0.79%.

- Amazon.com rocketed to $3,514.05 as the e-commerce company wrapped up its “Prime Day”. This was 0.5% away from Amazon’s last record high in September.

- GameStop jumped 12.7% after the meme stock announced it sold around 5 million shares.

Fixed income

- The US 10-year yields 1.47% as of 4:00 pm ET.

Commodities

- Crude Oil had an intraday high of $73.95 per barrel and downticked -0.79% to $73.08 as of 4:00 pm ET.

- Gold is down – 0.27% at $1,778 as of 4:00 pm ET.

Currencies

- The US dollar is down -0.18%, according to Bloomberg Dollar Spot Index.

In other news…

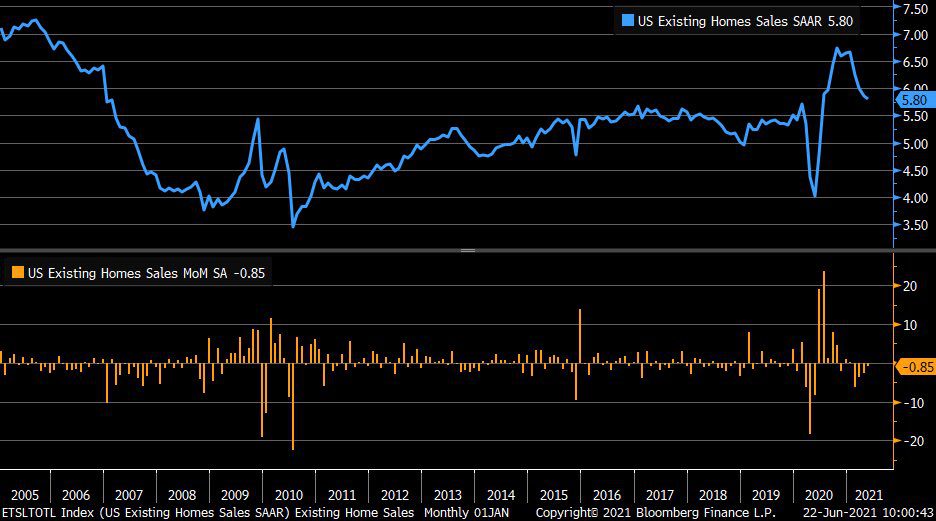

Existing home sales hit a benchmark high last month up 23.6% year to date while previously owned homes hit a fourth consecutive month of declining sales, according to a report by the National Association of Realtors on Tuesday. With a larger demand and lower mortgage rates, there aren’t enough homes for would-be buyers. This comes at a time when investment firms like Blackstone Group Inc. have just acquired 17,000 single-family homes in a $6 billion-deal with Home Partners of America Inc., Wall Street Journal reported on Tuesday.

Chart via Liz Ann Sonders, Chief Investment Strategist, Charles Schwab & Co., Inc.

Chart via Liz Ann Sonders, Chief Investment Strategist, Charles Schwab & Co., Inc.

We’re watching out for …

- The Fed will release stress tests results on key US banks on Thursday.

- Bank of England interest rate decision will take place on Thursday.

- PCE price index will be released on Friday.

That’s it for today’s markets wrap. I’ll see you back here tomorrow.