Brian Armstrong Calls Petition To Remove Top Coinbase Execs ‘Really Dumb’

An unknown number of Coinbase’s employees called for a leadership shakeup at the exchange

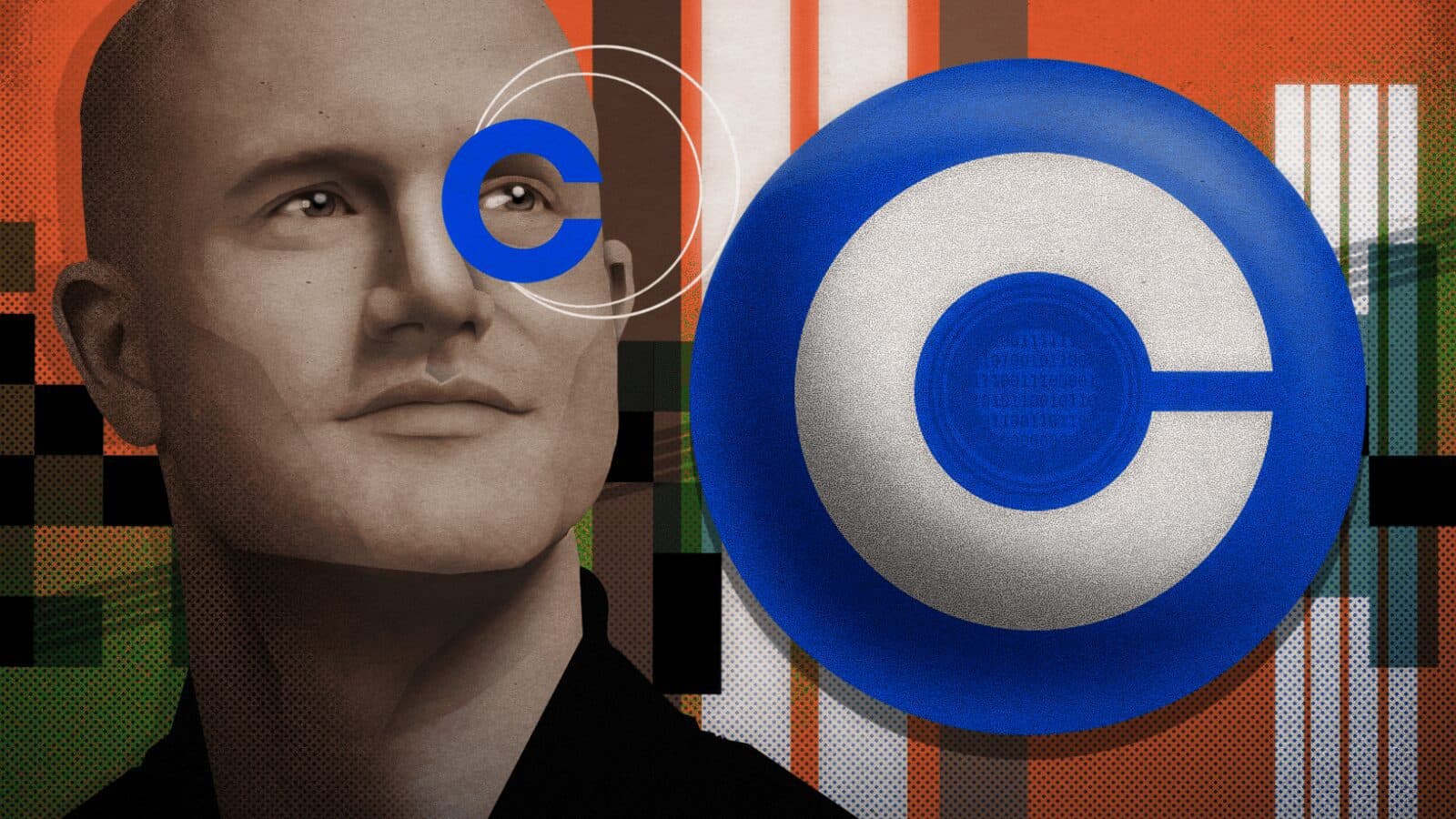

Coinbase CEO Brian Armstrong | blockworks exclusive art by axel rangel

- Coinbase employees express concern over leadership, direction of company in now-deleted petition

- CEO Brian Armstrong said any employees caught signing the petition would be fired

Some Coinbase employees want three top officials at the cryptocurrency exchange removed, according to a now-deleted petition that was first published on Mirror.xyz. Coinbase CEO Brian Armstrong, who was not listed as one of the three, took to Twitter to call the move “really dumb on multiple levels.”

The petition called for Coinbase Chief Operating Officer Emilie Choi, Chief Product Officer Surojit Chatterjee and Chief People Officer LJ Brock to be ousted. An archived copy of the petition is available from the Internet Archive’s Wayback Machine.

“We the employees at Coinbase believe that the executive team has recently been making decisions that are not in the best interests of the Company, its employees, and its shareholders,” the petition said.

Petition writers cited Coinbase’s “failed” NFT platform, its “toxic” employee review system and the exchange’s aggressive and “unsustainable” hiring practices.

Armstrong encouraged dissatisfied employees to “quit and find a company to work at that you believe in,” in his Twitter thread.

“Our culture is to praise in public, and criticize in private,” he added.

The rift comes shortly after the exchange announced it would be pausing hiring efforts and rescinding a number of accepted employment offers, a grievance also listed in the petition. Coinbase has decided to take more “stringent measures” to slow its headcount growth in hopes of navigating uncertain waters, Brock wrote in a blog post about the decision earlier this month.

Coinbase is also facing controversy from many customers, who were alarmed to learn that the exchange reserved the right to seize client assets in the event of bankruptcy.

“The crypto assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings,” the exchange said in its latest earnings report.

Armstrong noted that employees caught signing the petition would be fired, as it harms “fellow co-workers, along with shareholders and customers.”

“There is probably lots we can be doing better, but if you’re at a place where you want to leak stuff externally, then it’s time for you to go,” he said.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.