Craig Wright Trial Goes to Florida Jury, Which Could Award as Much as $189B

The man who claims to be Satoshi Nakamoto, awaits judgement in multibillion-dollar civil suit. Does it even matter if he is in fact Satoshi?

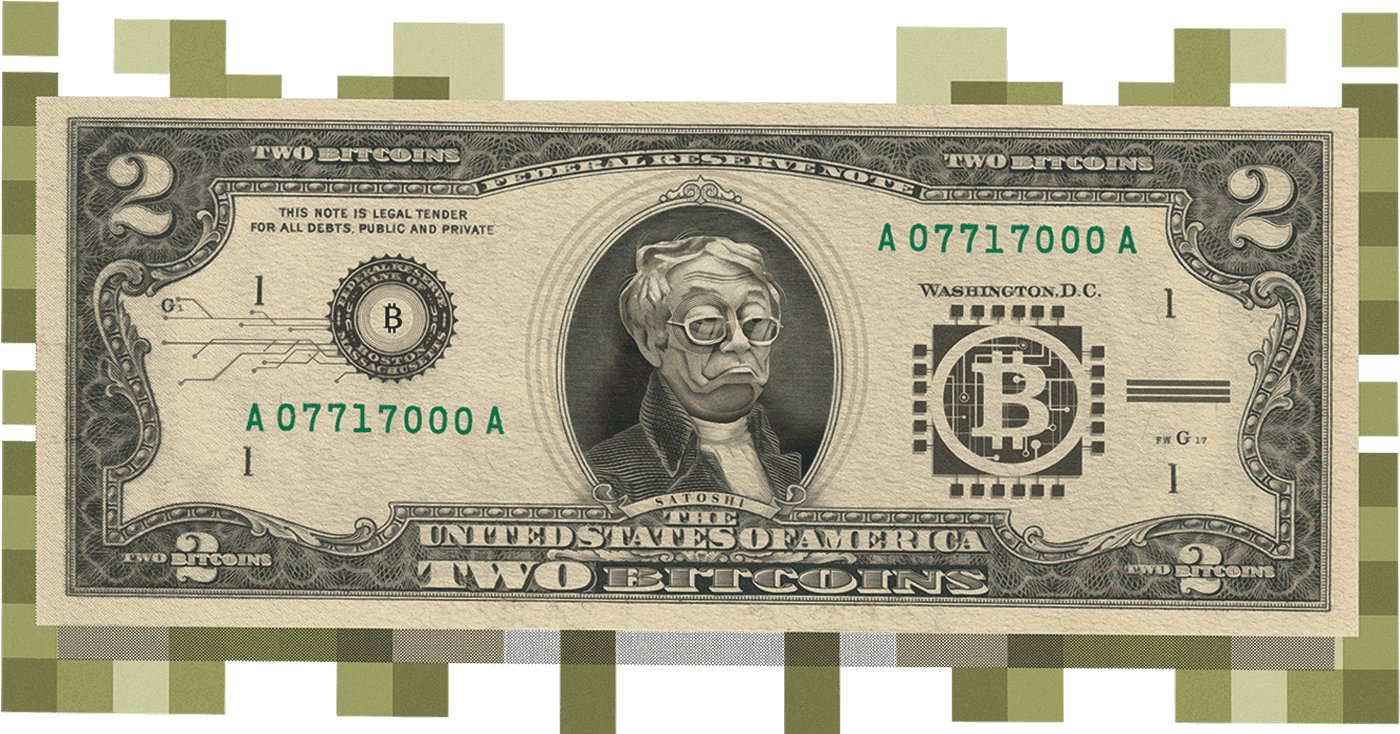

"Satoshi Nakamoto" (but not the inventor of Bitcoin) l Blockworks exclusive art by Axel Rangel

- Wright’s defense team’s Motion for Judgment as a Matter of Law was denied on November 22, ensuring a jury decision

- Seven counts, including Civil Theft and Fraud, are now in a jury’s hands

He claims to be the inventor of Bitcoin and the author of the original 2008 Bitcoin white paper, under the pseudonym Satoshi Nakamoto. But the ultimate outcome of the civil trial of Dr. Craig Steven Wright, an Australian computer scientist, is unlikely to settle that mystery.

The United States District Court for the Southern District of Florida, however, accepts it as a given, by granting the plaintiff in the case standing to sue Wright in the first place. Although the prevailing view among Bitcoin proponents is that Wright’s assertion is specious, as far as Judge Beth Francine Bloom is concerned, Wright has 1.1 million bitcoins.

The jurors, slated to resume deliberations on Monday after a Thanksgiving break, are tasked with passing judgment on a more limited question: whether Wright is guilty of fraud, theft, breach of fiduciary duty, and a handful of other counts that could leave him liable for half of the bitcoin stash that he may have mined in Bitcoin’s early days.

The plaintiff in the case, Ira Kleiman, says that the bitcoin, while ostensibly Wright’s, rightfully belongs to the estate of Kleiman’s deceased brother David, a friend and alleged business partner of Wright’s. David Kleiman died in April 2013 at the age of 46, without ever laying hands on the fortune his brother now says should be his.

Ira Kleiman initially sued Wright in February 2018, claiming that Wright schemed to steal both the 1.1 million bitcoins and the intellectual property connected with Bitcoin’s open-source code that David Kleiman may have helped develop. At the time of the original suit, the quantity of bitcoin at issue was valued at just over $10 billion. The stakes are somewhat higher now — that much bitcoin is worth some $60 billion dollars today.

If the jury of three men and seven women finds that Wright had a partnership with David Kleiman to mine those coins, assuming they are in fact under Wright’s control, they will have to determine the value owed to Kleiman’s estate, plus any punitive damages — and the plaintiffs’ lawyers have asked for plenty — bringing the total claims and damages to $189 billion. (For comparison, the world’s richest person, Amazon founder Jeff Bezos, is worth $177 billion and just the $30 billion in bitcoin alone would put Ira Kleiman among the top 50 richest people in the world, according to Forbes.)

Ira Kleiman has testified that Wright and his brother created a company in Florida in 2011 — W&K Info Defense Research LLC — which is how the Australian has ended up spending time in and out of a Miami courtroom since 2019.

Wright denies the allegations, and says Kleiman merely helped him temporarily transfer control of the bitcoin — which he says was purchased in 2011 from a “dodgy” Russian exchange — to keep it out of reach of Australian tax authorities.

A last-ditch effort to avoid a jury verdict

Shortly before closing arguments last week, Wright’s legal team filed a Motion for Judgement as a Matter of Law — basically an appeal to the judge that the plaintiffs haven’t presented sufficient evidence. Such a preemption by the judge is only an option if there “is no legally sufficient evidentiary basis for a reasonable jury to find for the non-moving party.” According to court documents, there is, and the motion was denied.

The court previously denied a motion from the defense for Summary Judgement, which uses a similar legal standard, so this last legal maneuver was a long shot.

Among the Wright team’s arguments was that the market value of the bitcoins at issue could not be used as the basis for the jury judgment under a Florida precedent known as the “Blockage Discount Theory” — that the bitcoin could not be sold without substantially adversely affecting the price. The judge disagreed.

To be or not to be Satoshi Nakamoto

Wright has never been able to prove that he is Satoshi Nakamoto by either signing a message using the PGP key for Satoshi’s encrypted emails, or moving any of the early Satoshi-mined bitcoin he presumably should control.

The case has yielded more sordid details of Wright’s behavior. In March 2020, a previous judge in the case, Judge Bruce E. Reinhart, reprimanded Wright for forging documents and giving perjured testimony.

Gavin Andresen, who once claimed that he was personally convinced Wright was indeed Satoshi, expressed doubts on that view in a sworn deposition during the trial, referring in particular to supposed proof proffered by Wright:

“That gobbledygook proof that he published was certainly, deception, if not an outright lie. So at the very least, that, I consider, you know, that — he bamboozled me there.”

When Wright set a date to prove his claims — by transferring bitcoin known to belong to Satoshi Nakamoto to Andresen — he failed to deliver. On the day that he was due to transfer the bitcoin — May 4th, 2016 — Andresen says he was told Wright attempted suicide and was taken to the hospital.

Wright is now in a precarious position. If the jury finds in Kleiman’s favor, it is unlikely that Wright will be able to access the half a million in bitcoin — whether or not he is Satoshi — for one simple reason: It’s almost inconceivable that he would not already have done so. Satoshi’s coins have not moved for over a decade, even as the price of 1 bitcoin has gone from less than a penny to $68,521. That’s the clearest indication that Satoshi is either dead, or has lost the keys.

As David Gerard put it, “Wright could end up owing half a million bitcoins he doesn’t control to the estate of the guy he didn’t invent Bitcoin with, just because he wouldn’t admit he wasn’t really Satoshi.”

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.