Are Bonds Still the “Smart Money”?

Wednesday’s steep inflation reading has put the bond market on high-alert.

Blockworks exclusive art by Axel Rangel

- “Having traded bonds for 32 years, I’ve never seen a worse risk/return opportunity in any asset in my entire life,” Greg Foss, a veteran credit trader and executive director at Strategic Initiatives said

- While inflation has historically been viewed by investors as a sort of kryptonite to government bonds, the resilience of longer-term Treasurys in the face of rising inflation has been a defining feature of market conditions since April

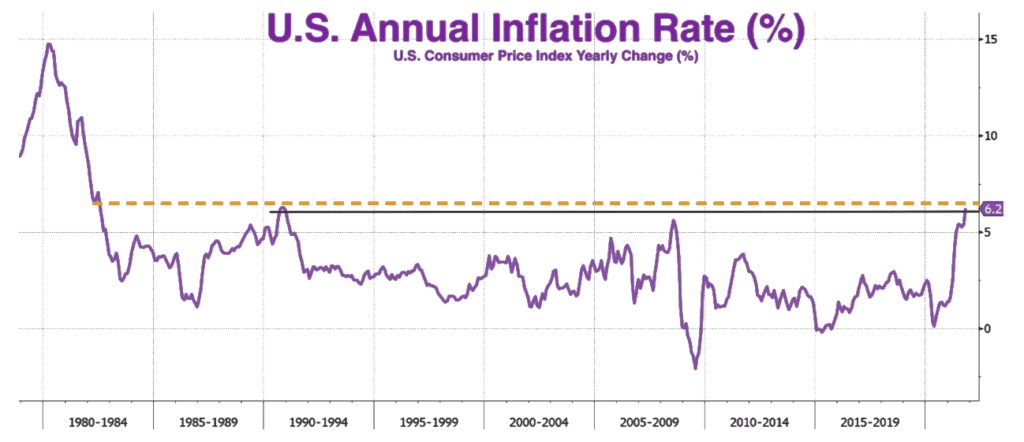

The market for US government securities sold off hard on Wednesday as it learned that the October inflation rate hit 6.2%, according to a report from the US Bureau of Labor Statistics released Wednesday. This surge in prices marked the largest advance in the consumer price index (CPI) since 1991, and in fact the rise was dangerously close to being a 39-year high:

US Annual Inflation Rate (%)

US Annual Inflation Rate (%)

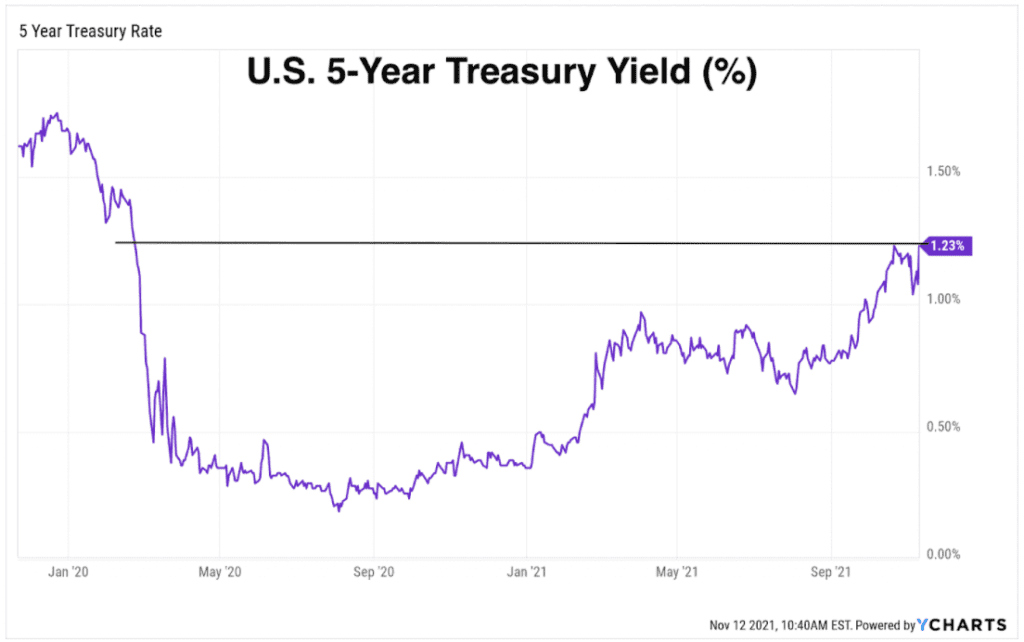

Treasurys had a day to rest yesterday as the bond market was closed due to Veterans Day. But as of this morning, it appears the rout on Treasury paper has resumed in full force. The 5-year Treasury note has surged to its highest level since February 2020:

US 5-year Treasury Yield (%)

US 5-year Treasury Yield (%)

The lofty inflation reading has brought to the fore strong views about the long-term viability of government bonds as an investment vehicle.

“If you’re a bond holder, you’re probably the world’s biggest fool,” said Greg Foss, a veteran credit trader and executive director at Strategic Initiatives. “Having traded bonds for 32 years, I’ve never seen a worse risk/return opportunity in any asset in my entire life,” Foss added.

Foss called Wednesday’s auction of 30-year Treasury bonds “horrendous,” in particular noting a wide spread or “tail” between the average price and the lowest bid.

Indeed, according to Bloomberg’s U.S. Government Securities Liquidity Index, trading conditions in the Treasury market are the worst they have been since March 2020, when a mad dash for Scramble for dollars triggered a liquidation of Treasurys alongside risk assets like stocks.

“So even though we have extremely high inflation, we also have extraordinarily high debt levels, both public and private sector debt,” Eric Basmajian, founder and editor of EPB Macro Research, told Blockworks in the latest episode of the Forward Guidance podcast.

“The long-term bond yields are basically saying that the Fed can try and raise the front end rates, but pretty quickly, it’s going to have to drop those rates back to zero because the structural forces in the economy are just way too strong,” Basmajian said.

But not all are convinced that monetary policy has impaired Treasury bonds’ ability to accurately foresee rates of growth and inflation.

“The Fed has created a collateral shortage of Treasury bills, and that indirectly affects the whole Treasury curve,” noted Macro Analyst Lyn Alden.

“A lot of people view bonds as the ‘smart money’ — and traditionally they have been. But during periods of rapid treasury purchases, the measurement has become the target and therefore loses a lot of informational value,” Alden said.

Whether Treasury bonds will be able to keep up with inflation has profound implications for investors. While inflation can be viewed as a form of fiat monetary debasement, investors can stay afloat if bonds pay out to investors much more than the rate of inflation — and as a matter of fact they can do very well if bond yields are well in excess of inflation.

However, fixed-income investors face a much bleaker picture if yields in the bond market remain submerged well below inflation, which is Alden’s base case.

“The combination of higher inflation and stagnant bond yields is a very good environment for hard assets, because cash or bonds are being sharply devalued relative to something, and that something is real assets, things that are finite,” Alden said.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.