Art, Blue-chip NFTs Drive Q2 NFT Market Growth

Nansen’s index of art NFTs saw decreased volatility over the quarter, but blue-chip and metaverse NFT indexes were more volatile than in Q1

Blockworks exclusive art by axel rangel

- Art Blocks’ Chromie Squiggle is among the top 10 blue-chip collections

- Gaming NFTs are down more than 59% year to date

Consumers are continuing to show interest in NFTs in the face of agitated markets, with art and blue-chip collections among the highest performing sectors of the market, a new report from Nansen shows.

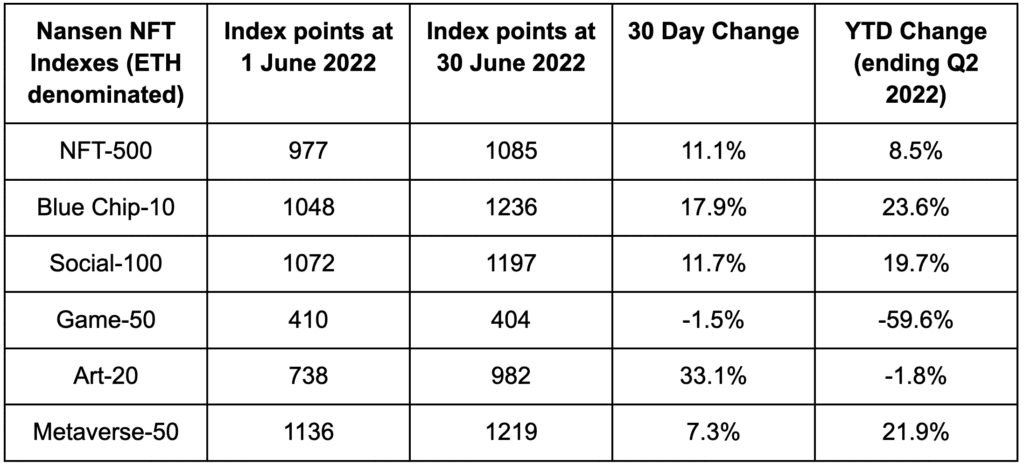

The blockchain analytics platform’s quarterly report on the state of NFTs (non-fungible tokens) analyzes Nansen’s six NFT indexes: Nansen NFT-500, Nansen Blue Chip-10, Nansen Social-100, Nansen Gaming-50, Nansen Art-20 and Nansen Metaverse-20. The indexes are weighted by market capitalization and denominated in ether (ETH).

Nansen’s NFT-500 index, which aggregates the performance of the leading 500 NFT collections on Ethereum, was up 49.9% on the year as of March 31. However, the index gave up most of those gains in Q2, clocking an 8.5% year-to-date change by the end of the quarter.

All NFT sectors recorded a bounce in terms of ETH-denominated sales in June, except for gaming NFTs, which are down more than 59% year to date.

Nansen NFT Indexes Performance; Source: Nansen

Nansen NFT Indexes Performance; Source: NansenBlue-chips led the way in the larger NFT market’s upward movement at the beginning of June — the top 10 collections reported a 23.6% increase in market capitalization at the end of the quarter and a 17.9% increase in June alone.

Yuga Labs’ Meebits reclaimed its spot in Nansen’s Blue Chip-10 index, and Chromie Squiggle from Art Blocks also joined the leaderboard, replacing the NFT Worlds and World of Women collections.

There is little evidence to support a continued uptrend due to limited liquidity, the report suggests — the inflows into blue chips still mark “risk off” sentiment by NFT market participants.

However, an analysis of NFT buyers on Ethereum shows a strong recovery in returning buyers in June and a slight recovery for first-time buyers.

The active buyer count indicates the continued growth of the market and the development of NFTs as a sector, according to Nansen.

Recent free mint events, such as those of GoblinTown and Moonrunners, could be a possible explanation for the recovery in buyers, the report suggested.

Nansen analysts also found that art NFTs demonstrated the biggest increase of the month, with a 33.1% boost. This sector encapsulates physical and digital art, plus generative art NFTs, which accounted for 92% of market capitalization in the Art-20 index.

In addition to consistent transaction volume and significant buy-in for Chromie Squiggle, an art NFT collection that performed consistently in Q2 was The Currency by Damien Hirst, a collection of 10,000 NFTs, each corresponding to a piece of physical artwork.

While the Art-20 index saw a decrease in volatility, Blue Chip-10, Social-100, Game-50 and Metaverse-20 indexes showed an increase in volatility, in line with the broad market. The metaverse NFT sector remains the most volatile, a conclusion Nansen also reported in its previous quarterly analysis.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.