Barter buys rival solver codebase to expand CoW Swap dominance

Acquisition of Copium Capital’s strategies strengthens Barter’s offering, but raises questions about solver concentration

Nikolay_E/Shutterstock and Adobe modified by Blockworks

Barter, the second-largest routing engine on Ethereum and the top solver on CoW Swap, has acquired the solver codebase of competitor Copium Capital in a move that could reshape the dynamics of decentralized trade execution.

The deal brings together two of CoW Swap’s most effective strategies. Copium had carved out a niche with efficient usage of RFQ (request-for-quote) and market maker liquidity, while Barter specialized in maximizing flow through AMMs. According to CEO Nikita Ovchinnik, the combination provides the missing piece for Barter to push beyond 50% market share on CoW Swap.

“Copium built its edge around efficient usage of RFQ and market maker liquidity, while Barter specialized in routing more flow through AMMs than anyone else,” Ovchinnik told Blockworks. With Ethereum’s Pectra upgrade and the rise of gas-optimized AMMs like Euler Swap, Fluid, and Ekubo, RFQ share has been declining — but Barter believes those capabilities are key to consolidating leadership.

From a user’s standpoint, CoW Swap’s mechanism selects the best price available for each order, so head-to-head comparisons between solvers are less meaningful: If a solver doesn’t win, it’s because another produced a better quote at that moment, a spokesperson told Blockworks.

Barter has already executed over $18 billion in total volume, averaging roughly $900 million weekly. The integration of Copium’s code will roll out gradually, with internal audits and canary releases before full production deployment. The first strategies to hit production will target new-token onboarding and RFQ upgrades, aimed at improving execution for large trades and fresh assets.

The acquisition comes as the solver market itself is maturing, according to Mounir Benchemled, founder of Velora (formerly Paraswap). “In ’23 or late ’22 where the first real solvers started to emerge, I think Barter was one of the first and [then came] Wintermute and others,” Benchemled told Blockworks. That evolution coincided with the rise of solver auctions. “Building auctions and innovating the auction structure, becomes the new standard for intent-based products,” he said.

While auctions broaden competition, some centralization concerns persist. “The selection of winners still happens in a centralized fashion…A user will send their sign order to the protocol server — which is a centralized AWS server in general — we create an option and select the winner,” Benchemled explained.

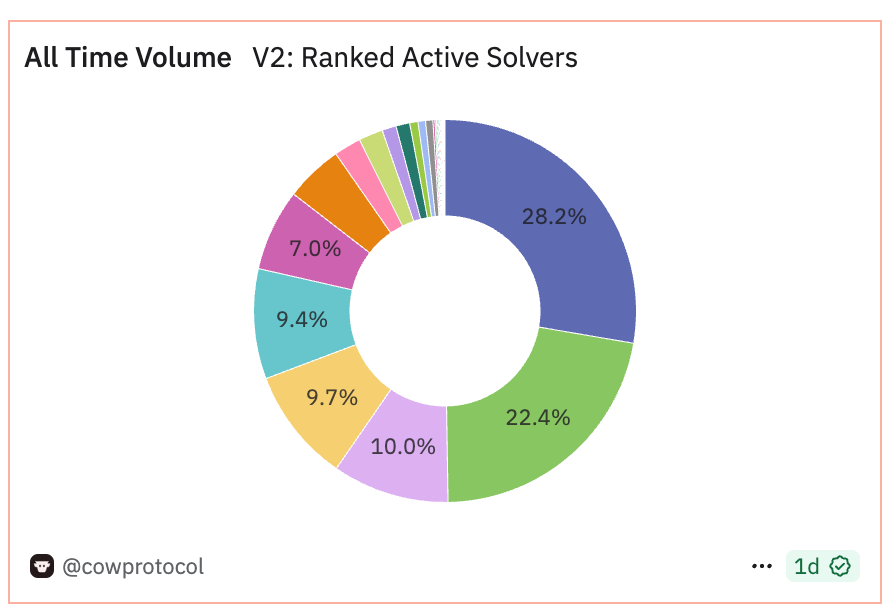

CoW Swap takes a pragmatic stance: RFQ owners set their own access rules, and from the protocol’s perspective the key criterion is whether users get better prices. CoW cares most about outcomes at the point of execution. The “Solver Info” Dune dashboard provides transparency into the distribution of active solvers.

Barter at 28.2% | Source: Dune / cowprotocol

Barter at 28.2% | Source: Dune / cowprotocol

In May, CoW DAO approved moving from batch auctions to “fair combinatorial auctions” to improve fairness and throughput and to address centralization risks (e.g., single-winner limitations and reliance on Ethereum Best Bid and Offer).

Ovchinnik counters that different teams still win across different order profiles. “Some teams excel at niche pairs, some win with best routes, others utilize their private liquidity to provide better prices,” he said. He added that CoW Swap’s evolving auction parameters and incentives ensure no single solver can rest on its laurels.

More broadly, the CoW team says it is not its role to dictate how the market should consolidate or diversify; the solver set is open to any team that follows the rules, and performance from there is up to each participant.

Barter says it will measure success in the next three to six months by expanding its presence on meta-aggregators and intent-based venues beyond CoW Swap, including UniswapX and 1inch Fusion. A user-impact update highlighting surplus metrics will be published on its social channels.

“This isn’t just about merging codebases — it’s about shaping the execution layer of Ethereum,” Ovchinnik said. Traders may never interact with solvers directly, but their algorithms are increasingly what determines the price users receive.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.