Biden’s New Communications Director Has Strong Crypto Connections

President Joe Biden appointed Ben LaBolt as his comms chief recently, and he holds BTC and ETH

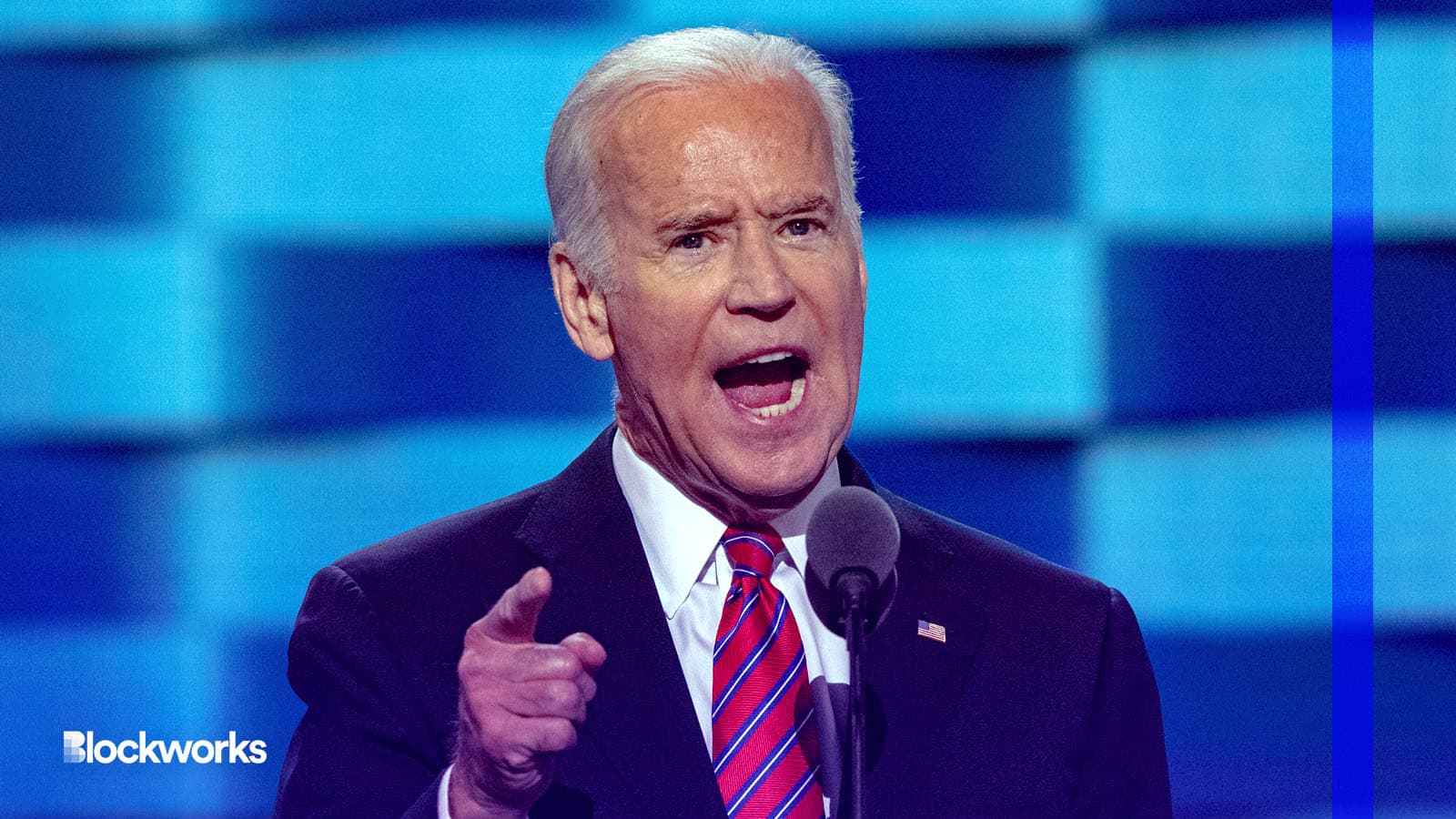

Mark Reinstein/Shutterstock modified by Blockworks

President Joe Biden’s new communications director has a history with crypto — including publicly disclosed holdings in bitcoin (BTC) and ethereum (ETH).

Ben LaBolt was named White House Communications director in February.

He will be allowed to advise the President and his administration on crypto but will not be allowed to participate in legal matters, investigations and contracts with crypto firms he’s previously worked with, per a report from Bloomberg Law.

According to public disclosures, LaBolt has reported that — while he was working at Bully Pulpit Interactive — his clients included Andreessen Horowitz and Uniswap.

Andreessen Horowitz is an active venture capitalist in the crypto space, with multiple crypto funds worth billions.

Uniswap is a crypto exchange on the Ethereum blockchain. It recently launched a wallet app on the iOS store after it was “stuck in limbo” for a month.

According to LinkedIn, LaBolt was at Bully Pulpit at the same time as Uniswap’s head of communications, Bridgett Frey, who left the company to join Uniswap last July.

The Biden Administration has been vocal about cryptocurrencies, releasing an executive order last year, proposing 2024 tax changes on crypto asset transactions — which would aim to eliminate wash trading — and criticizing proof-of-work mining.

LaBolt’s hiring also comes as the Securities and Exchange Commission seeks to regulate crypto firms more intensively.

The SEC is revisiting the definition of exchanges to include decentralized finance entities.

It’s also sent Coinbase, one of the largest cryptocurrency exchanges in the US, a Wells Notice, which generally precedes charges. The agency has also charged Bittrex, another crypto exchange, alleging that six tokens available on the exchange are securities.