Bitcoin Futures and Short ETFs Record Huge Volume Spike Tuesday

Increased activity came amid volatile markets as Binance revealed intention to buy FTX

Coinbase’s derivatives exchange and ProShares’ bitcoin ETFs notched record trading volumes Tuesday as crypto volatility ramped up both before and after Binance revealed its intention to buy rival exchange FTX.

Bitcoin’s price dropped Tuesday and stood at about $16,750 at 1:30 p.m. ET Wednesday — down 12% in the last 24 hours. Ethereum was below $1,200 at that time, a roughly 17% drop from a day ago.

Amid the price drop, Coinbase saw 588,451 contracts trade Tuesday, between its nano bitcoin and ether futures offerings. The total was the derivatives exchange’s highest since launching on June 27 of this year.

The volumes were far greater than its second-highest volume total tallied by Coinbase derivatives — 361,304 contracts on Oct. 13.

Coinbase’s stock dropped over the past 24 hours, mirroring a trend seen across sector stocks, as FTX halted withdrawals amid a liquidity crunch. COIN’s price, which is down more than 80% so far in 2022, dropped 10% on Wednesday, as of 1:30 p.m. ET.

Trading volumes of ProShares’ bitcoin ETFs skyrocket

The largest bitcoin futures ETF and short bitcoin ETF in the US also saw record volumes Tuesday.

About 49 million shares of the ProShares Bitcoin Strategy ETF (BITO) traded Tuesday — 64% more volume than any other day since it launched in October 2021, according to the firm.

BITO’s trading volume surpassed $1 billion roughly four hours after hitting the market a little over a year ago. The ETF, which is down about 65% year to date, had slipped by 9% on Wednesday, as of 1:30 p.m. ET.

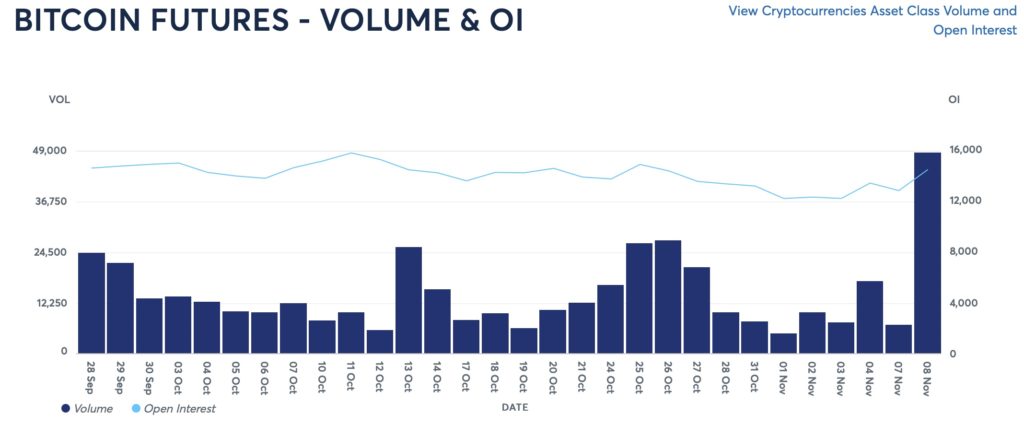

BITO invests in front-month CME Group bitcoin futures contracts. Volumes and open interest for CME Group’s bitcoin futures hit about 49,000 contracts and 14,500 contracts, respectively, up from volumes of nearly 7,000 contracts and open interest of 12,800 contracts the day before.

Source: CME Group

Source: CME Group

Shares traded of the ProShares Short Bitcoin Strategy ETF (BITI) totaled 7.2 million Tuesday, ProShares said, representing 366% more volume than the next highest day.

The fund, which aims to profit from the price decline of bitcoin by tracking the inverse daily price movements of an index of front-month CME bitcoin futures, launched in June. BITI traded about 870,000 shares on June 22, its second day of trading.

BITI’s price was up about 9.2% on Wednesday, as of 1:30 p.m. ET. It is up roughly 9.6% year to date.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.