The ZK rollup debate: Why Bitcoin isn’t there yet

As projects like BitVM innovate, Bitcoin builders call for transparency over misleading buzzwords

Traxer/Unsplash and Adobe modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Bitcoin enthusiasts often hear terms like “zk rollups” thrown around, but the reality is more nuanced. While Ethereum’s zk rollups rely on zero-knowledge proofs for trustless verification, Bitcoin’s architectural constraints make implementing true zk rollups a distant goal.

Misleading claims around Bitcoin’s layer-2 capabilities and trust assumptions threaten to confuse users, and the Bitcoin builder community is working to clarify these issues.

Ethereum zk rollups leverage the Ethereum mainnet (layer-1) to verify cryptographic proofs directly onchain. Bitcoin, with its 4MB block size and limited scripting capabilities, can’t accommodate these computationally intensive verifiers. As Alexei Zamyatin, a core contributor to BitVM, explains, a zk rollup verifier “simply won’t fit into a block.”

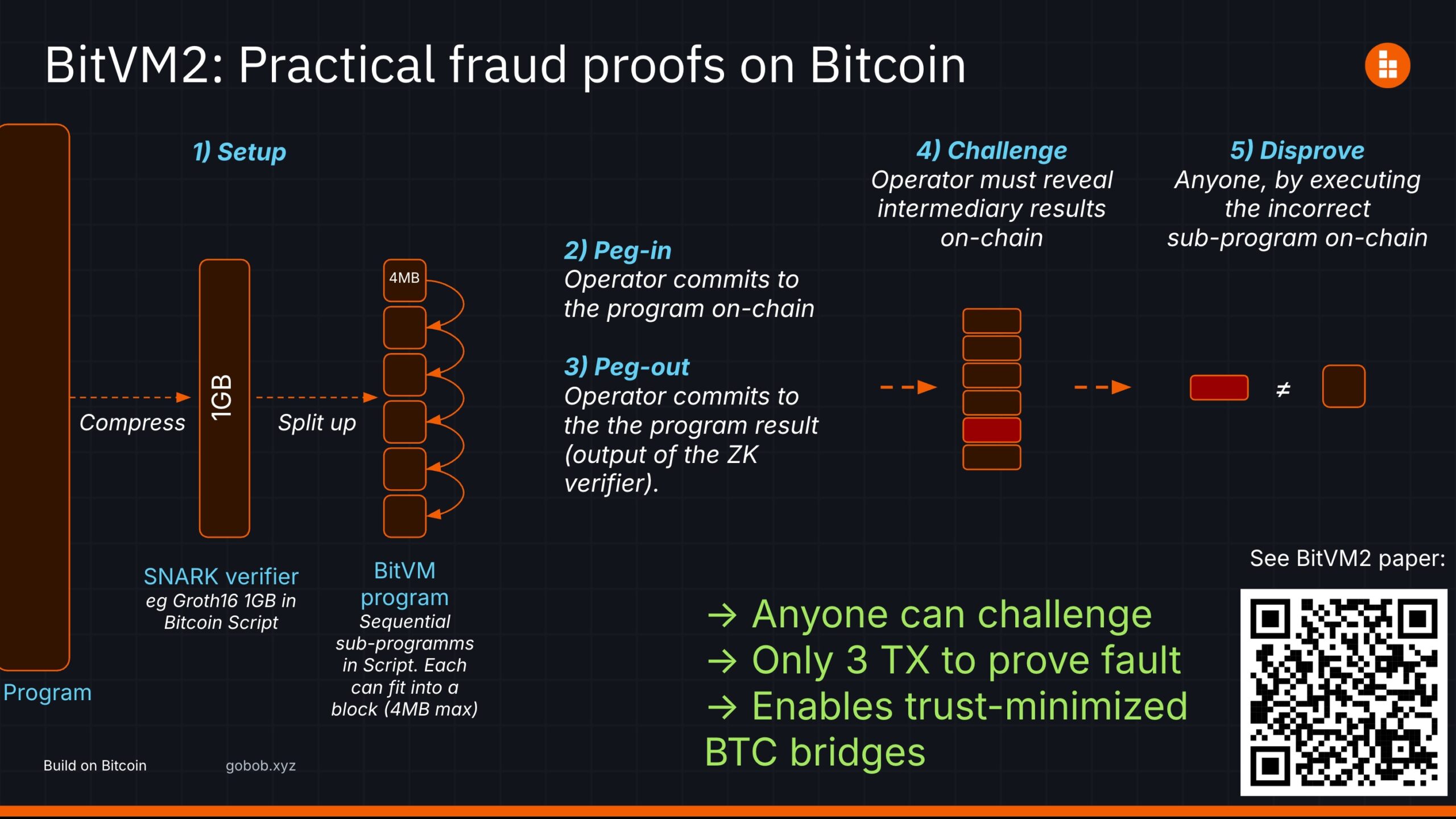

Projects like BitVM take a different approach, combining SNARK-based compression with optimistic verification. Rather than verifying proofs onchain, BitVM splits a program into smaller chunks, each verifiable sequentially. This method mirrors optimistic rollups like Arbitrum rather than Ethereum’s zk rollups.

Screenshot

Screenshot

“The zk part stops at the compression stage,” Alexei notes. “Everything else is an optimistic fraud-proof system.”

The broader discussion about Bitcoin L2s goes beyond just rollups. In a recent thread, Janusz Grzegorz, founder of Bitcoin Layers, reflected on the evolving definition of Bitcoin L2s. Initially, Bitcoin layers evaluated projects based on their claim of being a “Bitcoin L2,” but this approach excluded meaningful activity like BTC-backed tokens on Ethereum L2s.

Janusz advocates for a shift in focus to trust assumptions instead of semantics. He proposes evaluating the bridges that underpin these systems regardless of whether they market themselves as an L2. These include protocols like Rootstock, tBTC on Arbitrum and others.

Grzegorz, known online simply as “Janusz,” also has flagged projects like Merlin and BitcoinOS as having contributed to the confusion. Such projects often market themselves as zk rollups on Bitcoin, despite lacking the infrastructure to deliver security guarantees on par with how the term “rollups” is typically used. He cautions users to scrutinize projects for real progress, such as distributed or optimistic bridges, rather than relying on buzzwords.

For Zamyatin, education and transparency are key. By focusing on trust assumptions, clear definitions and robust analyses, the Bitcoin community can better understand what’s feasible — and what’s not. For now, zk rollups on Bitcoin remain a misnomer, but innovations like BitVM demonstrate how Bitcoin can scale within its unique constraints.

To achieve true zk rollups, Bitcoin will require a soft fork to enable building a native zk verifier. Several new opcodes are currently under consideration amid a recent push to clarify Bitcoin’s future roadmap.

An open Wiki-style forum lets interested stakeholders express their preferences and justify their views. Zamyatin’s team at Build on Bitcoin (BOB) has yet to weigh in, but expects to soon.

“What’s great about this effort is that it collects rationales in one place — instead of fighting on Twitter or scattered threads, you can see the reasoning for each individual’s stance,” Zamyatin said. “It makes it easier to evaluate proposals, summarize pros and cons, and have meaningful discussions.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.