#Breakout2024 – The Year of Radix

As part of the #Breakout2024 plans, Radix has introduced Token Trek

Photo provided by Radix

Radix, a “full-stack” Layer 1 network, has been busy building the foundation needed for the next generation of DeFi to thrive. In the past six months, following the introduction of smart contract capabilities with the Radix Babylon Mainnet Upgrade, the Layer 1 protocol has significantly expanded its total value locked (TVL), positioning itself for a major breakout year in 2024. With TVL metrics now stable, the focus has shifted to the next phase; expanding the Radix user base and increasing on-chain activity.

As part of the #Breakout2024 plans, which were announced in March and include major marketing campaigns, Radix has introduced Token Trek.

Token Trek, built by dmany, is a new community rewards program, launched with over $120,000 in rewards that any Web3 user can earn a share of by exploring the Radix Ecosystem. Designed to stimulate on-chain activity, Token Trek allows users to earn XP which can then be exchanged for $XRD, and ecosystem tokens by completing a range of tasks utilizing the rapidly growing number of dApps already live on Radix as well as for participating in those project communities.

Momentum on Radix

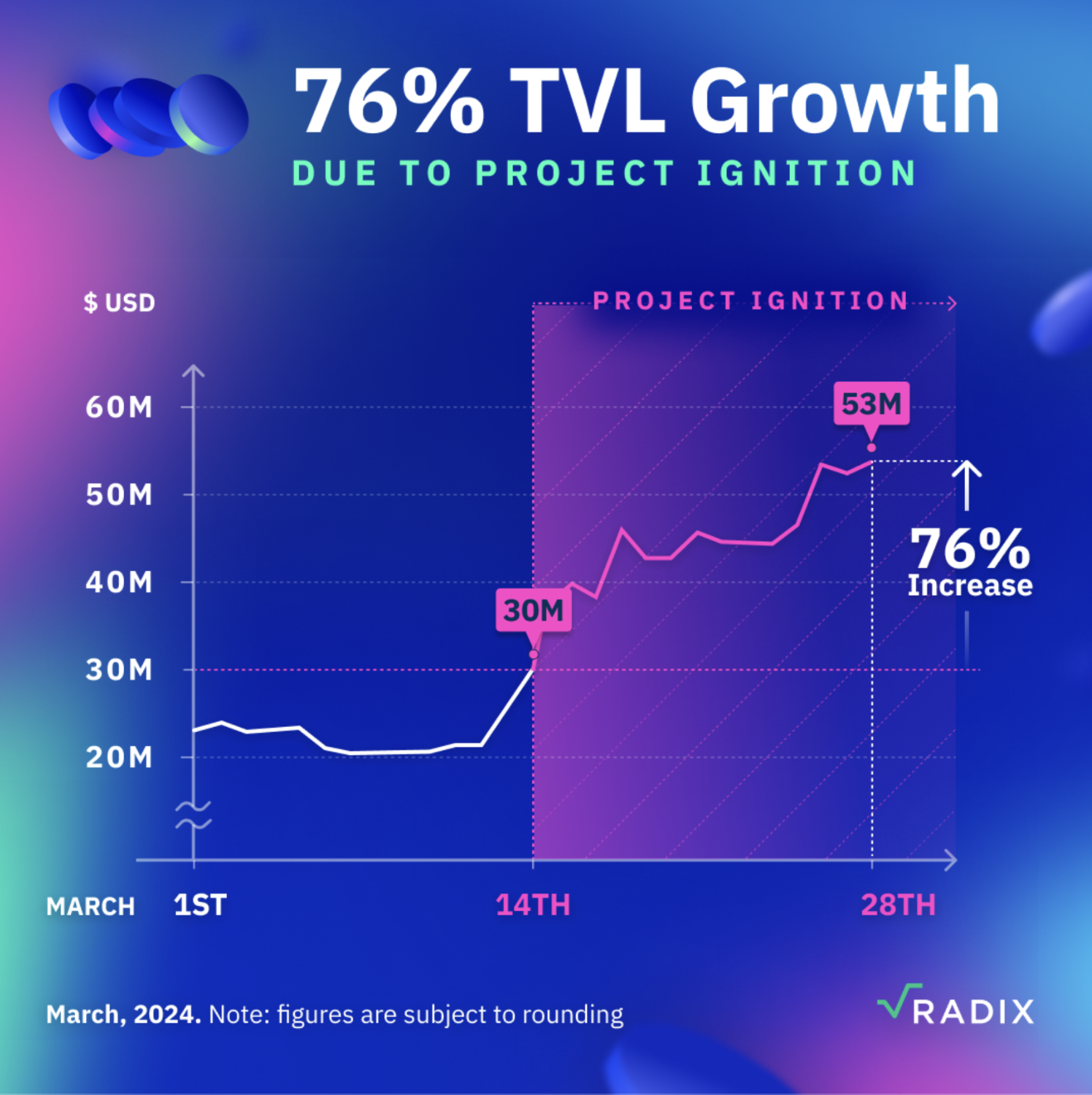

Token Trek follows the recent launch of Project Ignition in March 2024. Ignition was the first major event as part of the #Breakout2024 campaign, and saw $10+ million in liquidity injected into the Radix ecosystem. Project Ignition incentives aimed to increase the amount of TVL of major cryptocurrencies such as USD Coin (USDC), Tether (USDT), wBTC, and Ether (ETH) in the Radix ecosystem.

Within two weeks, Project Ignition resulted in a 76% increase in Radix total value locked (TVL) and a significant increase in on-chain activity on Radix.

Radix increased its total value locked by 76% in two weeks. Source: Radix

Radix increased its total value locked by 76% in two weeks. Source: Radix

Alongside Ignition and Token Trek, Radix is fostering new integrations as part of #Breakout2024, including LayerZero and Maya Protocol — a cross-chain liquidity and swap protocol that utilizes an innovative cross-chain liquidity mechanism.

The Maya community voted to integrate Radix, with over 95 percent of participants saying yes, demonstrating the excitement about the growth that a Radix integration will bring. This integration will allow for a permissionless flow of assets between Ethereum, Thorchain, Kujira, Arbitrum, Bitcoin, and the Radix network, boosting the growth of TVL and its users.

Getting started with Token Trek

If you’re new to Radix, Token Trek offers a fantastic gateway into its rapidly growing ecosystem. Several projects, like CaviarNine—the leading DEX on Radix—offer their own incentive programs, with liquidity providers potentially earning over $500,000 in $CAVIAR monthly.

Visit the Token Trek page and choose your inaugural quest. As you hit XP milestones, you can claim your XRD rewards. With more than 20 Radix ecosystem projects participating, you’ll have a firsthand look at the platform’s groundbreaking features, including the Radix Wallet, known for its sleek user interface and robust security measures.

This content is sponsored by Radix and does not serve as an endorsement by Blockworks. The veracity of this content has not been verified and should not serve as financial advice. We encourage readers to conduct their own research before making financial decisions.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.