Ika could redefine trustless cross-chain DeFi

A new Sui-based protocol promises to unlock Bitcoin’s idle liquidity and eliminate wrapped-token risk

maybielater/Shutterstock and Adobe modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

While crypto markets cooled this week under renewed macro pressure, Ika launched a multi-party computation design that enables trustless cross-chain signatures. With less than 1% of BTC currently productive in DeFi, Ika’s design could unlock tens of billions in dormant liquidity. ETFs continue to show outflows, though there are signs this may be ending.

Indices

Markets turned sharply risk-off, with nearly all crypto sectors in the red while traditional assets held steady. Gold (+0.6%) and the S&P 500 (+0.1%) eked out small gains, contrasting with broad crypto weakness as BTC (-2.8%) and the broader crypto equities index (-1.8%) retreated. The Nasdaq 100 (-0.4%) mirrored muted tech sentiment, underscoring a modest flight to safety after recent volatility.

Crypto sector performance painted a stark picture of risk aversion. AI (-6.4%), L2 (-6.5%), and Launchpads (-6.6%) extended their declines, while DeFi (-8.1%) and Modular (-8.3%) led losses among infrastructure plays. Solana Ecosystem (-9.3%) and Ethereum Ecosystem (-9.2%) were the day’s biggest laggards, with onchain activity tapering and liquidity thinning across DEX volumes.

The Solana Eco Index was weighed down by weakness in key components like Jito, Drift and Metaplex. Early-week strength, particularly from BONK and DRIFT, faded by the weekend as profit-taking and liquidity unwinds hit DeFi and meme-adjacent plays hardest. ORCA and RAY showed relative resilience, stabilizing above weekly lows but still closing red. The sharp dispersion between protocols highlights rotation away from higher-beta SOL DeFi names toward liquidity hubs and yield platforms.

Macro headwinds are reasserting themselves as US yields climb, traders reassess the timing of 2026 rate cuts, and a firmer dollar and slowing ETF inflows dampen crypto momentum. Leverage has begun to unwind, tightening liquidity across derivatives markets. With BTC consolidating near six figures and volatility creeping higher, attention now shifts to the inflation print and the Fed’s final meeting of 2025. The broader tone is cooling exuberance, not panic — but for the first time in months, crypto looks vulnerable to macro gravity.

Market update

Flows across major spot ETFs flipped green last week, led by BlackRock’s IBIT and Fidelity’s FBTC. The reversal follows a choppy stretch through late October when nearly all issuers saw redemptions. Outflows from Grayscale’s GBTC have eased, helping net flows move back above zero.

The shift suggests investors are nibbling again after BTC’s brief dip to $100,000. Derivative markets tell a similar story as funding rates have leveled off, and futures basis has started to recover, pointing to stabilizing sentiment rather than aggressive risk-taking.

Meanwhile, ETH ETFs remain under pressure, with intermittent inflows failing to offset steady redemptions from major issuers. The latest data show ETH ETF flows leaning negative into mid-November. The result is a choppy flow profile that underscores weaker conviction in the ETH trade relative to BTC. ETH’s muted price performance hasn’t helped either; it continues to trail BTC both in spot and derivative markets. Funding rates remain flat, and the futures curve is showing less optimism compared to earlier in Q4, suggesting limited appetite for leveraged exposure.

Until ETH ETF inflows turn consistent, ETH is likely to keep trading in BTC’s shadow rather than setting its own pace.

Redefining decentralized multi-party computation

Bitcoin remains underutilized in DeFi, with less than 1% of circulating supply currently tokenized and generating yield. Capturing even an additional couple percent of native BTC would inject tens of billions in fresh collateral into DeFi ecosystems, creating step-function improvements in most areas. Ika‘s trustless architecture, utilizing Sui’s object-based blockchain, presents a path to leapfrog incumbent solutions and capture this underserved market.

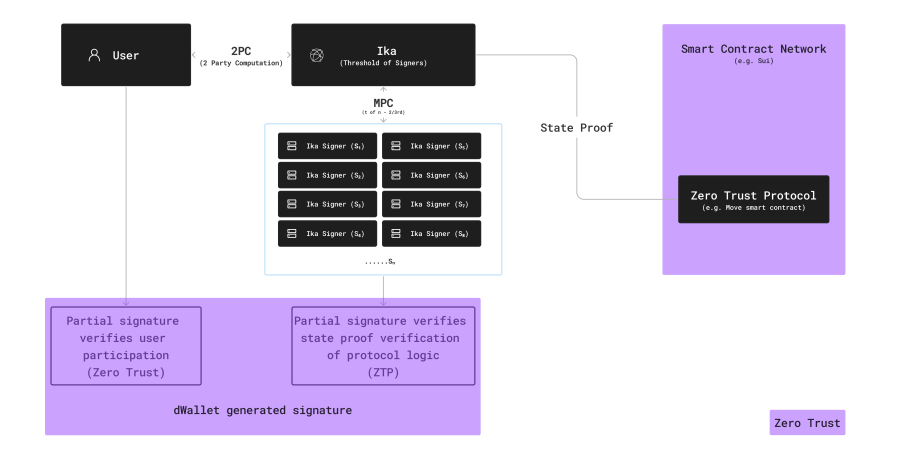

The protocol’s novel 2PC-MPC architecture enables distributed networks to generate signatures with cryptographic guarantees that require user participation, solving a critical limitation in existing threshold signature schemes. While competitors like Lit Protocol, NEAR and ICP offer threshold signatures controlled by permissioned validator sets, Ika can ensure no transaction can execute without explicit user authorization, eliminating risks from compromised validators or rogue employees.

The strategic implications extend far beyond custody. Ika eliminates traditional bridge honeypots and wrapped token risks by enabling trustless cross-chain operations at Sui’s native speed, effectively making wallets on all chains programmable objects within Sui’s ecosystem. This architecture should allow Sui-based applications to access users and liquidity from any chain without wrapped intermediaries, while enabling projects on other chains to leverage Sui Move smart contracts as their backend without user-facing changes. As this technology matures, Ika could position Sui as a global coordination layer sitting above individual blockchains, capturing value from cross-chain activity while driving institutional integrations seeking compliant, trustless infrastructure.

Source: Ika white paper

Source: Ika white paper

The Ika mainnet launched earlier this year, with developers like Human Tech and Native expected to launch products using Ika later this year.

Human Tech leverages Ika to create a single interface controlling native assets across multiple chains through user-network co-signing, eliminating wrapped tokens and bridge risks while maintaining unified policies for recovery, limits and approvals.

Native aims to leverage Ika’s 2PC-MPC architecture to enable Sui contracts to control actual bitcoin on Sui, delivering one-click, noncustodial BTC deposits and yield generation without bridges or wrapped intermediaries.

Nativerse plans to employ Ika’s native signature capabilities to collateralize stablecoins with real bitcoin holdings, allowing Sui contracts to mint and manage BTC-backed dollars while maintaining dWallet policies for security limits and programmatic redemptions.

Following the mainnet launch, Ika’s token has sold off sharply, though meaningful onchain activity will take time to develop as the first production apps begin driving signature demand. The Ika token powers the network’s economy: Users and apps pay Ika for MPC operations like wallet creation and signing, while node operators earn those fees and staking rewards for securing the protocol. Ika also enables governance, with MPC nodes voting on protocol and economic parameters.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.