Ethereum’s Fusaka upgrade lands today

Ethereum rolls out Fusaka, setting the stage for a stronger blob fee market and renewed deflationary potential

NatalyLad/Shutterstock and Adobe modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Today markets leaned decisively risk-on, with crypto leading the move while traditional assets stayed muted. Ethereum’s Fusaka upgrade arrived with PeerDAS, BPO hard forks, and the under-discussed EIP-7918, which together may finally restore deflationary pressure on ETH. On the thematic front, Sui is making an aggressive full-stack push into robotics, positioning onchain coordination, settlement and telemetry as critical primitives for a coming wave of real-world machines.

Indices

Markets leaned firmly risk-on, with crypto broadly outperforming traditional assets. BTC (+5.8%) sat mid-pack, while equities were muted. The S&P 500 (+0.3%) and Nasdaq 100 (+0.9%) barely budged. Gold (-0.3%) slipped, and crypto miners were the clear outlier to the downside (-8.7%), suggesting profit-taking and sensitivity to BTC’s consolidation.

The crypto sector breadth was exceptionally strong. Oracles, lending and the broader Ethereum ecosystem led the board, signaling a clear rotation back into core infrastructure and high-utilization protocols. DeFi, Modular, the Solana ecosystem, and perps followed close behind with similarly solid showings, pointing to broad appetite for beta across liquid alt sectors. Lower down the stack, L2s, AI plays, launchpads and gaming tokens all moved higher, while more speculative areas like memes lagged. The only clear pockets of weakness were crypto equities and miners especially, which saw meaningful pullbacks.

The move fits with improving sentiment as macro headwinds ease. Yields stabilized, liquidity indicators firmed, and positioning metrics suggest investors are adding risk after a muted stretch. Strong rebounds in infra sectors imply expectations for higher onchain activity and potential catalysts from upcoming protocol upgrades. Looking ahead, attention turns to macro prints later this week, which could test the durability of this risk-on tone. Volatility remains compressed, but with crypto sector dispersion widening, traders should expect sharper rotations as narratives evolve.

Market update

Today is Fusaka day in Ethereum land, the second upgrade this year (the Pectra hard fork was in May). It’s not often that Ethereum has two upgrades in one year, and that’s because Fusaka is more of a half-upgrade. Over a dozen EIPs were removed after EOF was mothballed in April.

Of the 12 EIPs remaining, PeerDAS, is the most significant, according to Gabriel Trintinalia, protocol engineer at Consensys.

“During the initial development of the Fusaka upgrade, any feature that carried a risk of delaying the fork, such as those requiring more research or having high complexity, was deprioritized and removed from the scope,” Trintinalia told Blockworks.

PeerDAS introduces data availability sampling, which allows validators to share the load of blobs, effectively allowing for an increase in blobs per block. There is one upgrade being overlooked, but first, some background:

Blobs have failed to hit their target of six per block, and just when it looked like they were about to, Ethereum is looking to raise the target again. Technically, Fusaka will not be raising the blob target, but is instead introducing Blob Parameter Only (BPO) hard forks. This creates a separate and easier process to adjust blob storage parameters. So instead of waiting for a major upgrade, Ethereum can make smaller, more frequent adjustments to blob capacity.

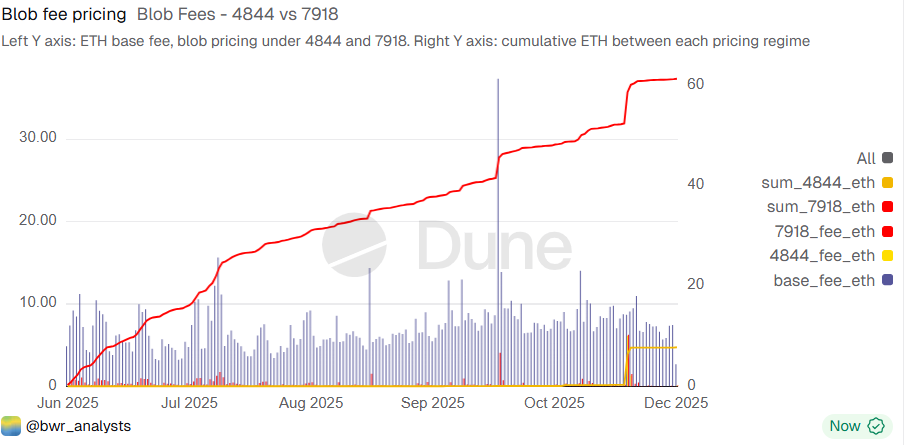

The larger point still stands: With supply exceeding demand, the blob gas price has been largely immaterial (apart from a few blips here and there when the blob price reached a measly 1 gwei).

Post-Pectra, between June and October, Ethereum generated around $900 in blob fees. The brief spike in November brought this to ~$23,000. Still not material, but it highlighted the order-of-magnitude difference when blobs actually have a market.

This is why EIP-7918 needs more attention. It addresses the blob fee market problem by introducing a reserve price tied to execution costs (a floor price of sorts). When L2 execution costs dominate blob costs, this prevents the blob fee market from becoming ineffective at 1 wei. For example, as shown below, if EIP-7918 was introduced on June 1, 2025, burnt blob fees would have been nearly 8x more. The upgrade isn’t only a reserve pricing model, it also presents more price stability and predictability, avoiding dramatic fee spikes when the blob market becomes inelastic.

Together with PeerDAS and BPO, this suggests that as Ethereum scales L2 capacity, blob fees should go up as well (historically, this relationship has been strictly inverse). For ETH holders, this, combined with L1 scaling, can hopefully return the ETH supply to a deflationary phase.

Updated Dec. 4, 2025 at 2:12 am ET: Clarified comment

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.