Yen pressures meet soft crypto carry

BTC’s Asia-session move and Ethena’s weaker yields reflect a market adjusting to tighter yen funding and softer derivatives carry

Chukemon/TradingView/Shutterstock and Adobe modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Today, we break down the BTC move during Asia hours and the renewed pressure from Japan’s carry unwind. We then look at China’s latest crypto FUD and track the continued USDe deleveraging cycle ahead of Pendle expiries, mapping what needs to shift for Ethena yields to recover.

Indices

BTC dropped about 5% in early Asia hours, trading near $86K. The move hit thin late-weekend liquidity and flushed several hundred million of long leverage.

On the rates side, Japan is again reactivating the yen-carry unwind. Two-year Japanese Government Bonds (JGBs) trade near 1%, 10-year yields are around 1.9%, both the highest since 2008. Overnight Interest Swaps now price about 80% odds of a December hike from the BOJ.

The last surprise move in mid-2024, when the BOJ lifted rates to 0.25%, drove a sharp USD-JPY reversal and contributed to a near 30% BTC drawdown to roughly 49K as macro books de-grossed risk. A similar pattern appeared today, with BTC tracking the Nikkei lower during Asia hours.

The underlying mechanism is unchanged. Global macro funds and institutions borrow yen or short JGBs to fund higher-yielding USD and EUR assets. As JGB yields rise, the yen funding leg becomes more volatile and more expensive. Investors reduce carry books and cut the highest beta exposures first, so BTC sits at the front of the liquidation stack.

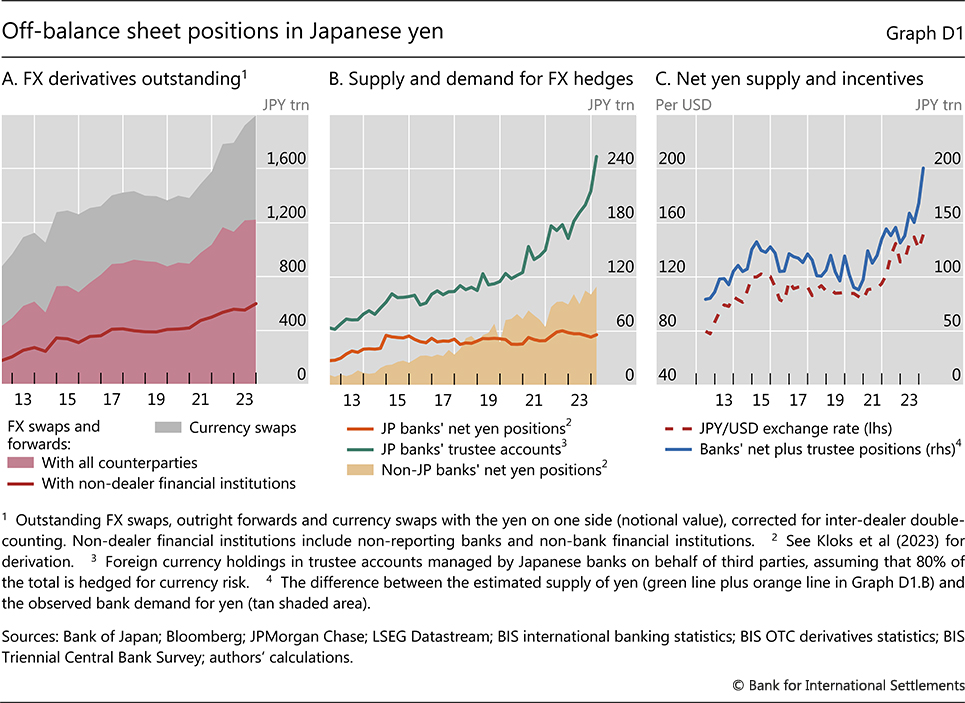

The September 2024 BIS Quarterly Review quantified the size and opacity of this ecosystem:

- Notional FX swaps and forwards with JPY on one side reached $14.2 trillion dollars (about 1,994 trillion yen). These positions sit off-balance-sheet and do not appear in conventional debt metrics.

- Visible on-balance-sheet yen loans to foreign non-banks totaled only $271 billion dollars, confirming that most yen borrowing happens through derivatives rather than loans.

- About $1.7 trillion dollars of yen liquidity is provided by non-bank financial institutions like trustee accounts. These allocators are volatility-sensitive and are prone to withdraw liquidity quickly under stress.

Source: Sizing up carry trades in BIS statistics

Source: Sizing up carry trades in BIS statistics

As yen becomes more expensive, positions need to be unwound. This forces both de-risking in high beta assets and mechanical JPY buying, which can feed a reinforcing loop as yen strengthens.

Adding fuel to the fire, China contributed another catalyst. The PBoC reiterated that all virtual-currency trading remains illegal and explicitly categorized stablecoins under AML and capital flight restrictions. Hong Kong crypto-linked equities reacted immediately: Yunfeng Financial fell more than 10%, Bright Smart dropped about 7%, and OSL Group declined over 5%.

The substance of the policy is not new, and it seems this is the hundredth time China is banning crypto. However, the price reaction is significant, and shows we are still in a highly skittish regime.

Charts for The Week

This year’s Oct. 11 liquidation episode was the largest in crypto’s history. A Trump tariff tweet sent BTC from about $120K to roughly $102K and wiped out about $19 billion dollars of open positions in 24 hours. USDe traded as low as $0.65 on Binance and about $0.92 on Bybit. Despite this, Ethena processed $1.9 billion of redemptions, maintained full backing and contained systemic contagion. Combined with Bybit’s February $1.5 billion exploit, this was a second major stress event that USDe passed with flying colors. However, despite that resilience, USDe supply has fallen almost 50% from the $14 billion dollar peak to about $7 billion.

Source: Ethenas Dashboard

Source: Ethenas Dashboard

The driver behind this is unattractive carry. Following October’s OI wipeout, funding rates for BTC and ETH are muted to negative, with Ethena’s dashboard showing negative funding across majors. Since November, the sUSDe spread has been below three-month Treasury yields.

With core delta-neutral strategy being unprofitable or returning low yields, 63.3% of the system is now held in liquid stables rather than deployed in delta neutral carry.

The unwind also shows up in Aave and Pendle TVL.

- sUSDe looping became unattractive as sUSDe yields fell below USDC borrow rates (4.87% USDC borrow vs 4.77% sUSDe APY).

- The November Pendle sUSDe PT expiry removed most of the size from Aave, and exposure fell from more than $5.4 billion to about $340 million.

Source: SeaLaunch Dunes

Source: SeaLaunch Dunes

Going forward, the market needs to assess whether new expiries will attract significant utilization. The February 2026 PT implies a yield of only 5.8%, the lowest of any previous expiry, and at current levels, looping against Aave borrow rates is not profitable, so Aave PT utilization should remain low. Secondly, sUSDe rates must climb back above USDC borrow rates to continue to see demand on Aave.

Therefore, until funding turns frothy, Ethena’s core engine remains impaired. And as crypto becomes more institutionalized, with larger market makers and deeper derivatives liquidity, our base case is that funding rates trend structurally lower. For yields to recover, directional appetite must return so perp basis widens, and ETH vol needs to rise so positive funding can re-establish itself.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.