Bullish Plans to go Public Through SPAC Merger

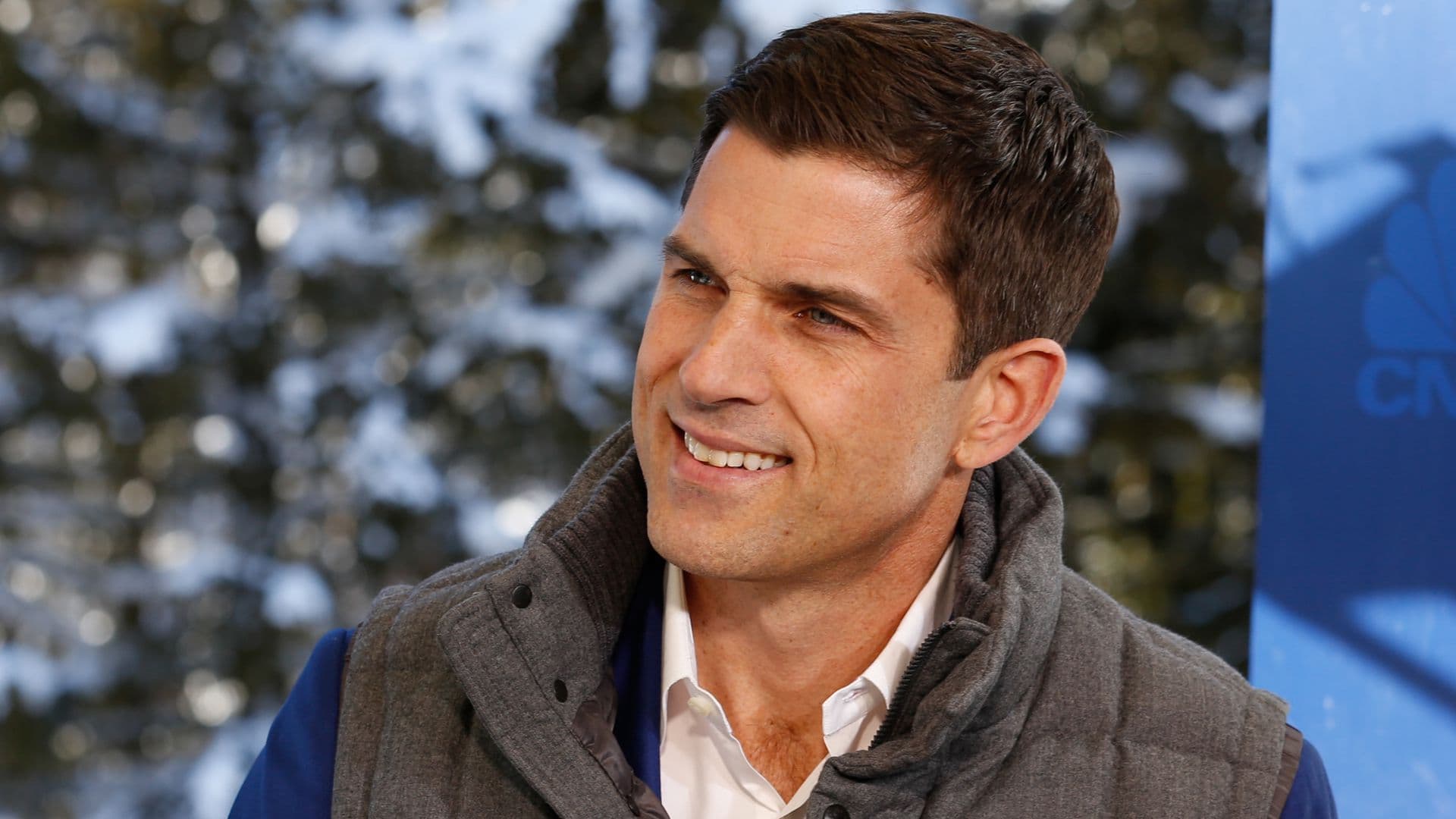

Former NYSE President Thomas Farley to become CEO of Bullish

- Bullish preparing release of crypto exchange that will provide portfolio balancing tools, deep predictable liquidity

- CEO of Block.one, which gave Bullish initial capital injection in May, to serve as company’s chairman

Digital assets firm Bullish announced plans on Friday to become a public company through a merger with Far Peak Acquisition Corporation, a SPAC led by former New York Stock Exchange president Thomas Farley.

Farley, who led NYSE as president from 2013 to 2018, will become the CEO of Bullish upon completion of the deal. Block.one CEO Brendan Blumer, will be appointed the company’s chairman.

The transaction, approved by the director boards of Bullish and Far Peak, is expected to close by the end of the year, and the combination’s equity value at signing is roughly $9 billion at $10 per share. Proceeds include $300 million in private investment in public equity, or PIPE, commitments from EFM Asset Management, as well as funds and accounts managed by BlackRock, Cryptology Asset Group and Galaxy Digital.

Donald Putnam, a managing partner at principal investing firm Grail Partners, told Blockworks that this is a situation tailor-made for a SPAC merger, adding that the PIPE participants provide important validation as well as funding.

“It’s a story stock, and the story is about the future, not the past,” Putnam explained. “At the moment, SPACs have a decided advantage when it comes to growth company funding – they compete brilliantly with private equity investors, at much lower cost and vastly better transparency.”

Bullish is preparing to launch a crypto exchange with portfolio balancing tools and deep predictable liquidity that will serve both retail and institutional investors, the firm said in a news release. Farley said in a statement that the increased interest from institutional players and sophisticated traders in crypto makes it critical to iterating on the existing exchange infrastructures.

In a survey by Arcane Research published last month, institutional market participants labeled reliability of technology, depth of liquidity and low latency, and certainty of execution as the three most important factors when selecting a cryptocurrency trading venue.

“We view the cryptocurrency market as a high growth market that is large, profitable, and filled with opportunities,” Farley told Blockworks. “In terms of the merits of the investment overall, the cryptocurrency market is just in the first or second inning.”

The company will run a private pilot program before its public launch during which participants will test the platform in a simulated market environment. Tools users will try include the Bullish Hybrid Order Book and the firm’s liquidity pools.

Block.one, developer of the EOSIO protocol, injected $100 million, 164,000 of bitcoin, and 20 million of EOS to launch Bullish in May. Other investors in the capital raise were Peter Thiel’s Thiel Capital and Founders Fund, Alan Howard, Louis Bacon, Richard Li, Christian Angermayer, Galaxy Digital, and global investment bank Nomura.

“Bullish’s entry into the public markets allows our customers to take part in the growth of Bullish by holding a piece of our company without any of the regulatory uncertainties or jurisdictional limitations of a profit-sharing token issuance,” Blumer said in an email.

Meltem DeMirors, chief strategy officer at Coinshares, said in June that excluding Bullish, there had been more than $7 billion in venture deals announced in 2021, noting that there is now more capital than ever looking to be allocated to various parts of the crypto ecosystem.

Bullish’s plans come a few months after crypto exchange Coinbase became a public company through a direct listing. Competing exchange Kraken is prepping to potentially go public by the end of 2022, the company’s CEO, Jesse Powell, told Bloomberg TV last month.

Powell has said that Kraken is likely too big to go public through a SPAC, and was considering an IPO, Fortune reported last month.