Coinbase Reports Q3 Net Revenue Dropped 39% to $1.234B

Although a handful of metrics fell on the quarter, the MTU was up 252%, trading volume increased about 627% and assets on platform rose 608% on the year.

Blockworks exclusive art by axel rangel

- The company entered Q3 with “softer crypto market conditions, driven by low volatility and declining crypto asset prices

- “Other crypto assets” accounted for the majority of trading volume in Q3 at 59%, surpassing bitcoin and ethereum trading levels of a combined 41%

Coinbase’s user base and trading volume fell in the third quarter of 2021, while the total assets on the platform increased, the company reported in its third-quarter earnings Tuesday.

The company’s total net revenue also dropped 39.3% from $2.033 billion to $1.234 billion.

“We think there’s an abundance of innovation in this space and we want to double down on those opportunities,” Emilie Choi, president and chief operating officer of Coinbase said during the company’s earnings call. Some of those opportunities reside within non-fungible tokens (NFTs) and Web3, Choi mentioned.

The company entered Q3 with “softer crypto market conditions, driven by low volatility and declining crypto asset prices,” according to the company. However, market conditions improved toward the end of Q3 and have continued into Q4, Coinbase added in their quarterly report.

“We have consistently indicated that volatility is a key factor influencing our transaction revenue. Q3 illustrates this point,” the shareholder letter stated. “Coinbase is not a quarter-to-quarter investment, but rather a long-term investment in the growth of the cryptoeconomy,” the company said.

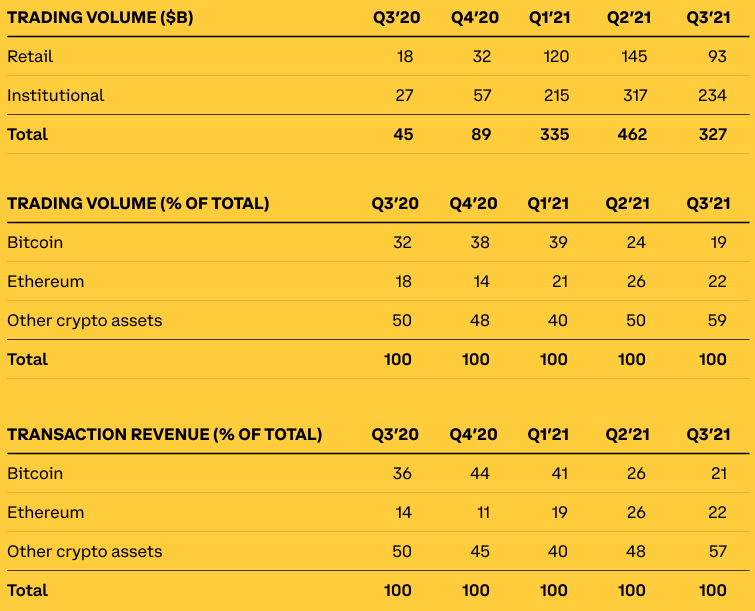

The largest cryptocurrency exchange platform in the US saw its monthly transacting users (MTU) drop about 16% from 8.8 million in Q2 of 2021 to 7.4 million in Q3 2021. During that time frame, trading volume fell 29.2% from $462 billion to $327 billion, but the assets on the platform increased 25% from $180 billion to $225 billion.

Although a handful of metrics fell on the quarter, the MTU was up 252%, trading volume increased about 627% and assets on the platform rose 608% on the year.

The company’s financial overview highlighted a handful of key metrics that showed its retail and institutional trading volume dropped on the quarter from $145 billion to $93 billion and $317 billion to $234 billion, respectively.

The company said that the decline in both retail and institutional trading volume was driven by lower levels of volatility.

“It is important for investors to remember that our business is inherently unpredictable, especially in these early days of the cryptoeconomy,” the company wrote.

Source: Coinbase

Source: Coinbase“Other crypto assets” accounted for the majority of trading volume in Q3 at 59%, surpassing bitcoin and ethereum trading levels of a combined 41%.

This is significant because while bitcoin and ethereum are the largest cryptocurrencies by market capitalization, they did not make up the majority of trading volume or transaction revenue for Coinbase, the data shows.

Coinbase shares were trading at $357.39 at the end of the trading period today.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.