Crypto Rallies on Bad-As-Expected Inflation Data

Prices rose 7% over the last 12 months, showing that inflation is slow to ease

Blockworks exclusive art by Axel Rangel

- Bitcoin and ethereum rallied early Wednesday after CPI data showed inflation rise in line with expectations

- Crypto and equities markets have mostly already priced in rate hikes and inflationary pressures, analysts say

Bitcoin and ethereum saw morning gains Wednesday following the release of December’s Consumer Price Index (CPI) data, which revealed that inflation is rising on par with expectations.

After weeks of losses, bitcoin rallied above $44,000 and ethereum rose above $3,300 Wednesday before 9:00 am EST before paring gains later in the morning.

“It’s not a surprise that we’re seeing the crypto markets react favorably in the wake of the highest annual inflation rate in almost 40 years,” said John Nahas, vice president of business development at Ava Labs. “These markets are 24/7, highly liquid, and have long been positioned as an asset class with hedging potential against portfolios that are more subject to easy money policies adopted by Central Banks over the past few years.”

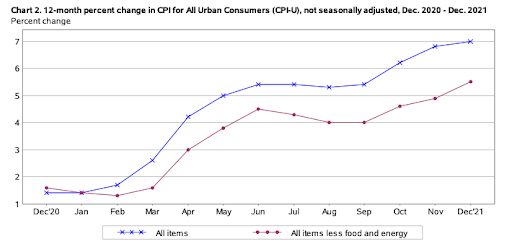

For the first time since 1982, the CPI rose 7% year-over-year in December for all items, according to Wednesday’s report. The reading, while in line with analysts’ expectations, shows that supply chain challenges, labor shortages and the ongoing pandemic have prolonged higher prices far longer than policymakers originally anticipated.

CONSUMER PRICE INDEX, DECEMBER 2021. Source: Bureau of Labor Statistics

CONSUMER PRICE INDEX, DECEMBER 2021. Source: Bureau of Labor StatisticsEquities opened higher with the Nasdaq Composite and S&P 500 rallying as much as 0.7% and 0.9%, respectively, before falling later in the session.

The report comes one day after Federal Reserve Chairman Jerome Powell appeared before lawmakers Tuesday to discuss central bank actions and defend his current position.

“In the near term, ‘hawkish fears’ of the Fed likely have peaked,” wrote Tom Essaye, founder of Sevens Report Research, in a recent note. “The market is now pricing in one, a March rate hike, two, four rate hikes total in 2022 and three, possible balance sheet reduction sometime in the second half of 2022.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.