Cryptocurrency Market Cap Hits Three-Month High Amid Bullish Outlook

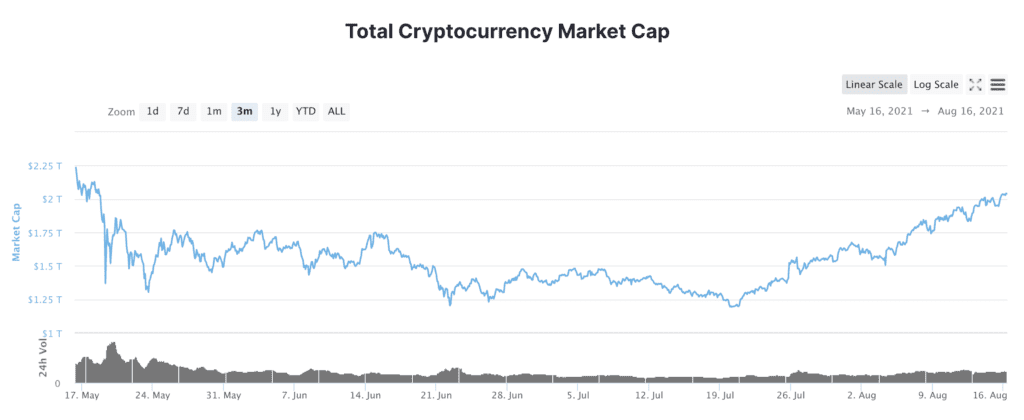

The total cryptocurrency market cap hit $2.036 trillion on Monday, reaching the highest level in three months, or since May 18.

Blockworks exclusive art by Axel Rangel

- Fear of missing out, commonly known as “FOMO” is starting to set in amongst smart money institutions, said Charlie Silver, Permission.io CEO

- The market cap is also up about 3.28% on the day and is 60.4% higher from the month-ago date, according to data from CoinMarketCap

The cryptocurrency market cap hit a three month high as crypto-based sectors continue to see new bullish sentiments.

The total cryptocurrency market cap hit $2.036 trillion as of publication time on Monday, reaching the highest level in three months, or since May 18. The market cap is also up about 3.28% on the day and is 60.4% higher from the month-ago date, according to data from CoinMarketCap.

Source: CoinMarketCap

Source: CoinMarketCap“The surge in market cap is really coming from all sectors,” said Joshua Lim, head of derivatives at Genesis Trading.

The total market cap entails all crypto assets, including cryptocurrencies, utility tokens, security tokens and stablecoins. While there are four categories involved in CoinMarketCap’s crypto assets, the most prolific sector is cryptocurrencies, which makes up two of the largest assets by market capitalization with bitcoin and ethereum at $874.244 billion and $377.609 billion, respectively.

Fear of missing out, commonly known as “FOMO,” is starting to set in amongst smart money institutions, said Charlie Silver, Permission.io CEO. “Strong hands know the stage is set for massive dollar devaluation. I wouldn’t call this a bull market yet, until BTC reaches new highs and smaller market cap altcoins begin to participate,” Silver added.

Late last week, Cardano (listed as ADA) joined in as one of the largest cryptocurrencies alongside bitcoin, ethereum and binance coin, as it is just weeks away from its planned hard fork that will bring smart contracts to the platform, Blockworks previously reported.

On Friday, ADA’s market cap was below bitcoin and ethereum and slightly above Binance Coin (BNB) and Tether (USDT) but as of Monday, Binance Coin passed ADA’s market cap by about $3.4 billion, CoinMarketCap data showed.

Bitcoin is overcoming a “wall of worry” from regulatory and legislative issues in the US, while ethereum successfully forked into EIP-1559, Lim said.

The London hard fork went live in early August, and despite some vocal opposition from miners, the EIP-1559 upgrade went through without a hitch and the price of ether subsequently rose, Blockworks previously reported.

Additionally, the Solana and FTX ecosystems are getting more institutional investment, while the governance token for Axie Infinity, or AXS, and other revenue-linked tokens are getting retail interest, Lim added.

“We think it’s largely new institutional money allocating into the space, we’re also seeing crypto-native hedge funds growing AUM,” Lim said.

Separately, CoinShares reported that digital assets investment saw a sixth consecutive week of outflows totalling $22 million, bringing the six week outflows to $115 million, marking the longest run of consecutive outflows since January 2018. However, the outflows are far less, making up only 0.2% of assets under management (AUM) compared to about 5% in 2018, the report said.

While this sentiment can be perceived as negative, “it comes at a time of low investor participation likely due to seasonal effects as seen in other asset classes,” it said. Ethereum and Binance Coin both saw minor outflows totalling $1.1 million and $900,000, respectively, CoinShares said.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.