DraftKings Continues NFT Push With Metabilia Partnership

Blockworks exclusive: Sports betting company will be exclusive distributor of NFTs that feature budding MLB stars

Source: Shutterstock

- DraftKings seeks to continue delving deeper into the NFT space by “aligning with Web3-centric partners”

- The company launched its first in-house NFT collection in March ahead of the NCAA’s college basketball tournament

DraftKings has teamed up with NFT company Metabilia as it looks to continue capturing what the company considers to be rising demand for digital sports collectibles.

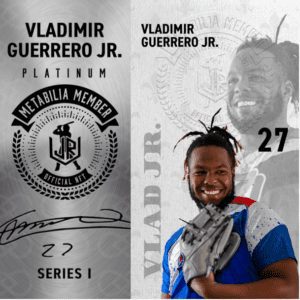

The sports betting company is set to release NFTs featuring some of the youngest Major League Baseball stars as part of the collaboration. The collection includes NFTs of Vladimir Guerrero Jr., Ronald Acuña Jr., Shane Bieber, Wander Franco, Joe Musgrove and Fernando Tatís Jr.

Called NFT Membership collectibles, owners will be rewarded with various event-based NFTs throughout the season, which will correspond to milestones or accomplishments for the respective athletes.

“DraftKings will continue to push its footprint within the NFT industry by continuously aligning with Web3-centric partners to produce curated content that resonates with our DraftKings users,” a spokesperson told Blockworks.

“[We will focus] on providing unique experiences and collectibles in the sports and entertainment space and a frictionless way for our users to interact with those.”

DraftKings Marketplace, which the company launched last August, will be the exclusive distributor of Metabilia NFTs. The marketplace was already the exclusive distributor of sports-related NFT content from Autograph, a company co-founded by Tom Brady.

Metabilia has multi-year partnerships with franchises in the NFL and NBA and has direct deals with more than 40 athletes.

“At Metabilia, we are focused on delivering NFT collectible programs that deliver high-quality benefits for the long term, and our Membership NFT programs allow fans to show their support for a young athlete and be a part of his or her journey,” Metabilia CEO Joseph De Perio said in a statement.

DraftKings Marketplace has incorporated many iconic sports stars on its platform, including Derek Jeter’s first-ever NFTs ahead of his Hall of Fame induction last year.

The company launched its first in-house NFT collection in March ahead of the NCAA’s college basketball tournament.

The 2022 College Hoops Collection was the first within a planned Primetime NFT Series that will drop around other major sporting events, Beth Beiriger, DraftKings’ senior vice president of marketplace operations, told Blockworks at the time.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.