Ethereum Extends Gains, Outperforming Bitcoin: Markets Wrap

“For the first time since Ethereum’s launch, the protocol is burning more than the block reward is creating,” Joshua Scigala of TheStandard.io said. “Speculators believe that this newfound scarcity mechanic will drive Ethereum much higher in the long run.”

SHUTTERSTOCK

- ETH jumped 11.31% in the past week, while BTC shed 2.91%, according to Messari

- Financial services platform Evrynet secured $7 million in a private funding round, led by Signum Capital

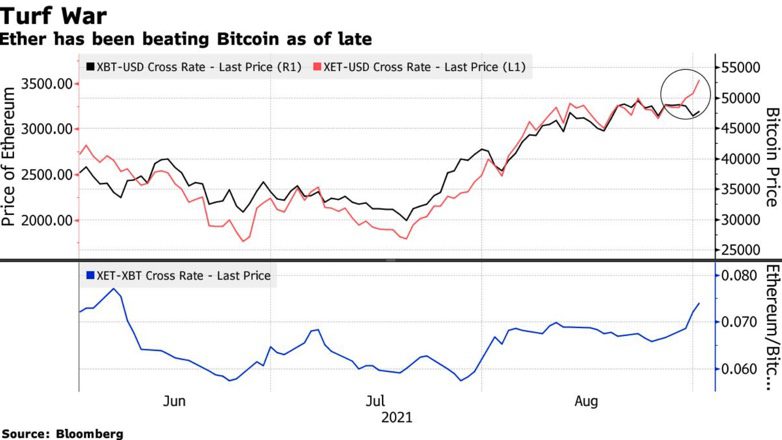

In years past, bitcoin has led bullish trends in cryptocurrency prices. When the price of BTC rises, ether and various altcoins have followed. But as of late, ether has been beating bitcoin by the widest margin in three years, according to data from Bloomberg.

Ether has had a return on investment (ROI) of 11.31% in the past week while bitcoin has declined 2.91%, according to Messari. In the last month, ETH jumped 40%, while BTC rose 21.42%. In the past year, ETH skyrocketed 655.04%, while BTC increased 298.49%. ETH-BTC is up 6.43% to 0.0768, as of press time. Crypto market capitalization remains above $2 trillion.

Ether, the native token of the most-used blockchain, has had a bullish stint following its network upgrade. The London Hard Fork or EIP-1559 has burned 161,081 ETH, limiting its money supply since it went live in early August. In brief, transaction fees that previously went to miners are taken out of circulation through the issuance of burn blocks, Blockworks reported.

Ethereum competitors, dubbed as “ETH killers”, like Solana and Polkadot continued their bullish streak on Wednesday. In the past week, Solana’s native token (SOL) has hiked 58.74%, trading at $114.59. Polkadot (DOT) is trading at $31.70, advancing 18.23% in the same period of time.

DeFi

- Uniswap (UNI) is trading at $30.15 with a total value locked of $5,109,539,924 advancing 2.2% in 24 hours at 4:00 pm ET.

- Chainlink (LINK) is trading at $29.17, up 8.5% with trading volume at $1,744,002,429 in 24 hours at 4:00 pm ET.

- DeFi:ETH is 30.5% at 4:00 pm ET.

Crypto

- Bitcoin is trading around $48,270.54, up 2.66% in 24 hours at 4:00 pm ET.

- Ether is trading around $3,710.94, advancing 9.44% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.0768, up 6.43% at 4:00 pm ET.

Insight

“While bitcoin corrected downward over the last few days, ethereum is climbing. This is very rare as most coins traditionally follow bitcoin’s lead. For the first time since Ethereum’s launch, the protocol is burning more than the block reward is creating,” Joshua Scigala, co-founder of TheStandard.io, said. “Speculators believe that this newfound scarcity mechanic will drive Ethereum much higher in the long run.”

Equities

- The Dow declined -0.05% to 35,299.

- S&P 500 is up 0.02% to 4,523.

- Nasdaq advanced 0.37% to 15,315.

- VIX fell -2.12% to 16.13 at 4:00 pm ET.

Commodities

- Brent crude declined to $71.35 per barrel, shedding -0.39%.

- Gold was down -0.04% to $1,817.3.

Currencies

- The US dollar fell -0.15%, according to the Bloomberg Dollar Spot Index.

Fixed Income

- US 10-year treasury yields 1.3% as of 4:00 pm ET.

In other news…

Financial services platform Evrynet secured $7 million in a private funding round led by Signum Capital. The money will go toward furthering Evrynet’s mission to make decentralized finance (DeFi) accessible to an institutional audience, the company announced Wednesday.

We are looking out for

- US jobs report is due on Friday

That’s it for today’s markets wrap. I’ll see you back here tomorrow.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.