Ethereum Foundation takes stock of a turbulent decade

EF report maps eight factions within the ecosystem, warning that short-term pragmatism is eclipsing the protocol’s founding vision

Omeris/Thx4Stock team/Shutterstock and Adobe modified by Blockworks

The Ethereum Foundation is taking a hard look in the mirror, and at the community it helped create, reflecting on what some insiders are calling the network’s deepest existential crisis in years.

A new report, published yesterday and produced by research group WE3 with support from Optimism and Espresso Systems, pulls from more than 60 interviews with core developers, researchers, investors and community leaders. The project, known internally as “Mirror,” was designed to capture how Ethereum is perceived from multiple vantage points.

“The goal was to understand how different audiences view Ethereum, identifying challenges and strengths, and reflect those back to the ecosystem so that we can learn from them,” the authors write.

A network with many stories

The report begins with a striking collage of metaphors. Interviewees described Ethereum as “a world computer, a new material for civilization, and humanity’s coordination layer.” Others were more critical, calling it “a trillion-dollar casino” or even “MySpace waiting to be displaced.”

“Each metaphor captures something essential, yet none captures everything,” the report notes, underscoring how Ethereum’s identity defies consensus even among its closest allies.

This tension — between idealistic vision and harsh pragmatism — forms the backbone of the 40-page study.

The research maps Ethereum’s stakeholders into archetypes: Guardians defending its original ethos, Pioneers expanding into new frontiers, Translators bringing ideas to a broader world, and Challengers pressing on perceived stagnation. Traders, institutions, and Web3 communities round out the picture.

I’m reminded of the archetypes of a chess player espoused by Grandmaster Yuri Averbakh. Averbakh’s taxonomy of chess players, such as explorers, fighters and artists, was meant to explain how different minds approach the same game. Ethereum’s “archetypes” map surprisingly well onto this framework:

Guardians → Scientists (rule-based, principle-driven, maintaining order)

Pioneers → Explorers/Artists (venturing into new territory, inventing, risk-taking)

Challengers → Fighters (forcing confrontation, opportunistic, adversarial when needed)

Translators → perhaps a hybrid Scientist/Artist (bringing systematized knowledge into broader cultural language)

The study’s conclusion is blunt: “From traders chasing cheap fees to core devs chasing market relevance, the number of people prioritizing immediate needs over long-term vision is growing significantly.”

In other words, the protocol’s biggest fight may not be with rival blockchains but within its own ranks.

Stability vs. evolution

For much of the past decade, Ethereum has juggled two competing imperatives: stabilizing its base layer, and evolving fast enough to stay relevant in a competitive landscape. According to the report, those imperatives are now colliding more forcefully than ever.

“Understanding who builds, uses, and shapes Ethereum requires seeing beyond code to human motivations,” the authors write. The implication is that the project’s greatest challenge lies beyond technical roadmaps, in the messy work of governance, culture, and perception.

Ethereum still anchors the largest ecosystem in crypto, with billions locked in DeFi protocols and thousands of active developers. Yet the Mirror report suggests the protocol’s long-term positioning could hinge less on throughput benchmarks than on whether its community can reconcile divergent visions.

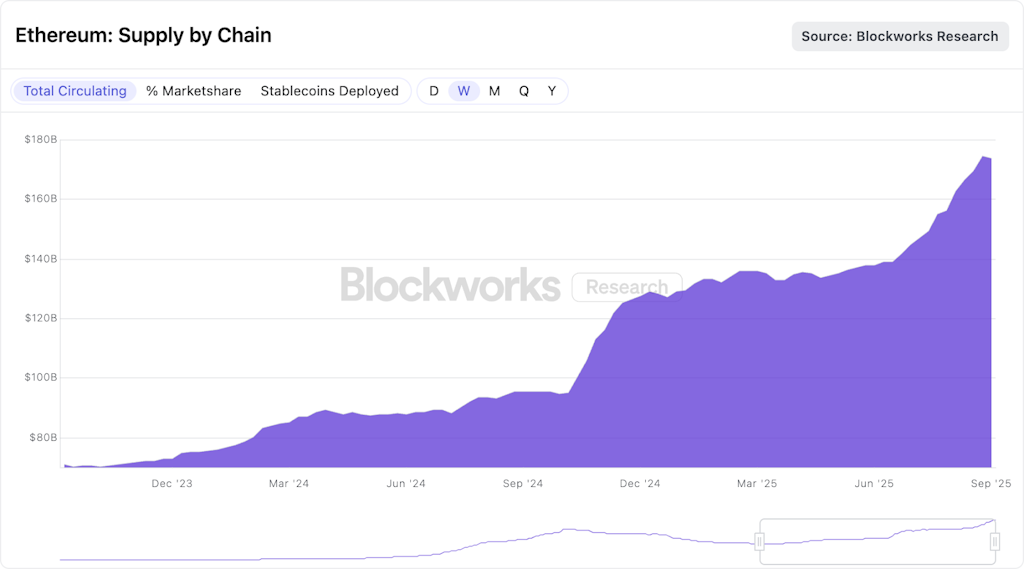

About $174 billion in stablecoins on mainnet, or more than 60% market share | Source: Blockworks Research

About $174 billion in stablecoins on mainnet, or more than 60% market share | Source: Blockworks Research

For the Ethereum Foundation, commissioning such a self-critical survey is notable in itself. Few large technology projects would publish an outside assessment that bluntly labels them both “a telescope pointed at stars while standing in a forest” and “a playground with forgotten toys.”

Whether Ethereum can turn those metaphors into momentum — or whether they signal further fragmentation ahead — will shape the next decade of its experiment.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.