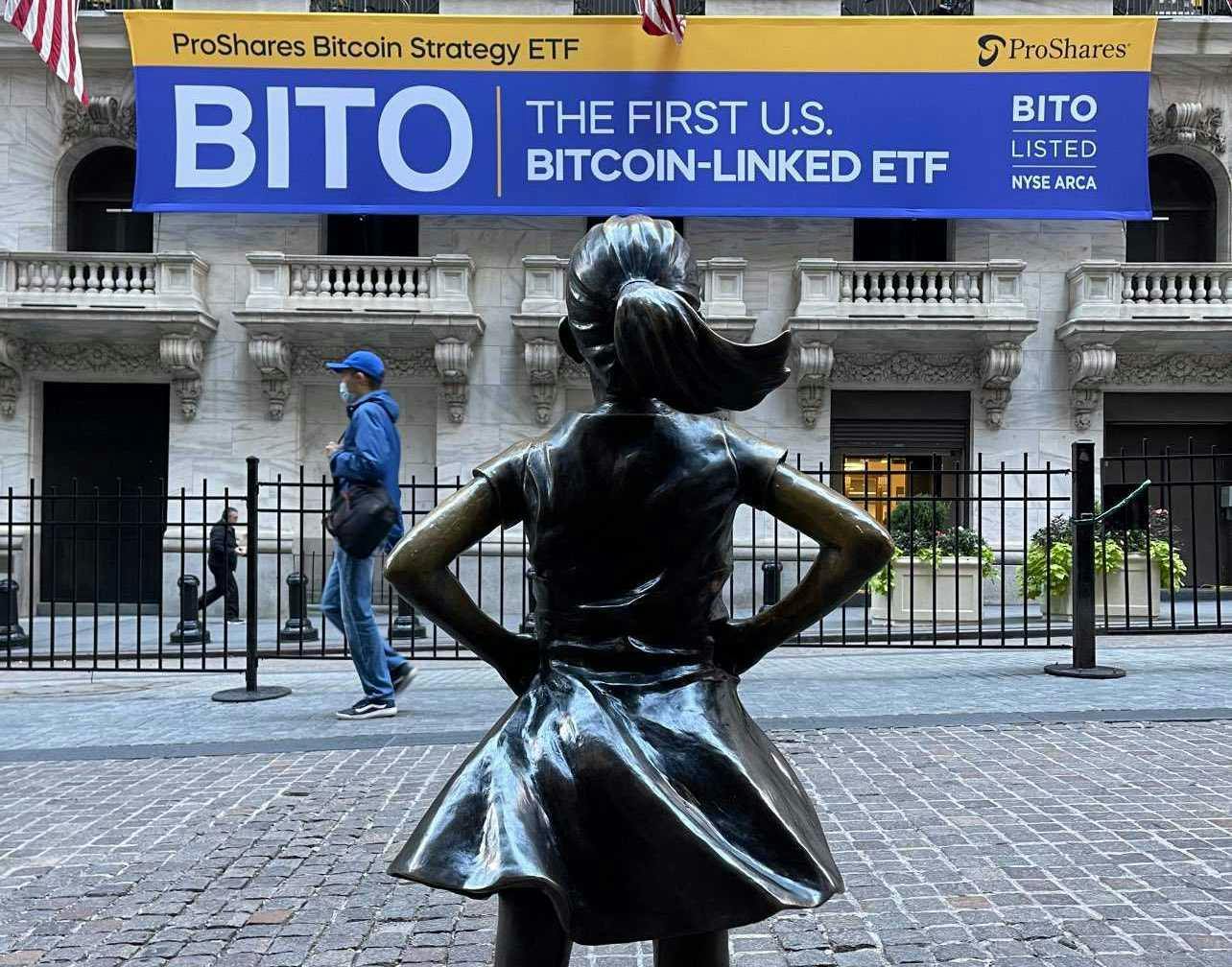

First Bitcoin Futures ETF Nears $1B on First Day of Trading

The world’s first bitcoin futures ETF sustained high volume throughout the trading session.

- ProShares bitcoin strategy ETF ranks second in daily trading volume

- While there were doubts about how a futures-based product would perform given the amount of spot trading options available to investors, the overall sentiment seemed to be positive

The first-ever bitcoin futures exchange-traded fund, the ProShares Bitcoin Strategy Fund (BITO) has become the second-highest ETF ever in opening day volume.

BITO, which debuted on the New York Stock Exchange Tuesday, closed the session Tuesday with 23.103 million shares traded, or about $950 million, according to data from TradingView. Blackrock’s US Carbon Transition Readiness ETF, launched in April 2021, holds the record for opening day volume with $1.1 billion.

“I’m not surprised in the least by today’s volume,” said Nate Geraci, president of the ETF Store. “BITO’s strong debut is reflective of the pent-up demand among individual investors and advisors to access bitcoin price exposure via traditional brokerage and retirement accounts.”

BITO closed the session Tuesday 4.73% higher at $41.89.

The world’s first bitcoin futures ETF sustained high volume throughout the trading session. Less than half an hour into the market open, 6.4 million shares had traded, or roughly $264 million. Volume hit $500 million just after 11:00 am EDT.

While there were doubts about how a futures-based product would perform given the amount of spot trading options available to investors and the fact that futures products come with roll costs, the overall sentiment seemed to be positive.

“As could be expected from a highly anticipated and highly discussed new product, the futures ETF is performing well, and attracting many investors who are looking for prudent ways to get more exposure to crypto,” said Chen Arad, COO of Solidus Labs. “But the bigger significance is the strong signal it gives for increased regulatory approval and adoption of Bitcoin and crypto as a whole, indicated by the general price increases.”

Analysts and investors are now waiting to see how Valkyrie’s product, the Bitcoin Strategy ETF, will perform later in the week. The issuer was originally expected to launch its product alongside ProShares on Tuesday, however, launch on the Nasdaq is now expected on Wednesday or Thursday.

“As the second mover, I wouldn’t expect Valkyrie to put up the same numbers as ProShares,” said Geraci. “However, I still think they’ll experience brisk demand. More importantly, it’ll be game on for the bitcoin ETF race.”

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.