FTX NFTs Provided Loophole For Non-Bahamas Residents Wanting to Withdraw Funds

One NFT sold for $10 million on the FTX NFT marketplace, and the only logical conclusion is it was a way to retrieve frozen USD balances

SOURCE: SHUTTERSTOCK

FTX Group has filed for Chapter 11 bankruptcy in the US, and customers have been scrambling to get their money off the platform — by any means necessary.

The crypto exchange had re-enabled withdrawals on Thursday, but only in the Bahamas, the location of its headquarters and many employees.

Some users without a Bahamian account themselves found a way to circumvent the system by using FTX’s NFT marketplace.

The marketplace tracked over $50 million in volume in the past 24 hours despite a Bahamas securities regulator freezing the assets of local subsidiary FTX Digital Markets (FDM).

Bahamian residents were buying NFTs on the FTX marketplace at inflated prices and withdrawing the cash for non-residents, UpOnlyTV host Cobie tweeted.

A closer look at collections on the marketplace showed some extreme price jumps for some otherwise unremarkable NFTs.

For instance, on Nov. 10, FTX Crypto Cup 2022 Key #25162 sold for $2.5 million when days earlier the NFTs in this collection were being traded for less than $1. Activity for the collection picked up only between Nov. 10 and Nov. 11 when it saw dozens of trades in the six and seven digit range.

FTX Crypto Cup NFT sales

FTX Crypto Cup NFT sales

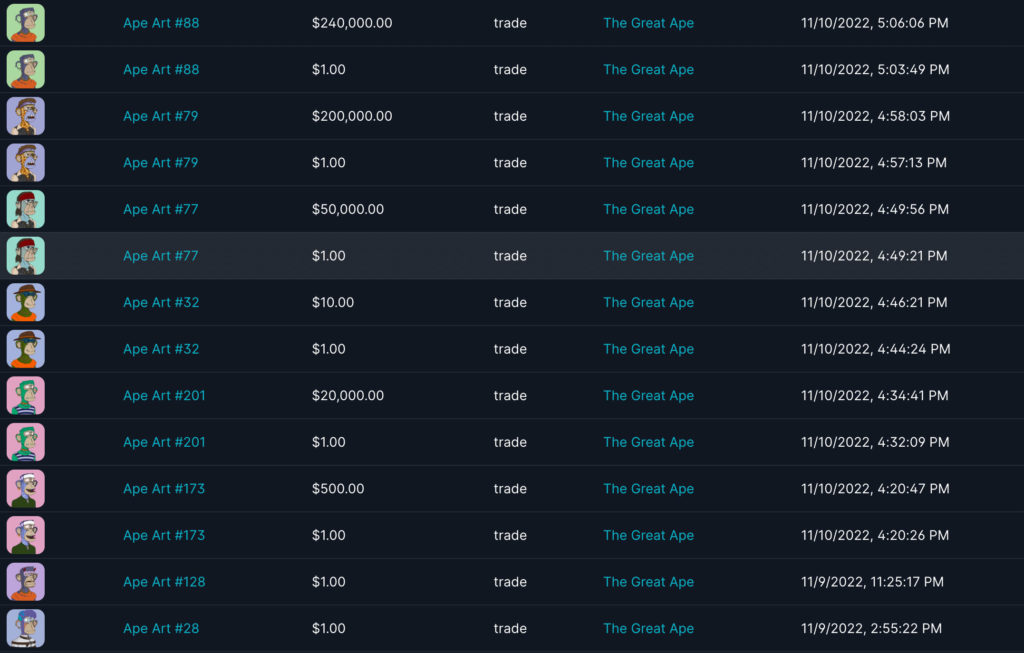

The Great Ape collection and its Ape Art NFTs saw its first jump from $1 to a $500 trade, while the most expensive Ape Art #312 went for a $10 million bid and trade on Friday.

Ape Art NFT sales

Ape Art NFT sales

One user, AlgodTrading, was lambasted by crypto Twitter for offering a 100K fee to anyone that could help him “KYC on FTX.” However, he responded to the screenshot, claiming that he did not “buy any discounted claims/assets or accounts” and that “these rumors are false.”

The identities of those behind the Bahamian accounts helping non-residents is unknown, and the legalities around this are unclear.

The FTX.com website states that “depositing and minting of NFTs is not supported on FTX International” and is directing users to its FTX US NFT marketplace.

While bids continue to be placed on FTX International’s NFT marketplace, the last trade occurred at 2:47 AM ET on Nov. 11 for a FTX Crypto Cup 2022 Key NFT for $500, indicating this exit ramp is no longer available.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.