Funds Are SHIB? Crypto.com Reserves Are 20% Memecoin

Dogecoin ripoff shiba inu is a major asset at one of the world’s largest crypto exchanges.

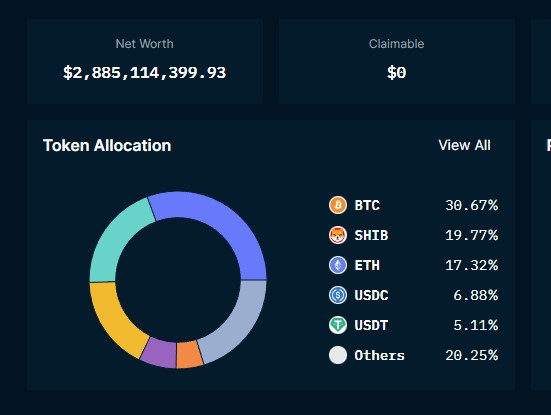

According to a wallet analysis published by Crypto dot com CEO Kris Marszalek on his official Twitter feed, 20% of all reserves at the exchange are held in the highly speculative memecoin shiba inu (SHIB).

As fear of crypto contagion from the FTX meltdown spreads, Marszalek seems eager to prove that any exposure to the crisis is limited, and shared links to a Nansen dashboard that illustrate over $2 billion in reserves.

A Crypto dot com spokesperson said that “The reason our Proof of Reserves include Shiba is because we hold customers balances 1:1. Thus, our Proof of Reserves are dictated by our customer holdings.”

Bitcoin accounts for 30.67% of the total reserves, while ether is 17.32%. Only 11.99% of the reserves published are held in stablecoins USDC and USDT.

It’s the 19.77% of reserves held in SHIB that will raise eyebrows.

Image: Nansen

Image: NansenEach shiba inu token has a current value of $0.000000979 this morning, representing a market cap of $5.7 billion. CoinGecko data showed that Binance and Coinbase had trading volumes of around $32 million and $25 million respectively.

Read more: What Is Proof of Reserves and Can It Build Back Trust?

SHIB also briefly flippened Solana’s token SOL this week as market participants worried about the close ties of the Solana ecosystem to FTX and Alameda.

Australian exchange CoinJar decided to delist CRO, the native token of Crypto dot com, earlier this week, explaining that “In light of recent events, we have decided that [Crypto dot com] Coin (CRO) no longer meets our listing requirements. Unfortunately, we have to take this action on short notice due to ongoing market volatility.”

Update: November 11 2022 4:42pm ET: Added quote from Crypto dot com spokesperson, contextual update.

Macauley Peterson and David Canellis contributed reporting.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.