Gachapon on the blockchain is already a hundred-million dollar market

From Labubus to Pokémon

Shutterstock AI/Shutterstock and Adobe modified by Blockworks

This is a segment from the Lightspeed newsletter. To read full editions, subscribe.

In his work on the pre-800 AD Classic Maya economy, the historian Philip Curtin recounts a striking finding: Archaeologists measured the ratio of cutting length to weight in obsidian blades and discovered that the ratio varied inversely with distance from obsidian sources.

The economist Deirdre McCloskey cites this as evidence that the human impulse toward exchange and profit-seeking gain has always existed.

“If Mayans lived in a gainless, profitless, nonmarket economy, it would not matter to them how expensive obsidian was. But…the ratio varied inversely with the distance from the sources of the obsidian. By taking more care with more costly obsidian, the blade makers were earning better profits, as they did by taking less care with less costly obsidian.”

Formal markets add property rights and legal enforcement. But they channel innate human behaviors that were already there, contrary to the popular belief that capitalism “causes” consumerism.

Modern Japan (and parts of Asia) offers a vivid illustration of what that economic logic looks like in the extremes.

The average Tokyo street is chock-full of cute and colorful Gachapon capsule machines. People flock to them for the prospect of a rare collectible.

Yet a meaningful share of buyers in these markets aren’t pure collectors: Many chase quick flips.

Take Asia’s latest Labubu phenomenon, for instance. Resale prices of the wildly popular Pop Mart series reportedly halved when the company announced a supply increase.

There’s also evidence that at least 40% of consumers buy such toys for “appreciation potential.”

But if profit-seeking is the dominant motive to make and sell these things, then it’s not surprising that the door to hyperfinancialization inevitably swings wide open.

Predictably, crypto entrepreneurs are the first ones kicking the door down.

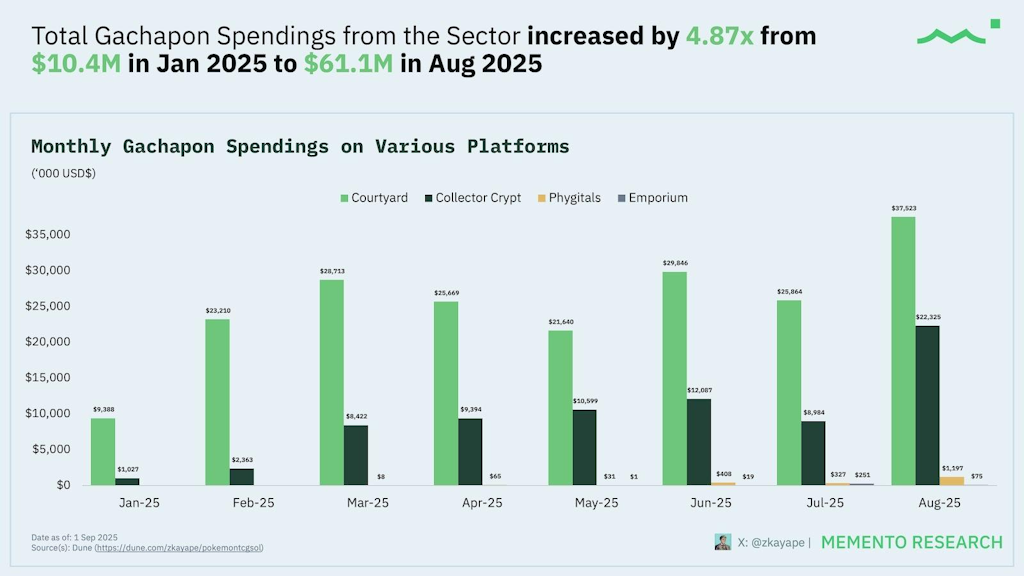

In the last few months, Gachapon-like platforms have seen growing product-market fit. Total money spent on platforms like Courtyard, Collector Crypt, Phygitals and Emporium grew from $10.4 million in January to $61.1 million in August, according to Memento Research.

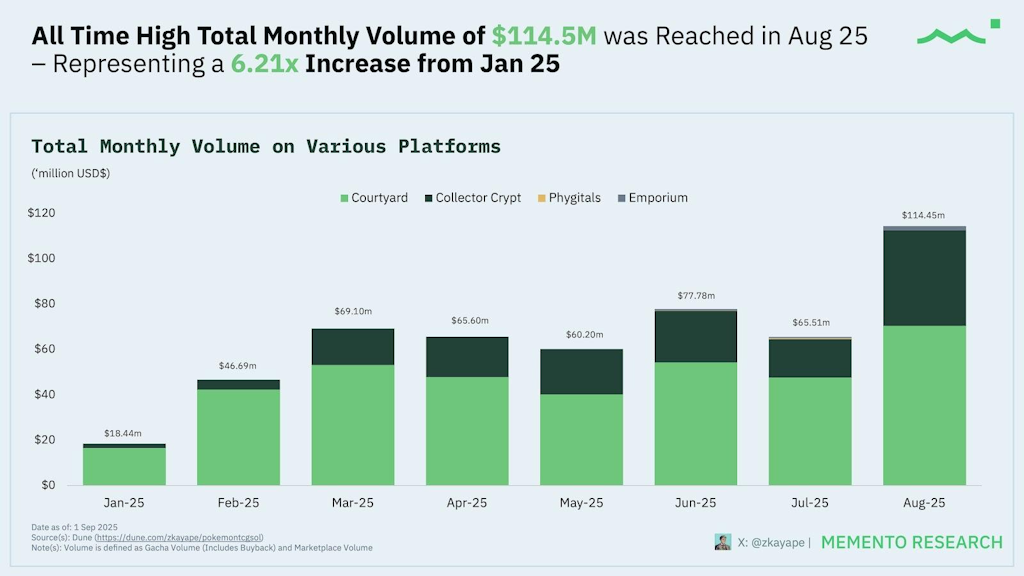

Last month clocked a monthly high of about ~$114 million of trading volumes.

These platforms have a similar business model:

- Platforms keep a secure vault inventory of professionally-graded collectible cards (typically Pokemon/baseball).

- The cards are tokenized as a NFT.

- They are sold as randomized Gachapon items to users with paying stablecoins.

- After a reveal, you can sell them back to the platform at a predefined buyback rate based on the insured market value of the card, sell it on a secondary marketplace or redeem the physical card from the vault for a fee.

There are exceptions. The Phygitals platform on Solana, for instance, does not necessarily have rare cards on hand, and relies on “dropshipping” procurement if the user decides to claim the card. Otherwise, users are offered refunds.

“That’s a drawback because they don’t really own the card,” Memento Research’s analyst zkayape told me. “On the other hand, Collector Crypt rare cards are quite well-stocked (759 epic cards at the moment) due to strong procurement on their end from Web2 rails and connections. They’ve been in the scene for quite some time.”

Gachapon spending also resembles a similar whale-like economy structure across all four platforms.

Memento’s research shows that on Polygon’s Courtyard platform, 90.5% of total spend came from just 5.9% of users. On Solana’s Collector Crypt, 93% of all Gachapon revenues came from 17.5% of users — about 50% of users spent above the “whale” threshold of $1000.

Revenues are conclusively driven by Gachapon spending, rather than secondary marketplace trading.

As far as I can tell, these platforms do not use a verifiable RNG, so users are still trusting that platforms are assigning cards at the stated tier probabilities.

Do users care?

The average consumer of real-world Gachapon or blind boxes certainly doesn’t. I don’t know any blind-box collectors complaining of the non-transparency involved with these products.

Financial speculators, however, are a different breed of consumers. These are the guys who live in “expected value” probability math, seeking to optimize every basis point for an edge.

The platforms are designed to buy back cards at a fair market value from users (to keep users gambling), so there’s at least a cap on the financial downside.

Even so, a trust gap remains. Verifiable randomness and zero-knowledge proofs could make Gachapon draws auditable, not just promised.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.